SBI Education Loan EMI Calculator: Aarav, an ambitious student, aspired to pursue a master’s degree at a reputed university abroad. While his academic ambitions were clear, the financial aspects of funding his dream seemed difficult. Tuition fees, living expenses, and a volatile currency market left Aarav with just one question: How will I manage my loan repayment while balancing other financial priorities?

That’s when Aarav learned about the SBI Education Loan EMI Calculator, an online tool to calculate your education loan EMIs. By entering the required details, he immediately received a breakdown of his Equated Monthly Installment (EMI) amount. Now, Aarav can easily track his finances, repayment obligations, and explore ways to lower his monthly payments by adjusting the loan term.

Intrigued by the SBI education loan EMI calculator? Let’s understand what it is and see how it can ease out your financial woes.

What is the SBI Education Loan EMI Calculator?

Student loans are vital financial tools offered by various lenders to financially assist students who are in need. These education loans help students manage significant expenses, cover unexpected financial needs, or fund educational goals. Based on their requirements, students can avail collateral-free or student loans with collateral. The loan amount and repayment terms are generally determined by factors such as credit history, income, and overall financial stability.

Before taking a loan, it’s important to know how much you’ll pay each month and the total cost of the loan. This will help you plan your finances and make sure you can afford the loan payments.

Here comes the SBI Loan EMI Calculator to the rescue. It’s a powerful tool that simplifies loan planning by providing accurate EMI calculations. This helps you make informed decisions about your financial future.

Features of the SBI Education Loan EMI Calculator

The SBI abroad education loan EMI calculator is a valuable tool designed to simplify the process of planning your loan repayments. It helps students and parents make informed financial decisions by providing instant and accurate calculations. Here’s a detailed look at its key features:

- User-Friendly Interface: The calculator is designed with simplicity in mind. Its straightforward interface allows users to easily input loan details and receive instant accurate results. Whether you’re a seasoned financial planner or a first-time user, the tool’s ease of use ensures a smooth experience.

- Instant EMI Calculation: Simply enter the loan amount, tenure, interest rate, and the calculator instantly generates your monthly EMI. This eliminates the need for manual calculations, saving you time and effort.

- Customisable Loan Parameters: You can easily personalise your loan calculations by adjusting the loan amount, repayment period, and interest rate to align with your specific financial requirements.

- Flexible Repayment Scenarios: Explore various repayment scenarios by adjusting the loan amount, tenure, and interest rate. This helps you find the optimal repayment plan that suits your financial situation better.

- Clear Repayment Breakdown: The calculator provides a detailed breakdown of your total repayment of the student loan, including the principal amount and interest. This transparency ensures you understand the full cost of the loan.

- Financial Planning Made Easy: You can effectively plan your budget and allocate funds for other expenses by knowing your exact EMI amount. This will help you manage your finances responsibly.

- No Hidden Costs: The calculator clearly shows your loan’s total cost, ensuring transparency and eliminating hidden charges.

- Accessibility: The SBI Education Loan EMI Calculator is accessible online, 24/7, allowing you to plan your finances conveniently.

Also Read: Education Loan by Government of India

How can I use the Education Loan EMI Calculator SBI?

An SBI EMI calculator works on three key factors: the loan amount, the interest rate, and the loan tenure. Below are the steps to use the student loan EMI calculator SBI:

Step 1: Visit the official page of the State Bank of India (SBI) [sbi.co.in/web/personal-banking/home]

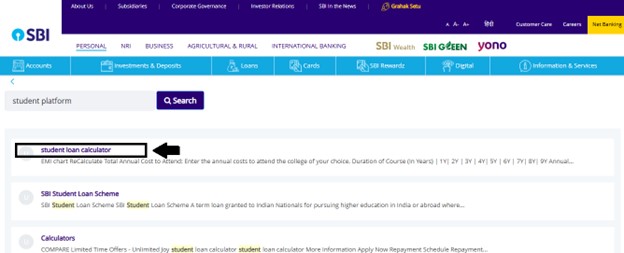

Step 2: Navigate to the search bar and type ‘Student Platform’ in it.

Step 3: Now, click on the ’Student Loan Calculator’ to access the SBI education loan EMI calculator.

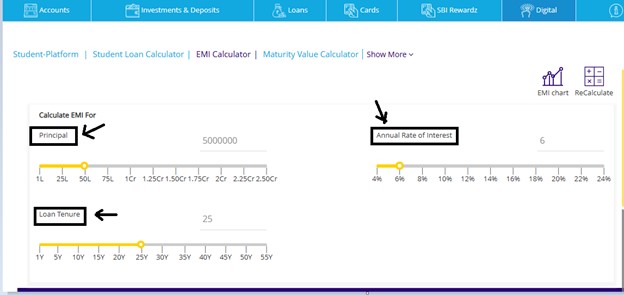

Step 4: Now, simply enter the education loan amount, interest rate, and loan tenure into the calculator.

Step 5: The calculator quickly processes the information and provides an estimate of your monthly EMI.

Step 6: Additionally, it displays a breakdown of the total interest payable and the overall cost of the loan.

