Credila Education Loan: Soaring education costs in India have made it increasingly challenging for families to fund their children’s aspirations for higher education. Credila, formerly known as HDFC Credila, is India’s pioneering education loan provider. It offers specialised financial solutions tailored to the unique needs of students. With a vision to shape bright futures and a mission to make education accessible, Credila has transformed the landscape of higher education financing.

This guide provides a comprehensive overview of Credila’s funding solutions for studies in India and abroad, ensuring students can focus on their education without financial hurdles.

Why Choose Credila Education Loan?

HDFC Credila stands out for its deep understanding of the education sector and its customised approach to financing. Unlike traditional banks, Credila offers personalised loan solutions tailored to each student’s unique needs, considering factors like academic background, chosen institution, co-borrower profile, and collateral security. This approach ensures flexibility, fairness, and competitive rates.

With features like pre-admission loan sanctions, no margin money requirements, long repayment tenures, and attractive tax benefits under Section 80-E, Credila makes quality education accessible without financial strain. Its global reach, funding students in 63+ countries across 4,600+ institutes and 3,300+ courses, underscores its commitment to empowering academic aspirations. Whether for studies in India or abroad, Credila remains a trusted partner, helping over 178,000 students turn their dreams into reality.

Credila Education Loan: Funding Solutions for Studies in India

Pursuing higher education in India can be financially challenging due to rising costs and complex admission processes. Credila simplifies this journey by offering customised loan products that cater to diverse courses and student needs.

Key Features:

1. Specialised Products for Diverse Courses: HDFC Credila offers specialised loan products to cater to a wide range of courses, including full-time and executive MBAs, MS, MBBS, MD, engineering, and clinical research. Even long-duration programs like 4-6 year MBBS courses are covered, with repayment starting only after course completion.

2. Flexible Financing Options:

- It provides comprehensive financial coverage, including 100% financing for tuition fees and living expenses. Loan amounts are flexible, ranging from ₹8-10 lakhs for professional programs to ₹35 lakhs or more for medical courses, with no upper limit.

- HDFC Credila allows students to apply for loans even before securing admission, avoiding last-minute stress to ease the financial burden. The lender also offers flexibility in co-borrower requirements and collateral security, making loans accessible to a broader audience.

- No upfront margin money is required, and repayment periods can be extended up to 15 years to ensure manageable EMIs. Additionally, attractive tax deductions under Section 80-E of the Income Tax Act make education loans a smart financial choice.

- Credila goes beyond traditional financing options by offering loans for both AICTE-approved and non-AICTE-approved courses. This ensures wider access to education, especially for emerging fields and institutions.

Credila Education Loan: Course-wise Funding Solution

Credila understands the complexities of choosing the right institution and the importance of not letting financial constraints hinder academic aspirations. That’s why they offer education loans for many major courses that require significant financial investment. Below are a few of them:

1. MBA/PGDBM: HDFC Credila education loan simplifies the education loan process by encouraging students to apply and undergo a loan evaluation even before the admission process begins. This proactive approach enables students to plan their finances, making it easier to choose their preferred colleges without financial constraints. Credila ensures that students can fund the complete cost of their education by offering loans that cover both tuition fees and living expenses with no upper limit. Flexible collateral requirements and non-collateralised loan options for selected MBA/PGDMB courses and institutions further enhance accessibility.

2. Executive Management Courses (For Working Executives): HDFC Credila offers specialised education loans for residential and non-residential executive management courses. These loans cover up to 100% of the costs, including tuition fees and living expenses. It offers attractive interest rates and provides home-delivery service for a hassle-free application process, making financing executive management education both convenient and affordable.

3. MBBS/MD: Credila offers comprehensive education loan solutions. Students can avail loans that cover 100% of tuition fees and living costs, with no upper cap on the loan amount. This includes support for long-duration courses like 6-year MBBS programs. Additionally, Credila offers flexible co-borrower norms and attractive tax benefits under Section 80E of the Income Tax Act 1961. To ease the financial burden, the company provides longer repayment tenures and eliminates the need for margin money.

4. Engineering: HDFC Credila’s education loan covers both tuition fees and living costs. Additionally, it offers longer repayment tenures to ease the burden of repayment.

5. All Other Courses: Credila offers loans covering both tuition fees and living costs, with no upper cap on the loan amount. This flexibility, combined with lenient collateral norms, makes education financing more accessible.

