Indian Bank Education Loan (IBA) scheme is an education loan model that offers need-based loans to students who want to pursue undergraduate, postgraduate, and postgraduate diploma courses in India and abroad. Under this scheme, students can get an education loan of up to ₹25 lakh for the Executive Management Program and Executive Master of Business Administration (MBA) courses conducted within India only.

Students who apply for educational loan of up to ₹7.5 lakh under the IBA scheme are eligible for the Credit Guarantee Fund Scheme for Educational Loans (CGFSEL). The guarantee cover will protect the lender by covering 75% of the loan amount in case the borrower does not pay back the loan amount on time.

Moreover, applicants are not required to provide third-party guarantees or collateral security* up to a specified loan limit. *Simple interest will be charged during the course duration and the *moratorium period until the first instalment of repayment.

This article provides comprehensive information about IB Education Loan eligibility criteria, required documents, eligible courses and institutions, loan limits, repayment terms, and more.

*Important Note:

|

Indian Bank Education Loan – General Overview

| Name of the Scheme | IB Education Loan (Indian Bank Education Loan) |

| Official Website | indianbank.in/departments/educational-loan-iba/#! |

| Eligibility |

|

| Eligible Courses | Undergraduate, postgraduate, and postgraduate diploma courses |

| Maximum Loan Amount | Up to ₹25 lakh for Executive Management Program or Executive MBA courses in India |

| Moratorium Period | One year after completion of the course |

| Application Mode | Online/offline |

| Last Date to Apply | Runs throughout the year |

Indian Bank Education Loan – Eligibility

The eligibility criteria for the loan scheme are as follows:

- Applicants must be Indian citizens, Non-Resident Indians (NRIs), Persons of Indian Origin (PIOs), Overseas Citizens of India (OCIs), or individuals born abroad.

- Applicants must have completed Higher Secondary level (10+2 or equivalent) education.

- Students must have secured admission in undergraduate or postgraduate courses in either India or abroad based on merit or through an entrance test.

- Students can apply for the Indian Bank Education Loan to pursue various programs such as graduation, post-graduation, diploma, or degree courses in either India or abroad.

- There is no specific age limit to apply for the education loan scheme. So, students need to fulfil the other eligibility criteria.

Indian Bank Education Loan – For Executive Management Program/Executive MBA

- Applicants must be pursuing a graduation course or degree from any stream.

- Applicants could be working professionals (restricted to salaried class only) with at least three years of work experience in the relevant field to apply for the program.

- Students must have secured admission to a Premier and Prime Plus institute to pursue the Executive Management Program/Executive MBA program.

- Part-time and distance education programs are available to working professionals who are salaried employees.

Note:

- Beneficiaries identified under the Prime Minister Cares for Children Scheme (PMCCS) are eligible to apply for the education loan.

- For NRI, PIO, OCI, and Student born Abroad, loans can be considered only for studies in India.

Indian Bank Education Loan – Benefit/Amount

- Interested candidates who fulfil the eligibility criteria can apply for a loan ranging from ₹4 lakh to ₹25 lakh.

- Candidates who are pursuing an Executive Management Program/Executive MBA across India will receive a maximum loan limit is ₹25 lakh. However, this education loan is exclusively available to students undertaking these courses within India.

Note: Students can apply for a need-based education loan based on the expenses of their chosen course in India or abroad, but they must meet specific margin requirements.

Additional Benefits under the Indian Bank Education Loan:

The education loan is designed to offer financial support to students pursuing higher education. Below is a list of the expenses that the loan covers during the course duration:

- Tuition fees

- Hostel fees or lodging and boarding charges

- Living expenses and travel expenses/passage money

- Insurance premium (if any)

- Caution money/building fund/refundable deposit

- Fund to purchase books/uniform/equipment/instruments

- Money to purchase a computer at an affordable price

- Academic and maintenance fee

- Tour fee

- Project or thesis expenses and other miscellaneous expenses

Important Note –

The above-listed covered expenses are tentative and subject to the bank’s lending policy. The bank reserves the right to set limitations on these expenses.

Indian Bank Education Loan – Loan Limit & Margin

For loans ranging from ₹4 lakh to ₹25 lakh, students are required to provide a *margin money as per the percentages mentioned in the below table:

| Loan Limit | Margin |

| Up to ₹4 lakh | 0% margin money to study in India and abroad |

| Between ₹4 lakh and ₹7.5 lakh | 5% margin money to study in India

15% margin money to study abroad |

| Above ₹7.5 lakh | 15% margin money to study in India

20% margin money to study abroad |

| Up to ₹25 lakh (for Executive Management Program/Executive MBA) | 25% margin money to study in India only |

| *Margin money refers to the student’s own contribution towards their educational expenses, while the loan covers the remaining amount. The Indian Bank’s lending policy determines the percentage of margin money required. |

