HP Education Loan Scheme is an initiative by the Government of Himachal Pradesh for students belonging to religious minority communities and Persons with Disabilities (PwD) categories. Qualified students from both these categories can obtain educational loans from any Himachal scheduled bank for up to ₹20 lakh at a nominal interest rate of 3% and 4% respectively.

The Himachal Pradesh Education Loan Scheme is applicable to undergraduate and postgraduate professional/technical courses, as well as other courses approved by the University Grants Commission (UGC), the Government of India, or the All India Council for Technical Education (AICTE). The scheme extends its benefits to minority communities residing in Himachal Pradesh, such as Muslims, Sikhs, Buddhists, Christians, and Parsis.

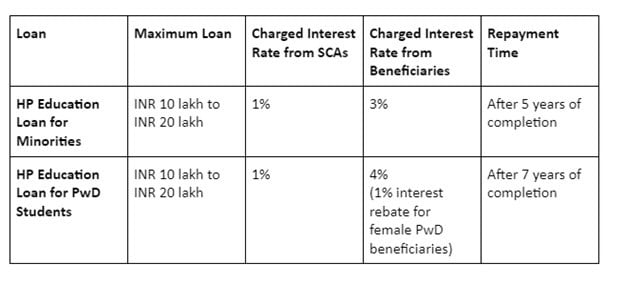

The program is an initiative of the National Minorities Development and Finance Corporation (NMDFC) and the National Handicapped Finance and Development Corporation (NHFDC). Under the scheme, the NMDFC (National Minorities Development & Finance Corporation) provides loans to the SCA (State Channelizing Agency) to the Himachal Pradesh Minorities Finance & Development Corporation (HPMFDC) at an interest rate of 1%. Further, the SCA lends this money to beneficiaries (individuals or groups who are eligible for NMDFC loans) at an interest rate of 3%.

Similarly, the NHFDC provides the SCA with funds at an interest rate of 1%. The SCA then lends that money to students with disabilities at an interest rate of 4%, while also offering a 1% rebate to female students with disabilities (PwD).

This article provides crucial information about the scheme, such as who is eligible, what the benefits are, what documents are needed, what the loan terms are, how to repay the loan, and how to apply.

HP Education Loan Scheme – An Overview

| Name of Scheme | HP Education Loan Scheme |

| Provider | Government of Himachal Pradesh |

| Website | minority.hp.gov.in |

| Beneficiaries | Students belonging to religious minority communities (Muslims, Sikhs, Buddhists, Christians, and Parsis) and students with disabilities |

| Amount | a) ₹ 10 Lakh for studying at Indian institutions

b) ₹ 20 Lakh for studying at foreign institutions |

| Application Timeline | Around the year |

| Interest Rate | Up to 4% |

| Repayment Time | Up to 7 years |

HP Education Loan Scheme – Benefits

Here is an extensive compilation of advantages that students hailing from Himachal Pradesh can avail through this program:

- Education Loan – The scheme aims to facilitate a maximum loan amount of ₹ 10 lakh for courses within India and ₹ 20 lakh for courses pursued abroad. For professional and technical courses, the loan disbursement is capped at ₹ 4 lakh per year.

- Interest Rate – The interest rate for education loans is 3% for students belonging to minority communities, while it is 4% for male PwD students. Additionally, female PwD students are eligible for a 1% rebate on the interest rate.

- Loan Repayment Time – For students from minority communities, the loan repayment period starts after 5 years of completing their course. In contrast, for students in the PwD category, the loan repayment period begins after 7 years of course completion.

HP Education Loan Scheme – Eligibility

Below is a concise checklist of key points to determine the education loan eligibility criteria for the Himachal Pradesh Education Loan Scheme:

- The applicant must be an Indian citizen and have a domicile in Himachal Pradesh.

- Students belonging to minorities and PwD categories can apply for this scheme.

- The annual family income should not exceed ₹ 81,000 for students belonging to rural areas and ₹ 1,03,300 for urban areas from all the sources (only for students belonging to religious minority communities).

- For applicants from minority communities, the age limit ranges from 18 to 55 years. On the other hand, students with disabilities must be above 18 years of age to be eligible for the scheme.

- For students with disabilities (PwD), the significant disability level is considered to be 40% or above, and a medical certificate must be provided to prove this.

- The applicants should not have any history of defaulting on payments to government or semi-government banks/institutions.

- The beneficiary is required to contribute 5% of the total loan amount as margin money*, while the remaining balance is contributed by the SCA as the state share.

*Margin money is a student’s own contribution towards the total education expenses when applying for a loan. It is a specific amount that borrowers allocate as their personal investment.

