Axis bank Education Loan Interest Rates: Imagine yourself at the cusp of a life-changing educational journey – but the hefty weight of tuition fees threatens to derail your dreams. The future belongs to those who dare to learn, and financial constraints should never stand in the way. Higher education shouldn’t be a privilege reserved for the wealthy, but a right for everyone. At this crucial time, students who want to pursue higher education in India or abroad, Axis Bank serves as a strong financial support and offers a range of education loans with attractive interest rates and government subsidies to help these students achieve their academic aspirations.

Axis Bank Education Loan Interest Rate – Features

| Benefit | Description |

| Special Education Loan Interest Rates | For Female Applicants |

| No Education Loan Processing Fees | Applicable for all eligible loans |

| Low Interest Rates | For Education Loans for Study Abroad |

| Maximum Loan Amount | Up to ₹75,00,000 |

| Processing Time | Up to 15 days |

| No Margin Payment | Applicable for education loans up to certain limits |

Axis Bank Education Loan Interest Rate

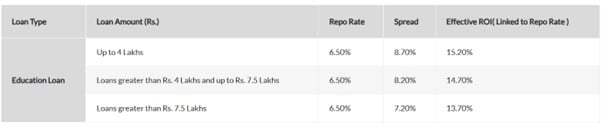

Axis Bank provides detailed listings of interest rates on the various student loans. Aspirants who are opting for higher education in a foreign university should not be worried as Axis bank education loan interest rates are relatively stable for both domestic and overseas student loans. However, these rates may vary on a case-by-case basis depending on factors such as government policy changes, loan tenure, and other conditions. Below are the details of Axis Bank’s education loan interest rates:

Axis Bank Education Loan Rates of Interest (ROI):

Axis Bank Education Loan MCLR Rates:

Axis Bank Education Loan interest rates are calculated based on the MCLR (Marginal Cost of Lending Rate). These rates are revised on a monthly basis. The latest Axis Bank MCLR rates, effective December 18, 2024, are available here, with a base rate of 10.80% effective December 21, 2024:

| Axis Bank Education Loan Tenure | Respective MCLR Rates |

| Overnight | 9.25% |

| 1 Month | 9.25% |

| 3 Month | 9.35% |

| 6 Month | 9.40% |

| 12 Months (1 year) | 9.45% |

| 24 Months (2 years) | 9.55% |

| 36 Months (3 years) | 9.60% |

Axis Bank Education Loan Based on MCLR

Below is the details of ‘Study Power’ education loan provided by the Axis bank based on the MCLR:

| Charge | Details |

| Loan Processing Charges | Applicable as per the interest rates above |

| Prepayment Charges | NIL |

| No Due Certificate | N/A |

| Penal Charge |

|

| Cheque/Instrument Swap Charges | ₹500/- + GST per instance |

| Duplicate Statement Issuance Charges | ₹250/- + GST per instance |

| Duplicate Amortization Schedule Issuance Charges | ₹250/- + GST per instance |

| Duplicate Interest Certificate (Provisional/Actual) Issuance Charges | ₹50/- + GST per instance |

| Cheque/Instrument Return Charges | ₹339/- + GST per instance |

| Conversion charges for switching from Floating to Fixed and Vice-versa | 1% of the outstanding principal with a minimum of ₹5,000/- + applicable 1 GST |

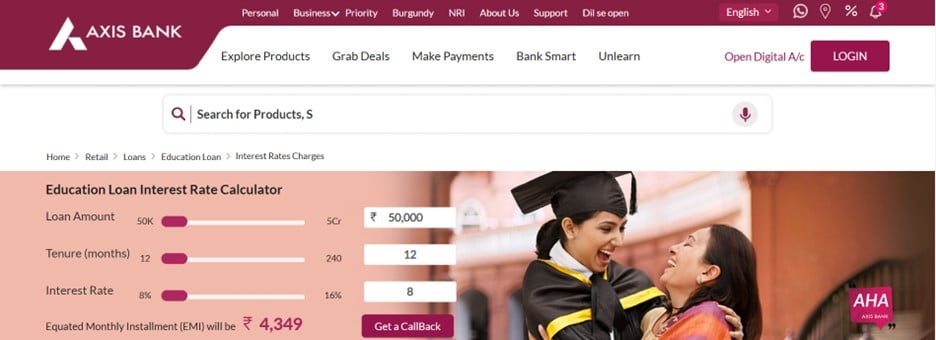

Axis Bank Education Loan EMI Calculator

Axis bank education loan interest calculator makes it very easier for students to calculate their student loan EMIs using the below steps:

Step 1: Visit the official website of Axis Bank (www.axisbank.com)

Step 2: Navigate to the education loan, there you will see the education loan interest rate calculator.