Indian Bank Education Loan – Approved Colleges, Universities and Institutions

The students pursuing graduate, postgraduate, or diploma courses from specific colleges, universities, or institutions are eligible to apply for the Indian Bank Education Loan scheme. Below is a category-wise detailed list of educational institutes:

Premier Special Category (Study in India)

- All Indian Institutes of Technology (IITs), Indian Institutes of Management (IIMs), All India Institute of Medical Sciences (AIIMS) (Institutions established before April 2017)

- Indian Institute of Sciences (IISc) Bangalore

- Indian School of Business (ISB) (Hyderabad and Mohali campus)

- Indian Institute of Foreign Trade (IIFT) New Delhi

- Postgraduate Institute of Medical Education and Research (PGIMER) Chandigarh, Sanjay Gandhi Postgraduate Institute of Medical Sciences (SGPGI) Lucknow, National Institute of Mental Health and Neurosciences (NIMHANS) Bangalore, Christian Medical College Vellore, King George’s Medical University (KGMU) Lucknow, Jawaharlal Institute of Postgraduate Medical Education and Research (JIPMER) Puducherry, Madras Medical College Chennai

- Birla Institute of Technology and Science (BITS) Pilani

- Xavier School of Management Jamshedpur, Management Development Institute Gurugram

- National Institute of Technology, Tiruchirappalli

- National Institute of Technology Karnataka, Surathkal

- National Institute of Technology Rourkela

- National Institute of Technology Warangal

- National Institute of Technology, Calicut

- National Institute of Technology Durgapur

- National Institute of Technology, Silchar

- National Institute of Technology Kurukshetra

Premier Category (Study in India)

- National Institutes of Technology (NITs) (Institutions established before April 2017)

- National Institutes of Designing (NIDs) situated in Ahmedabad, Gandhinagar and Bangalore

- Indian Statistical Institutes (ISI) situated in Kolkata, Delhi and Bangalore

Prime Plus Category (Study in India)

- Indian Institutes of Technology (IITs), Indian Institutes of Management (IIMs), National Institutes of Technology (NITs), All India Institutes of Medical Sciences (AIIMS), National Institutes of Designing (NIDs), Indian Statistical Institutes (ISIs) not included in Premier category

- National Institute of Fashion Technology (NIFTs)

- Institutions of National Importance (INI) as published by the Government of India, Ministry of Education, Department of Higher Education, and as updated from time to time (excluding those institutes that come under the Premier category)

- According to the latest National Institutional Ranking Framework (NIRF) rankings top 200 institutes for Engineering, the top institutes 75 for Management and top institutes 50 for Medical courses (excluding institutes under the Premier category)

- All the medical colleges run by the government

- Top 10 institutes for Law, Architecture, Pharmacy and Dental courses as per the latest NIRF ranking

Prime Plus Category (Study abroad)

- All the institutes ranked in the top 1,000 according to the latest world ranking issued by the bank’s accepted websites

Other Institutes (Study in India)

- All the recognised colleges/universities/institutes not covered under the above two categories

Other Institutes (Study abroad)

Institutions ranked above 1,000 in the world rankings issued by Bank-accepted websites.

Indian Bank Education Loan – Eligible Courses

Students pursuing the following courses highlighted below can apply for the education loan scheme:

Full-time Courses to Study in India

- Graduate or postgraduate degree/courses, and postgraduate diploma from any University Grant Commission (UGC) recognized universities/colleges.

- Courses such as Institute of Cost and Works Accountants (ICWA), Chartered Accountancy (CA), Chartered Financial Analyst (CFA), etc.

- Courses conducted by Indian Institute of Management (IIMs), Indian Institute of Technology (IITs), Indian Institute of Science (IISC), Xavier School of Management (XLRI), National Institute of Technology (NITs), National Institute of Design (NIDs), National Institute of Fashion Technology (NIFTs), etc.

- Regular diploma/degree courses, including aeronautical, pilot training, shipping, etc., or any other discipline approved by the Director General of Civil Aviation/shipping or any other regulatory body

- All the approved courses offered in India by reputed foreign universities

| Note: Diploma in Teacher Training course is not eligible under the Indian Bank Education Loan scheme. |

Part-Time or Distance Learning Courses to Study in India

- Executive Management Program

- Executive Master of Business Administration (MBA)

Full-Time Courses to Study Abroad

- Any accredited or recognised courses.

- Courses that are defined under various government subsidy schemes.

- Job-oriented professional/technical graduate courses offered by reputed foreign universities or institutions.

- Master of Computer Application (MCA), Master of Business Administration (MBA), Master of Science (MS), etc.

- Courses conducted by Chartered Institute of Management Accountants (CIMA) in London, Certified Public Accountant (CPA) in the United States of America (USA), etc.