Funding Solutions for Studies in the USA

The United States remains a top destination for Indian students pursuing higher education. However, the rising costs and stringent proof-of-funds requirements can make it challenging to finance your studies. Credila, formerly known as HDFC Credila, specialises in providing education loans to Indian students aspiring to study in top US universities, particularly for MS and MBA programs.

Key Features of Credila’s US Education Loans:

- Customised Loan Products: Credila offers tailored loan solutions to meet your specific needs, including pre-approved loans to simplify the visa process.

- Flexible Financing Options: Benefit from unsecured (collateral-free) loans for select courses and no upper limit on the loan amount, ensuring comprehensive financial coverage.

- Efficient Loan Processing: Credila prioritises timely loan processing, providing early evaluations based on your academic records and test scores. You’ll also receive solvency letters to support your admission and visa applications.

- Transparent Interest Charges: Interest is charged only after the loan is disbursed, ensuring transparency and affordability.

- Expert Guidance: Credila advises students to start planning early, especially for fall intakes, which typically begin in October.

Why Choose Credila for Your US Education?

- Secure Your I-20: HDFC Credila helps you demonstrate the required liquid funds to secure your I-20 form.

- Proven Track Record: Trusted by thousands of students at top US universities, Credila has a strong reputation for reliable and efficient education financing.

Funding Solutions for Studies Abroad

Beyond the USA, an increasing number of Indian students are choosing countries like Canada, Germany, Australia, and France for higher education. The rising popularity of these destinations highlights the need for customised funding solutions tailored to diverse requirements.

HDFC Credila offers loans for studies in popular destinations such as Canada, known for its high-quality education and attractive post-study work opportunities; Germany, a global leader in engineering and technology; Australia, offering a diverse range of professional and academic courses; and emerging study hubs like France, Singapore, Dubai, Ireland, and New Zealand.

Credila’s Offerings for Overseas Studies

HDFC Credila recognises the diverse costs associated with studying in different countries and offers customised loan solutions to cater to these specific needs. With a wide range of coverage, Credila supports hundreds of courses across 35+ countries, funding tuition fees, living expenses, and other educational costs. Leveraging its proven expertise, HDFC Credila has empowered thousands of students to pursue their academic aspirations at prestigious global institutions.

Eligibility Criteria for Credila Education Loan

To qualify for education loan support with Credila, both the borrower/applicant and co-borrower need to meet specific eligibility criteria:

- The borrower/applicant must be an Indian citizen.

- Co‐applicants must be Indian citizens with a valid bank account in any Indian bank with cheque-writing facilities.

- Applicants must have confirmed admission to a college or university before disbursement.

- Both borrower and co-applicant(s) must meet Credila’s credit and underwriting standards.

Co-Applicant Eligibility Requirements:

- A co-applicant is a mandatory requirement for the Credila student loan application. The co-applicant’s income is used to determine loan eligibility, and their liability is co-extensive with the student’s. Accepted co-applicants include a Father, Mother, Brother, Sister (married), and Spouse.

- In cases where the relatives do not provide the collateral, extended family members such as father-in-law, mother-in-law, siblings-in-law, uncles, aunts, and grandparents can act as co-applicants, provided they meet Credila’s credit norms.

- The co-applicant must provide documentary proof to establish their relationship with the student to Credila’s satisfaction.

Costs Covered by Credila Education Loan

HDFC Credila’s education loan is designed to cover various educational expenses such as:

- Tuition fees as determined by the educational institution.

- Up to 100% of other costs, including living expenses, hostel fees, travel expenses, examination fees, library/laboratory fees, purchase of books, uniforms, computers, and laptops required for the course.

- Travel fare for one economy-class return ticket between your residing city and study location, for international students.

Credila Education Loan: Amount & Repayment Terms

HDFC Credila offers flexible loan amounts and repayment terms to cater to various education needs. The minimum loan amount is ₹1,00,000, and there is no upper limit, with Credila processing loans exceeding ₹25,00,000, subject to credit and underwriting norms.

Credila offers a floating interest rate linked to its Benchmark Lending Rate (CBLR)*, which is currently 14% per annum (subject to change). This interest rate is calculated using simple interest and varies based on factors like the student’s academic background, course employability, and the co-borrower’s financial strength.

Repayment begins immediately after the disbursement of the first installment. The loan tenure includes the duration of study, a grace period after study, and the repayment period, with a maximum tenure of 12 years, depending on factors like the co-applicant’s age and repayment capability.

Repayments are conveniently managed through the Electronic Clearing System (ECS)**, which deducts monthly payments directly from the bank account of the borrower or co-borrower.