Also Read: CGFSEL Education Loan Scheme – Interest Rates, Eligibility & Application

HP Education Loan Scheme – Documents Required

To avail of the benefits of the Himachal Pradesh Education Loan Scheme, applicants need to submit specific documents as per the requirements.

- Education loan application form – This form can be obtained from the designated bank or financial institution. It must be filled out accurately and completely with all the necessary details.

- Mark sheets of the last qualifying examination – Applicants are required to provide the mark sheets or transcripts of their most recent academic qualifications to demonstrate their educational background and eligibility for the loan.

- Proof of scholarship/studentship – Applicants who have received scholarships, studentships, or other forms of financial assistance from the government or private organizations are required to submit relevant documents as proof of their awards.

- Expenses for the specified courses – A detailed breakdown of the expenses associated with the chosen course or program should be provided. This may include tuition fees, accommodation charges, book costs, and other related expenses.

- Passport-size photographs – Two recent passport-size photographs of the applicant need to be submitted for identification purposes.

- Bank account statements – The bank statements for the past six months should be provided to verify the financial standing and transaction history of the borrower.

- Income tax assessment – Applicants must submit their income tax assessment orders for the past two years to verify their income and financial stability.

- Statement of assets and liabilities – If a co-borrower is involved, a statement detailing their assets and liabilities should be provided to evaluate their financial capacity.

- Proof of income – Documents such as salary slips or form 16 should be submitted as evidence of the borrower’s income and employment status.

HP Education Loan Scheme- What Expenses Does It Cover?

This scheme covers expenses such as tuition fees, tour costs, and other related expenditures incurred while pursuing professional/technical courses at the undergraduate and postgraduate levels. Below are the details of the expenses that will be covered under this scheme:

- Fees payable to hostel/college/school

- Laboratory, examination, and library fees

- Purchase of books, equipment, instruments and uniforms

- Caution deposit, building fund, refundable deposit (maximum 10% of tuition fees for the entire course)

- Travel expenses and passage money to study abroad

- Purchase of laptop/computers (if considered necessary for the completion of course)

- Cost of a two-wheeler up to ₹ 50,000

- Other expenses like study tours, project work, assistive devices etcetera

HP Education Loan Scheme – Rate of Interest, Maximum Loan & Repayment Time

The interest rate for HP Education Loan varies depending on the category of students. Please refer to the table below to find details on the interest rate, maximum loan limit, and repayment period:

| Note: The applicants must submit the collateral security, which should be equivalent to the loan amount. Furthermore, in the case of government employees, applicants need to deposit an amount that is 15 times of the net monthly salary (in-hand salary). |

HP Education Loan Scheme – How to Apply?

Students can apply for the Himachal Pradesh education loan through online and offline modes. Hereunder are the steps that must be followed by students while applying for the scheme:

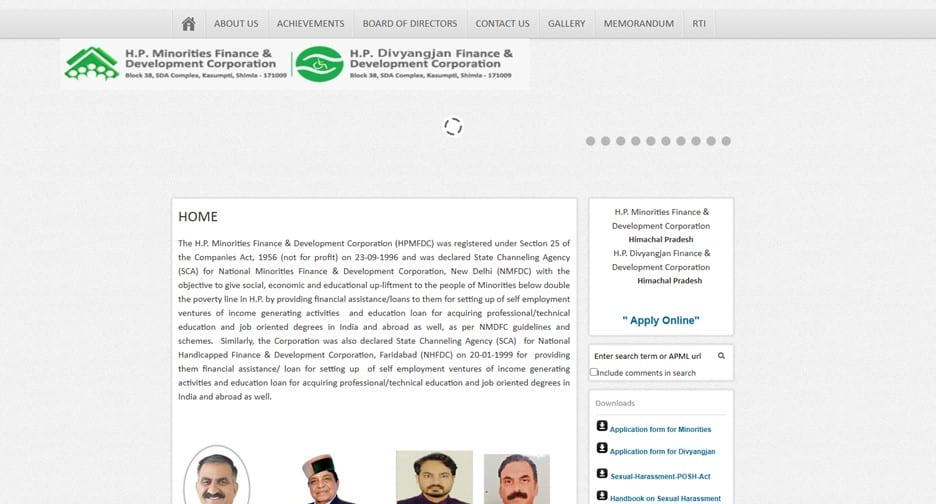

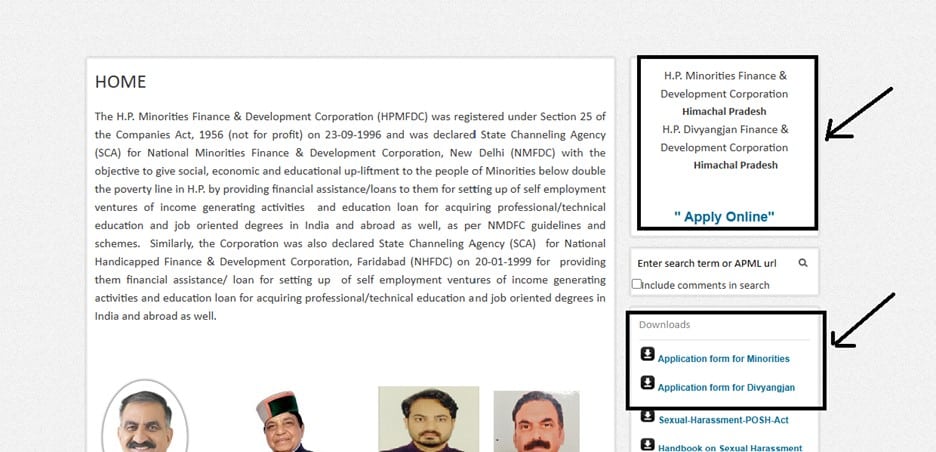

1. Visit the official website: minority.hp.gov.in.

2. Click on the ‘Application Form for Minorities’ or ‘Application Form for Persons with Disabilities’ to download the application form. Alternatively, students can apply online by clicking on the ‘Apply Online’ button at the right hand side of the dashboard.

3. Applicants who are applying online can simply fill the online form by clicking on the ‘Apply’ button in the left hand side of the dashboard. (Note: Students can make repayments online through the ‘Pay Now’ option available on the website.

4. On the other hand, students who are applying offline will have to download the application form for the respective category.

5. Fill in the important details in the application form, attach the required documents and submit the application form to the H.P. Minorities Finance and Development Corporation or HP Handicapped Finance and Development Corporation’s official address.

| Application Form For Minorities |

H.P. Minorities Finance and Development Corporation – Contact Details

H.P. Minorities Finance and Development Corporation

SDA Complex Block No.38, First Floor, Kasumpti, Shimla, Himachal Pradesh – 171 009

Phone Number – 0177-2622164

Detailed information on Himachal Pradesh education loan scheme

Also Read: Jharkhand NMDFC Education Loan Scheme – Up to ₹30 Lakh Credit for Minorities

HP Education Loan Scheme – FAQs

This scheme is an initiative by the Himachal Pradesh government to provide financial assistance to religious minority and PwD students. Furthermore, eligible students can get education loans of ₹ 10 lakh (study in India) and ₹ 20 lakh (study abroad) at a maximum interest rate of 3% (religious minority communities) and 4% (PwD) respectively.

The scheme covers a wide range of courses consisting undergraduate, postgraduate, professional, technical and vocational courses in India and abroad.

Students belonging to minority communities can obtain an education loan at an interest rate of 3%. Male students with disabilities are eligible for an education loan at an interest rate of 4%. Additionally, female students with disabilities will be granted a 1% rebate on the interest rate.

As part of the Education Loan Scheme, the National Minorities Development and Finance Corporation (NMDFC) and the National Handicapped Finance and Development Corporation (NHFDC) provide funds to the State Channeling Agency (SCA), which in this case is the Himachal Pradesh Minorities Finance & Development Corporation (HPMFDC), at an interest rate of 1% for the purpose of making them available to students. The funds are subsequently lent by the SCA to students belonging to minority categories at an interest rate of 3%. In a similar manner, the NHFDC provides funds to the SCA at an interest rate of 1%. The SCA, in turn, disburses funds to students with disabilities at an interest rate of 4%, while also granting a 1% rebate to female students.

Eligible students are provided with an education loan of up to ₹ 10 lakh for studying within India and ₹ 20 lakh for studying abroad.

The loan covers expenses such as tuition fees, hostel fees, examination fees, purchase of books/equipment/uniforms, caution deposits, travel expenses for studies abroad, and the cost of necessary computers or two-wheelers.

Yes, students are required to deposit an amount of ₹5,000, which will be adjusted as margin money towards the loan. Furthermore, in the case of government employees, applicants need to deposit an amount that is 15 times the net monthly salary (in hand salary). What is the Himachal Pradesh education loan scheme?

What courses are covered under the Himachal Pradesh education loan?

What is the interest rate for the HP Education scheme?

What is the role of SCAs in the HP education loan scheme?

How much loan can I get under the Himachal Pradesh education loan scheme?

What type of expenses are considered under the HP Education Loan Scheme?

Is there any margin money or deposit required for the HP education loan?