- Diploma or degree courses such as aeronautical, pilot training, or shipping are recognised in India or abroad.

Indian Bank Education Loan – Repayment Period

- Students studying in India or abroad must repay their education loan in 180 equal monthly instalments (EMIs). The repayment period begins immediately after the moratorium period.

- Executive Management Programme/Executive MBA students must repay their education loan in 120 equal monthly installments (EMIs). The repayment period begins the month after the first disbursement of the loan, and there are no grace periods. The borrower must make an EMI payment every month, even if it is a holiday.

Important Note –

- The moratorium period is a maximum of one year, and it includes the course period and a holiday period. In simple terms, it refers to a grace period during which borrowers do not have to repay the loan amount.

- Simple interest is charged on the outstanding loan amount from the date of disbursement until the start of repayment, during the study period and the moratorium period.

- Students can choose to pay the interest on the loan during the study period and the moratorium period before they start repaying the loan. If they don’t pay the interest during this time, it will be added to the principal amount, and the EMI for loan repayment will be adjusted accordingly.

Indian Bank Education Loan – Credit Guarantee Cover

The credit guarantee cover for the IB Education Loan will be applicable for 75% of the defaulted amount. Below are the specific details regarding the guarantee cover.

- Educational loans granted up to ₹7.5 lakh limit under the Indian Bank Education Loan scheme are eligible under the Credit Guarantee Fund Scheme for Educational Loans (CGFSEL).

- The requirement for a third-party guarantee or collateral is waived for this loan scheme.

- Parents/spouses of borrowers are required to act as co-obligates or joint borrowers.

- Applicants can apply for education loans to study in India as well as abroad.

- The annual guarantee fee will be 0.5% per annum for the outstanding loan amount, which the bank will absorb.

- The guarantee cover will be provided for 75% of the defaulted loan amount.

Indian Bank Education Loan – Collateral Security

The requirement of collateral security varies as per the loan amount and policies of the lending bank. Check the specific requirements regarding collateral security for the IB Education Loan below:

Collateral Security to Study in Premier Institutes –

- No collateral security is required for a loan amount of up to ₹30 lakh (for institutes other than Indian School of Business – ISBs) and up to ₹40 lakh (for ISB Hyderabad and Mohali).

- Loan amount above ₹30 lakh (for institutes other than ISBs) and above ₹40 lakh (for ISB Hyderabad and Mohali) require 100% collateral security cover.

- Acceptable collateral includes:

- SARFAESI-compliant land (bounded and demarcated)

- Building or flat

- Government securities

- Public Sector Undertaking Bonds (PSU) bonds

- Gold Jewellery

- Bank deposits

- National Savings Certificates (NSCs)

- Loan-in-process accounts (LIPs)

- In cases where the Credit Guarantee Fund Scheme for Educational Loans (CGFSEL) is applicable, borrowers do not need to provide any collateral or third-party guarantee.

Collateral Security to Study in Prime Plus and Other Institutes –

Students need to provide 100% collateral security for the education loan. It includes:

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) compliant land (bounded and demarcated)

- Building or Flat

- Government securities

- Public Sector Undertaking Bonds (PSU) bonds

- Gold Jewellery

- Bank deposits

- National Savings Certificates (NSCs)

- loan-in-process accounts (LIPs)

Important Note –

Students applying for an education loan must have a life insurance policy covering the entire duration of the loan, including the study, moratorium period, and repayment period. The premium for the insurance policy can be included as a financeable component of the loan.

Indian Bank Education Loan – Subsidy Schemes

Students can avail the benefits of three education loan subsidy schemes mentioned below:

- Padho Pardesh Subsidy

- ACSISOBCEBC (Dr Ambedkar Central SectorScheme of Interest Subsidy on Educational Loans for Overseas Studies for Other Backward Classes (OBCs)and Economically Backward Classes (EBCs)) Subsidy

- Central Scheme to Provide Interest Subsidy to Educational Loan (CSIS)

| Note – For more information regarding subsidy schemes please visit the official website: indianbank.in/departments/edu-subsidy-schemes |

Indian Bank Education Loan – Documents Required

The following documents are required for the education loan application process:

- Application Form with three passport-size photographs

- Assets and liabilities statement in the bank’s prescribed format from the applicant(s), co-applicant(s), and guarantor(s)

- Aadhaar card/Permanent Account Number (PAN) card/voter identification card/passport/driving licence

- Income proof signed by a signed authority

- Recent telephone bill/electricity bill/property tax receipt

- Marksheet (Class 10, 12, graduation, or last qualifying examination)

- Community certificate (if applicable)

- Income certificate issued by the designated authority

- Admission letter/bonafide student certificate from the college/university (must include fee structure)

- Passport and VISA to study abroad

- Details of parents/guardian/co-obligation/guarantor

- Details regarding the source of funds to meet the margin (must be supported by documentary evidence)

