Imagine a small-town girl, Radhika, filled with dreams of studying for an MBBS degree at one of India’s premier institutes. Her father, a school teacher, did his best to save for her education, but the skyrocketing costs of higher education were beyond their reach. Radhika’s dreams seemed unachievable, while looking for various financial options, her family came across Canara Bank’s education loan scheme. Luckily, she qualified the eligibility requirements for the student loan.

With the loan covering her tuition and living expenses, Radhika not only completed her degree but also secured a reputation in her community as a doctor. The affordable interest rates on Canara bank education loan made her dream come true.

Radhika’s story is not unique. Thousands of students across India rely on student loans to pursue their aspirations. Among the many options available, Canara bank’s student loans stand out for their competitive interest rates and student-centric policies making higher education accessible for the students who aspire to excel in life.

Did you know? The annual spend on higher education in India and abroad has risen exponentially by the time. According to a report by the Ministry of Education in 2023, the average cost of a professional degree in India ranges from ₹5 to ₹20 lakhs, while studying abroad can cost upwards of ₹50 lakhs. With such high costs, education loans are no longer a luxury but a necessity for many students and their families.

Canara Bank, with its long-standing reputation and student-friendly policies, has emerged as a preferred choice for student loans.

Canara Bank Education Loan Eligibility Criteria

To apply for an education loan through Canara bank, students must be Indian citizens and pursuing higher education in India or abroad. Eligible applicants must have secured admission to a professional, technical, and vocational program at a recognised institution through merit-based selection or an entrance exam. Applicants must be between 18 to 35 years old, with a co-borrower, such as a parent or guardian, providing collateral for higher loan amounts. Students must have a good academic record and adherence to specific loan terms, including repayment guidelines, are mandatory for approval.

Canara Bank Education Loan Interest Rates

Interest rates are a critical factor when choosing a student loan. Canara Bank offers various education loan schemes with interest rates linked to the Repo Linked Lending Rate (RLLR), currently at 9.25% per annum. The effective interest rates for different schemes are as follows:

| Scheme Name | Loan Amount | Interest Rate (per annum) |

| IBA Model Education Loan Scheme | Up to ₹7.50 lakhs | 11.25% |

| Above ₹7.50 lakhs (India) | 10.85% | |

| Above ₹7.50 lakhs (Abroad) | 10.50% | |

| Vidya Turant Scheme | With Co-borrower | 9.25% |

| Without Co-borrower | 9.85% | |

| Select Top 76 Institutes | 8.60% | |

| IBA Skill Loan Scheme | ₹5,000 to ₹1.50 lakhs | 10.75% |

| Education Loan for Master’s Abroad | With 100% Collateral | 10.50% |

Note: The above interest rates are subject to change based on the bank’s policies and prevailing market conditions.

Canara Bank Education Loan Interest MCLR Rates

Education loans interest rates in India are calculated by fixed formulas of MCLR (Marginal Cost of fund based Lending Rates). These MCLR rates are changed on a monthly basis by RBI and banks modulate their education loan interest rates every 6 months based on these changes. Canara Bank education loan interest rates are settled in terms of fixed percentage addition to changing MCLR Rates so that students can themselves be aware about the latest interest rates.

The below-mentioned Marginal Cost of Lending Rates (MCLRs) will be applicable only to the following two categories:

- New loans and advances that are sanctioned or where the initial disbursement occurs on or after October 12, 2024

- Renewed, reviewed, or reset credit facilities where the borrower has the option to switch to an MCLR-linked interest rate, and this switch is made on or after October 12, 2024

| Education Loan Tenure | Respective MCLR Rates |

| Overnight | 8.30% |

| 1 Month | 8.40% |

| 3 Months | 8.50% |

| 6 Months | 8.85% |

| 12 Months | 9.05% |

| 24 Months | 9.30% |

| 36 Months | 9.40% |

Important Note: Existing borrowers of the bank have the option to switch to interest rates linked to the Marginal Cost of Lending Rate (MCLR), excluding those with fixed-rate loans. Borrowers interested in switching to MCLR-based interest rates can contact their branch for further information. This option is currently unavailable for retail loans and loans to Micro, Small, and Medium Enterprises (MSMEs).

Canara Bank Interest Subsidy Educational Loans

Central Scheme of Interest Subsidy for Educational Loans for Inland Studies

The Government of India, through the Ministry of Human Resource Development, has launched an interest subsidy scheme to ensure that students from Economically Weaker Sections (EWS) can access professional education easily.

Canara Bank has been designated as the Nodal Bank to administer this education loan subsidy scheme to scheduled banks of the applicants. This scheme is available for student loans availed from scheduled banks for approved technical and professional courses after passing Class 12 from recognised institutes in India.

Students from EWS with an annual gross family income of up to ₹4.50 lakh can apply for this interest subsidy scheme.