Let’s understand this with the help of an example:

Loan Details:

- Loan Amount: ₹10,00,000 (₹10 Lakhs)

- Interest Rate: 9% per annum

- Tenure: 10 years (120 months)

Here’s how the SBI student loan EMI Calculator works:

- Input Loan Amount: Enter the loan amount of ₹10,00,000.

- Specify Interest Rate: Input the applicable interest rate of 9% per annum.

- Select Loan Tenure: Choose a 10-year (120-month) repayment tenure.

Calculated Results:

- Monthly Equated Monthly Installment (EM)I: ₹12,764

- Total Repayment (Principal + Interest): ₹15,28,530

- Total Interest Payable: ₹5,28,530

Understanding the Results:

The SBI education loan EMI calculator shows that the borrower will need to pay ₹12,764 every month for 10 years. In total, they will repay ₹15,28,530, which includes the original loan amount plus interest.

SBI Education Loan EMI for Different Schemes

SBI Student Loan Scheme:

| Loan Limit | EBR | RPR | Effective Interest Rate | Rate Type | Concession |

|---|---|---|---|---|---|

| Upto ₹7.5 Lakhs | 9.15% | 2.00% | 11.15% | Floating |

|

| Above ₹7.5 Lakhs |

|

SBI Scholar Loan Scheme (Including TAKEOVER and PART-TIME COURSES for select institutes):

| List | EBR | CRP | Business Strategy Premium/ Discount | Effective Interest Rate | Rate Type |

| AA (With or without co-borrower) | 9.15% | 0.00% | (-) 1.05% to (-) 1.00% | Starting 8.10% | Floating |

| AA (With or without co-borrower) | 9.15% | 0.05% | (-) 1.15% to (-) 1.05% | Starting 8.05% | Floating |

| A | 9.15% | 0.00% | (-) 1.00% | 8.15% | Floating |

| A | 9.15% | 0.50% | (-) 1.00% | 8.65% | Floating |

| B | 9.15% | 0.50% | (-) 1.00% | 8.65% | Floating |

| B | 9.15% | 1.00% | (-) 1.00% | 9.15% | Floating |

| C | 9.15% | 0.50% | (-) 1.00% | 8.65% | Floating |

| C | 9.15% | 1.50% | (-) 1.00% | 9.65% | Floating |

Other SBI Education Loan Options:

| Loan Scheme | Loan Limit | EBR | CRP | Effective Interest Rate | Rate Type | Concession |

| SBI Takeover Education Loans Scheme | Above ₹10 lakhs & Upto ₹1.5 Cr | 9.15% | 2.00% | 11.15% | Floating | 0.50% for female students or SBI Rinn Raksha |

| Shaurya Education Loan | Upto ₹7.50 lakhs | 9.15% | 2.00% | 11.15% | Floating | 0.50% for female students |

| Above ₹7.50 Lakhs & Upto ₹1.50 Cr | 9.15% | 2.00% | 11.15% | Floating | 0.50% for female students or SBI Rinn Raksha | |

| Above ₹7.50 Lakhs & Upto ₹1.50 Cr | 9.15% | 2.60% | 11.75% | Floating |

*EBR = Repo Rate + Spread | Currently: Repo rate = 6.50% | Spread = 2.65% | EBR = 9.15%

Conclusion

In conclusion, the SBI Education Loan EMI Calculator is a valuable tool that empowers students and parents to make informed financial decisions. By providing accurate EMI calculations and breaking down the total cost of the loan, it simplifies the loan repayment process. Whether you opt for a student loan without collateral or a secured loan, this calculator can help you plan your finances effectively and ensure a smooth & timely repayment.

Also Read: Study Loan Process: Eligibility, Application, & More

Frequently Asked Questions (FAQs)

Can I extend the loan tenure?

Yes, you can extend the tenure if your course duration is extended.

I’m unsure about the processing fee for my education loan. What steps should I take to find out?

You’ll need to know the exact processing fee to accurately calculate your EMIs using the education loan EMI calculator. You can find this information in your loan application documents or by contacting your bank directly.

What’s the difference between EMI and interest rate calculators?

The EMI calculator provides both the interest rate and the monthly EMI, while the interest rate calculator only calculates the interest.

Are there tax benefits for education loans?

Yes, you can claim tax deductions on interest payments under Section 80E of the Income Tax Act, of 1961.

What types of loans can I calculate using the EMI calculator?

You can use the EMI calculator to calculate EMIs for various loan types, including home loans, personal loans, car loans, education loans, business loans, and more.

What variables should be entered into the EMI calculator to get the result?

You need to input the loan amount, interest rate, and loan tenure into the calculator to calculate your EMI.

Are the EMI calculator and the student loan interest rate calculator the same?

No, the education EMI calculator not only provides the EMI amount you’ll be paying each month but also calculates the applicable interest rate. On the other hand, the student loan interest rate calculator helps you determine the total interest payable on your loan.

How many times may I use an EMI calculator for a student loan?

You can use the student loan EMI calculator as many times as you require. There is no limitation, and using the EMI calculator will not impact your credit score.

1 thought on “SBI Education Loan EMI Calculator – Benefits, Usage & Features”

Comments are closed.