Important Definitions:

*The Benchmark Lending Rate (CBLR) is a lending rate set by banks and financial institutions in India. It is used as a reference point for determining the interest rates charged on loans.

**Electronic Clearing System (ECS) is an electronic method of transferring funds between bank accounts. It’s primarily used for bulk transfers, such as salary disbursements, pension payments, dividend payments, and utility bill collections. ECS simplifies the process of transferring funds, making it efficient and convenient for both individuals and organisations.

Credila Education Loan: Collateral Requirements

HDFC Credila education loan accepts various forms of collateral for securing the education loan, ensuring flexibility for students and co-applicants. Acceptable collateral includes:

- Residential flat or house

- Non-agricultural land

- Fixed deposit assigned in favor of Credila

These options provide security for the loan, giving students the financial freedom to focus on their education.

Credila Student Loan: Applicable Fees & Charges

| Description of Service | Charges (in Indian Rupees, ₹) |

| Pre-payment Charges | NIL |

| No Objection Certificate (NOC) | NIL |

| Delayed Payment Charges* | 2% per month of the monthly installment (MI/PMII), plus applicable taxes |

| Statutory CERSAI Charges | As per charges levied by CERSAI |

| Cheque or ACH Mandate or Direct Debit Swapping Charges* | Up to ₹500 per swap instance, plus applicable taxes |

| Cheque/ ACH/ Direct Debit Bouncing Charges* | ₹400 per dishonour of cheque or ACH or Direct Debit return, per presentation, plus applicable taxes |

| Legal/ Incidental Charges | At actual |

| Stamp Duty and other Statutory charges | As per applicable laws of the state |

| Manual Collection Charges* | ₹200 per visit, plus applicable taxes |

| Charges for Updating & Handling Loan Account as per Customer Request* | ₹1,500, plus applicable taxes |

| Origination Fee | 1.5% plus taxes of the sanctioned amount (Non-refundable) |

*Terms and Conditions Apply

Documents Required for Credila Education Loan

The following are the supporting documents needed to apply for the education loan from HDFC Credila:

1. HDFC Credila Application Form

2. Two passport-sized photographs

- One set to be pasted on the application form

- One set to be stapled to the application form

3. Photo ID (any one of the following):

- PAN Card

- Voter’s ID Card

- Passport

- Driving License

- Aadhaar Card

4. Residence Proof (any one of the following):

- Passport

- Driving License

- Aadhaar Card

- Voter’s ID Card

For Student:

- Class 10 and 12 marksheets/certificates

- Graduation marksheets/certificates

- Entrance exam scorecards (if applicable)

- Scholarship certificates (if applicable)

- Proof of Admission or Printed admission letter from the institute (whichever is available)

For Co-Applicant: Last 8 months’ bank statements for all accounts, including the salary or business/professional income account

For Salaried Individuals:

- Last 3 salary slips or salary certificate

- Last 2 years’ Form 16 or Income Tax Returns

- Other income proofs (if applicable)

For Self-Employed Individuals:

- Last 2 years’ Income Tax Returns

- Last 2 years’ Certified Financial Statements or Provisional Financial Statements

- Proof of Office (Lease Deed, Utility Bill, Title Deed, etc.)

- Other income proofs (if applicable)

If Collateral is Immovable Property:

- Property Title Deed

- 7/12 Extracts (for land)

- Registered Sale Agreement and Society Share Certificate

- Registration Receipt

- Allotment letter from Municipal Corporation or Authorised Government Authority

- Previous Sale Deeds

- Latest maintenance bills and receipts

- Property Tax Bills and Receipts

- NOC for Mortgage

- Approved building plan

- Encumbrance certificate

Credila Education Loan Application Process

Credila offers a streamlined and user-friendly student loan process to make securing an education loan effortless. The applications for Credila can be filled both online and offline. Here is the step-by-step guide for smooth HDFC Credila login:

Online Application Process:

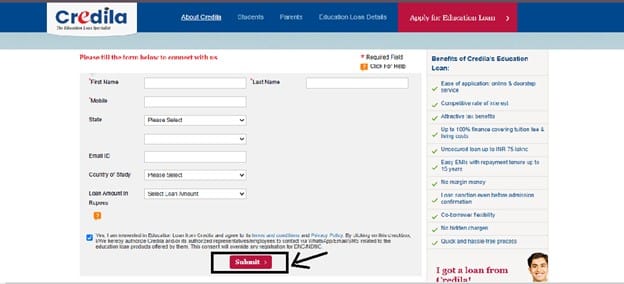

Step 1: Visit the official website of Credila (credila.com/index.html)

Step 2: Navigate to the ‘Click to Apply’ button and click on it.