The subsidy covers the full interest during the moratorium period (course duration plus one year) for loans availed from April 1, 2009, onwards. For loans sanctioned before this date, only amounts disbursed after April 1, 2009, qualify.

| Important Documents

Guidelines for CSIS | State-wise Income Certificate issuing Authority |

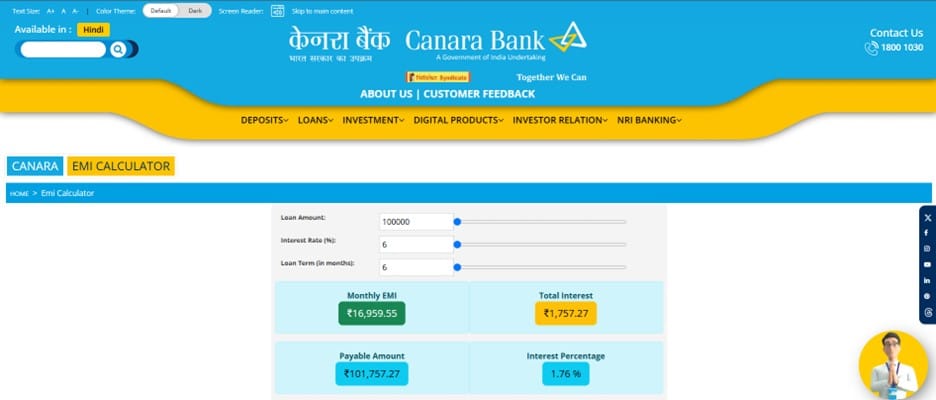

Canara Bank Education Loan EMI Calculator

The Canara Bank EMI Calculator is an online tool designed to help students to easily calculate their Equated Monthly Installments (EMIs). Individuals can use this education loan EMI calculator by following the below steps:

Step 1: Visit the official website of Canara Bank (canarabank.com).

Step 2: Now, on the left hand side of the dashboard, there is a search bar. Enter ‘EMI calculator’ and click on the first option in the drop down menu.

Step 3: Enter the loan amount, interest rate and loan term (in months) to calculate the EMI for your Canara bank education loan.

Also Read: Canara Bank Education Loan – Benefits, Interest Rates and Scheme Details

Frequently Asked Question (FAQs)

Who is eligible for the Central Scheme of Interest Subsidy (CSIS) scheme?

Students who are willing to pursue technical or professional higher education courses from recognised institutions in India are eligible to apply for the CSIS scheme. The institution should be NAAC, NBA, CFTI accredited, or a regulatory-approved institute.

Is there any income criteria for claiming the subsidy?

Yes, the total family annual income from all sources should not exceed ₹4.5 lakhs to be eligible for the interest subsidy scheme.

Is it compulsory to avail an education loan for getting the interest subsidy benefit?

Yes, students who have availed an education loan from scheduled commercial banks under the model education loan scheme of IBA and are studying in eligible Higher Education Institutions (HEIs) are eligible for the interest subsidy schemes.

Is there any upper limit on the loan amount for claiming the interest subsidy?

The Central Sector Interest Subsidy Scheme (CSIS) provides financial assistance to students by subsidising interest on student loans. Interest subsidy is currently available for loans up to ₹10.00 lakhs. For loans up to ₹7.50 lakhs, no collateral security or third-party guarantee is required. If the lender bank is registered under the Credit Guarantee Fund Scheme for Education Loan (CGFSEL), loans up to ₹7.50 lakhs must be covered under CGFSEL for CSIS coverage. Lenders not registered under CGFSEL may still be eligible for CSIS coverage for loans up to ₹7.50 lakhs, if they are sanctioned under the IBA Model Education Loan Scheme.

Who is the income certificate issuing authority?

The income certificate is issued by the appropriate authority designated by the respective State/UT Governments. For the detailed list of authorities, refer to the above article.

Where is the interest subsidy credited?

The interest subsidy is credited directly to the student’s loan account. The Ministry of Education is not liable for any back-payments if the bank fails to claim the subsidy before the closure of the loan account.

When can the bank file its interest subsidy claim?

The CSIS portal is open throughout the year. The bank should file the claim when the interest subsidy for the year is due, and the student has completed the academic year.

How can the borrower claim the subsidy from the Government of India?

The borrower cannot claim the subsidy directly. Only the financing bank is authorised to claim the subsidy on behalf of the borrower.

Is it necessary to submit the income certificate every financial year?

No, the income certificate is required to be submitted only at the time of loan sanction or the disbursement of the first installment of the interest subsidy.

What is the payment process for the CSIS?

The subsidy amount is directly credited to the beneficiary’s student loan account through the PFMS system. It is the responsibility of the loaner bank to ensure correct account details for the DBT credit process of the student.

What is the role of Canara Bank as a Nodal Bank for the CSIS scheme?

Canara Bank acts as the Nodal Bank for administering the Interest Subsidy Scheme.