- Declaration/affidavit stating that no other educational loan has been availed from any other bank by the applicant and their parents

- Copy of sale deed and related documents (if immovable property is offered as collateral security)

- Copy of liquid securities (if offered as collateral)

| Note: The documents listed above may vary based on the specific requirements of the Indian Bank and the loan application process. |

Indian Bank Education Loan – Application Process

Students can apply for the Indian Bank Education Loan by following the step-wise procedure listed below:

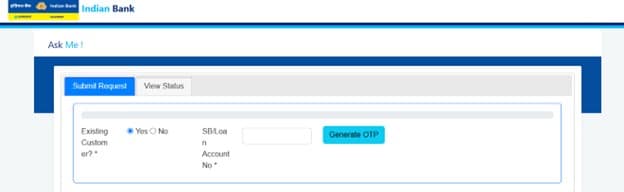

1. Visit the official website: indianbank.in/departments/educational-loan-iba/#!.

2. Navigate to the ‘Apply for Loan (Click Here)’ at the bottom of the page and click on it.

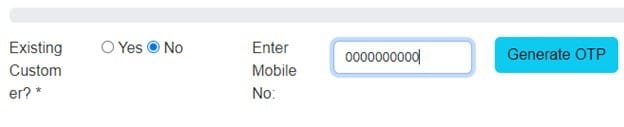

For Existing Customers of Indian Bank –

- Choose the ‘Yes’ option and enter ‘SB Account Number.’

- Click on the ‘Generate OTP’ button.

- Applicants will receive an OTP on the registered mobile number or email ID.

- Enter the OTP and click on the ‘Submit’ button.

- Now, fill in the required details.

- Applicants will receive a call from the bank agent regarding the IB Education Loan.

For Non-Existing Customers of Indian Bank

- Choose the ‘No’ option and enter a 10-digit mobile number.

- Click on the ‘Generate OTP’ button.

- Applicants will receive an OTP on the registered mobile number.

- Enter OTP; it will redirect to a new page.

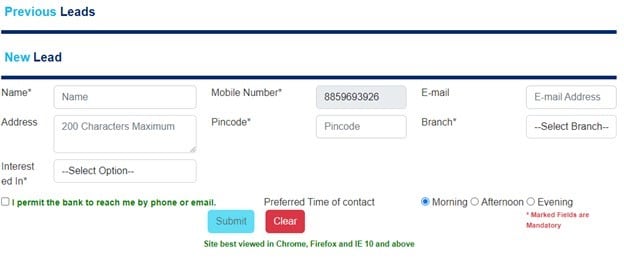

- Fill in the required details on the online application form.

- Now, select ‘I permit the bank to reach me by phone number or email’ and choose a preferred time of contact (morning, afternoon, or evening).

- Now, click on the submit button.

- Students will receive a call from the bank agent regarding the IB education loan.

Important Note – For any queries related to the application process, students can contact 1800-4250-0000.

Indian Bank Education Loan – Check Application Status

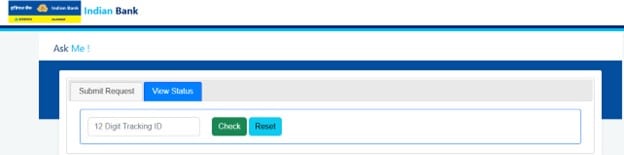

The student can check the status of the application process by following the below-mentioned steps:

- Once the application form is completed, the applicant will receive a confirmation.

- Bank will provide a ‘12-digit Tracking ID’ to the applicant.

- To check the application status, enter the ‘12-Digit Tracking ID’ and click on the ‘Check’ button.

Indian Bank Education Loan – FAQs

The Government of India established the Indian Bank on March 5, 1907. As a public sector bank, its primary objective is to offer various financial services, including education loans, home loans, and more, to its customers.

The students can call 180042500000, to get information regarding IB Education Loan interest rate and more details.

Yes, borrowers must get life insurance before applying for an education loan.

Students can apply for need-based education loans to meet the course expenses in India or abroad. Also, for Executive Management Program or Executive MBA in India, students can apply for a loan up to INR 25 lakh.

No, the Indian Bank provides education loans for specific courses approved by designated organisations. Please refer to the above article to check the eligible courses and colleges for education loan.

Students can apply for the education loan online or at any branch of Indian Bank in or near their domicile place. Please refer to the above article for more details on the application process.

Students belonging to any community can apply for an education loan. There are no caste, community, age, and gender restrictions for the loans. When was the Indian Bank established?

What is the interest rate for IB Education Loan?

Do I need life insurance to apply for the IB Education Loan?

What is the maximum loan limit for an IB Education Loan?

Does the Indian Bank provide education loans for all courses?

Where can I apply for Indian Bank Education Loan?

Who can apply for the Indian Bank Education Loan?