Step 3: Fill in all the required details, tick the checkbox to agree with the terms & conditions and click on the ‘Submit’ button.

Step 4: Once the online application is submitted, a follow‐up with the student & parents to answer questions will be done by Credila and Representatives will visit the applicants’ residence to collect the signed application form with the supporting documents.

Step 5: After collecting the Credila loan application, the credit team will thoroughly review and evaluate the application to ensure all criteria are met.

Step 6: If the application meets the requirements, Credila will approve the loan. If additional information is needed, applicants will be notified immediately.

Step 7: Once the loan is approved, applicants will have to sign the loan agreement and complete the disbursement formalities.

After completing all the formalities, the education loan amount will be deposited electronically into the designated bank account.

Note: Students can apply for a Credila Education Loan even before receiving confirmed admission.

Offline Application Process:

Students can also fill out HDFC Credila’s short loan application form offline by calling the toll-free number: 1800-209-3636, or by submitting the application form to one of the offices in Mumbai, Pune, Bangalore, Delhi, Ahmedabad, Chennai, Hyderabad, Kolkata, or Nasik.

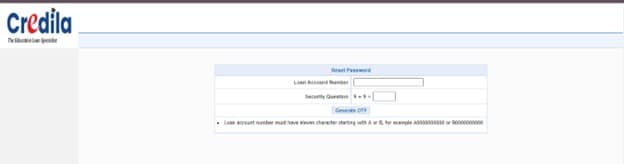

How to Reset Password for Credila Loan Account?

Resetting the password for your HDFC Credila loan account is a simple process. Here are the steps to reset password for Credila loan account:

- Visit the official website of Credila (credila.com/help/login.asp)

- Click on the ‘Reset Password’ button.

- Enter the ‘Loan Account Number’ and solve the security question to generate OTP.

- After generating the OPT, enter it and reset your password.

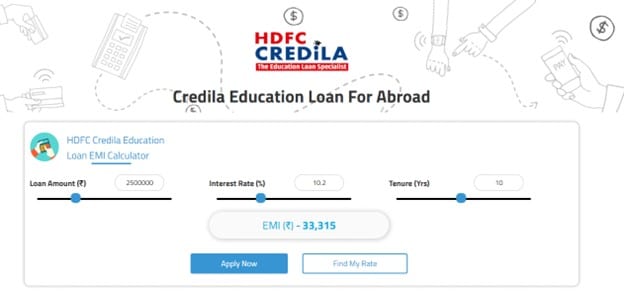

How to Use Credila Repayment Calculator?

Here’s a step-by-step guide on how to use the HDFC Credila EMI calculator:

- Visit the HDFC Credila Website: Go to the official HDFC Credila website (www.credenc.com/credila-student-loan).

- Locate the EMI Calculator: Look for the EMI calculator tool on the website.

- Input Loan Details:

- Loan Amount: Enter the total amount you wish to borrow.

- Interest Rate: Input the annual interest rate offered by Credila.

- Repayment Period: Specify the duration (in months or years) over which you want to repay the loan.

- Click ‘Calculate’: Once you’ve entered all the necessary details, click the “Find my Rate” button.

The calculator will display the estimated monthly installment (EMI) you’ll need to pay.

How to Track Credila Education Loan Status?

Keeping track of your HDFC Credila loan status has never been easier. With HDFC Credila’s online loan tracker, you can monitor your HDFC Crdila loan’s progress in real-time. Here’s how:

- Access the Loan Status Tracker: Visit the designated loan status tracker page on the HDFC Credila website.

- Provide Your Information: To identify your loan, you can use your full name as it appears on the application form OR unique reference or proposal number, date of birth, or Registered mobile number.

- Complete the CAPTCHA Challenge: Verify your identity by completing the CAPTCHA challenge.

- Submit and Track: Once you’ve entered the required details and completed the CAPTCHA, submit your request. Your loan details, including disbursement status, outstanding balance, and interest rate, will be displayed on the screen.

Credila Education Loan Disbursement Process

The disbursement process for Credila education loan is seamless and transparent for students pursuing higher education. Here’s a step-by-step guide to understanding how to access your education loan funds, making the journey hassle-free.

- Pay Origination Fees: Any remaining origination fees need to be cleared before disbursement of the education loan amount. Providing a cheque from the account linked to the ECS (Electronic Clearing System) will simplify this process and help Credila prepare the necessary forms.