Step 3: Enter loan amount, tenure (months), and interest rate and the amount will be reflected.

Axis Bank Education Loan Interest Rate Tax Benefit Calculation

Many tax-paying Axis bank education loan applicants and co-applicants are aware of the tax deductions available on Axis bank education loan interest rates. However, they often fail to plan effectively to maximise these benefits under the student loans. To determine the potential tax savings associated with an Axis bank education loan, you can utilise the Axis bank tax benefit calculator for student loan. Here are the steps to use this calculator:

- Visit the ‘Tax Benefit Calculator’ from the Education Loan section of Axis Bank Website.

- Enter your education loan amount.

- Select the Income Tax Slab which applies to you and the rate of interest for the education loan applied for.

- Click on ‘Continue’.

The results will provide you with information about the total interest paid per annum, the net tax savings as per Section 80/E regulations, the effective interest paid which is calculated by subtracting tax savings from the total interest paid, and the effective rate of interest on the student loan, which represents the actual interest rate paid after considering tax savings.

Also Read: Axis Bank Education Loan – Amount, Interest Rates & Features

Axis Bank Education Loan Interest Rate Subsidy

Axis Bank provides education loans in the best interest of applicant students and co-applicants. To promote the nature of regular EMI payment and to ease the load of repayment of education loans, Axis Bank supports various interest subsidy schemes. Proper documents of education loan are required for availing the benefits of these subsidies. These schemes include the Special Interest Subsidy for female applicants and Central Sector Interest Subsidy (CSIS) Scheme by Government of India. Details of these interest subsidies are:

Axis Bank Education Loan Interest Rate Special Subsidy for Female Education Loan Applicants

- Only applicable for female education loan applicants

- Female co-applicants are ineligible to apply unless the education loan specifically states that it is intended for the education of a female candidate.

- Provides a 25 basis point subsidy on interest for student loans i.e. 0.25% of the education loan Interest will be deducted for the respective education loan scheme.

Central Sector Interest Subsidy (CSIS) Scheme by Axis Bank

Benefits of CSIS Scheme are:

- Collateral Free Education Loan up to ₹ 7,50,000 for Economically Weaker Sections (EWS)

- Income Limit of CSIS benefactors is ₹ 4,50,000 per annum

- Complete Interest Subsidy for Moratorium period (course duration of course applicant + 1 year or 6 months from employment, whichever is earlier)

Frequently Asked Questions (FAQs)

How much time does Axis bank take to approve an education loan?

Axis bank approves an education loan application within 15 working days of receiving a loan request.

How will my loan’s effective ROI be calculated?

All floating rate loans will be linked to the repo rate of the bank. The rate offered to you will be the REPO RATE plus a spread determined by the bank and it is reset every three months. Furthermore, the bank reserves the right to adjust the spread over the repo rate during the loan tenure.

What are the charges for late payment of EMI?

A late payment fee of ₹500 plus applicable taxes are applicable per bounced cheque, along with a penal interest of 24% per annum (2% per month) on overdue installments.

Can I convert my floating rate loan to a fixed rate loan and vice-versa? Will there be any charge for the conversion?

Yes, you can switch from a floating rate of interest to a fixed rate of interest and vice versa. The conversion charges for switching from a floating rate to a fixed rate or vice versa are 1% of the outstanding principal with a minimum of ₹5,000/- plus applicable GST.

Is it possible to switch from a loan linked to the REPO RATE to one linked to the Base Rate, BPLR, MRR, or MCLR?

No, there is no option to revert from a REPO RATE-linked loan to one based on Base Rate, BPLR, MRR, or MCLR.

What is the margin for Axis bank education loans?

There is no margin requirement for education loans up to ₹4,00,000. For loans exceeding ₹4,00,000, the margin is 5% for studies within India and 15% for studies overseas.

1 thought on “Axis Bank Education Loan Interest Rate and Subsidy Schemes”

Comments are closed.