- Decide the Disbursement Date: Choose the exact date for the disbursement based on key factors such as your visa approval (for international studies) or the last date for tuition fee payment. Planning ensures the timely transfer of funds.

- Finalise the Disbursement Amount: Specify the amount Credila should release for university fees and living expenses. This ensures you have adequate funding for tuition and day-to-day needs.

- Provide Disbursement Details: Inform Credila of the payment method required by your university or college—such as a bank wire transfer or demand draft—and provide accurate banking details. These details are usually included in the admission package.

- Prepare the Final Loan Agreement: HDFC Credila will prepare the final loan agreement based on the provided details. The agreement must be signed by the student, co-borrowers, and guarantor (if applicable). If parties are in different cities, proper coordination is required to avoid delays.

- Submit ECS Mandate: Complete three copies of the ECS mandate, signed and stamped by your bank, and submit one copy to the bank manager for their records. This step ensures smooth monthly loan repayments.

- Provide Original Documents to Credila: During the signing of the loan agreement, the following original documents are required to be produced:

- KYC documents of the student, co-borrowers, and guarantors

- Two original copies of the signed ECS mandate

- Eight security cheques in favour of Credila Financial Services Limited

- Collateral documents, if applicable (e.g., FD receipts, property documents)

- A photocopy of the tuition fee receipt, if already paid

- Sign the Loan Agreement: Visit Credila’s office with all required documents to complete the agreement. Ensure all parties are present, or coordinate couriering documents for signature if located in different cities.

- Receive the Education Loan Funds: Once all documents are verified, Credila will transfer the loan amount to the university’s bank account or issue a demand draft, depending on the chosen method.

For assistance, applicants can contact the Credila Relationship Manager or write an email at: support@credila.com

Credila Education Loan: FAQs

What supporting documents are required when I apply for an education loan?

The supporting documents required for a Credila education loan application are standard. After submitting the short application form, you will receive an email with a detailed list of necessary documents.

Credila’s credit scoring module assesses various factors, including the applicant’s academic performance, the chosen university and course, any collateral offered, and the co-borrower’s profile.

What is the timeframe for loan disbursement?

The loan application process involves two phases:

- In-principle sanction: This typically takes 7-10 days from the date of receiving your completed application form and supporting documents.

- Disbursement of funds: This process usually takes 7 days after receiving all post-sanction documents and completing the necessary post-sanction formalities.

Please note that the actual timeline may vary depending on individual circumstances and the efficiency of document submission.

When is the right time to apply for an education loan – before admission confirmation or after?

Applying for an education loan can be a complex process, especially when deciding the right time to apply. While many banks require confirmed admission before approving a loan, universities often prefer students with assured funding. To simplify this process, it’s advisable to apply for an education loan early. This not only increases your chances of admission to your desired university but also provides peace of mind by ensuring timely fee payments and visa processes.

Can I apply for a Credila education loan before admission? (USA and abroad)

Yes, Credila offers loan sanction even before admission or I-20 issuance. An I-20 Form is issued by a US university to a student after admission confirmation and is crucial for obtaining a visa.

Do I need to be admitted before I can apply for an education loan at a particular university or college?

No, you don’t. You can apply for an education loan before receiving admission confirmation. If your application is approved, you’ll receive a conditional loan sanction letter. This can boost your confidence and allow you to apply to better universities without worrying about funding.

Can the repayment period be extended?

Yes, the repayment period can be extended in certain cases, subject to review on a case-by-case basis.

Can I prepay my Credila education loan? If yes, are there any charges? Given the RBI’s recent guidelines on prepayment charges, does this apply to Credila as well?

Yes, Credila allows students and parents to make part payments or foreclose their education loans. Credila is compliant with all relevant NBFC guidelines.

Can I avail any benefits for early repayment of the loan?

Yes, the pricing is typically designed to encourage at least interest repayment during the course period. This helps you:

- Avail unlimited tax benefits on the interest paid.

- Develop financial discipline from the outset.

Why is collateral required if my co-borrower has a very good income?

While a co-borrower’s strong income is a positive factor, collateral is often required to mitigate the risk associated with student loans. Since students typically haven’t started earning, their future income and profile can be uncertain. By providing collateral, you can secure better interest rates on your education loan. Credila’s dedicated Relationship Managers can guide you through the collateral process, making it as smooth as possible.

How much loan can I get from Credila?

Credila is one of the few lenders that can finance up to 100% of your education costs, including loans exceeding ₹20 lakhs.