Have you ever faced rejection for your education loan application? If so, you’re not alone. Many students find themselves in a situation where their application is rejected, even after carefully completing all the required formalities. The reasons for refusal are not always obvious, leaving applicants confused and uncertain about what went wrong.

To improve your chances of securing an education loan, it is essential to understand the critical do’s and don’ts of the application process. Several factors play a crucial role in determining approval, from selecting an eligible course and institution to ensuring proper documentation and financial backing. This guide will walk you through the do’s and don’ts to avoid educational loan application rejection.

Factors to Consider to Avoid Education Loan Application Rejection

There have been many cases of students who, despite providing all the correct details and collateral, have had their loan applications rejected. To help avoid this, we have provided some of the best tips to consider before applying for an education loan.

Complete Loan Application: An incomplete education loan application can lead to rejection. Lenders need comprehensive information about you and the co-signer. An incomplete application suggests that the borrower is withholding information, leading to distrust. Banks or NBFCs can reject your education loan on these grounds.

When you start filling out an education loan application, make sure you fill out all the details marked with a red asterisk sign (*). These boxes are mandatory to fill out, and for the rest of the details, you can go through them and fill them out if you believe it will help your loan application get accepted.

Also Read: How to Apply for an Education Loan

Collateral Value: Even after submitting collateral, education loans may be rejected if the requested loan amount exceeds the collateral’s value. Financial institutions generally require collateral that is worth more than the loan amount. They typically offer between 70% to 90% of the collateral asset’s value as an education loan.

The value of collateral depends on factors such as its liquidity and current market conditions. You can pledge bank FDs or RDs, provident funds, land deeds, shop deeds, business equipment, vehicles, jewellery, and other valuable assets as collateral for your education loan.

Also Read: What is a Collateral? – Understanding its Meaning, Purpose, Types and Importance

Co-Signer’s Job – Education loans often get rejected due to the co-signer’s inadequate income or unstable employment. Banks favour applications where the co-signer has a regular source of income from a formal job or business. Additionally, a high Debt-to-Income (DTI) ratio can also be a reason for student loan rejection.

A high DTI ratio indicates that a significant portion of the co-signer’s income goes toward loan or debt repayment. This can happen if the co-signer has an active loan for which he/she is paying EMIs. For a successful loan application, it is advised that the DTI ratio of the co-signer must be below 30% before applying for an education loan. So, for example, if the co-borrower income is ₹1 lakh a month, then his EMIs for all the debt he has must be below ₹30 thousand.

Choose A Bank Where Your College is Approved – When selecting a bank or NBFC to finance your education loan, it is essential to check the list of approved universities or colleges. Some banks have specific requirements and only approve loans for students attending institutions listed in the NIRF rankings or those they have partnered with. For example, if you need a substantial loan amount for your education and your college is listed among the top 100 NIRF colleges, you can opt for the SBI Education Loan, which has no upper limit. However, if your college is not listed in the top 100 NIRF-ranked colleges, you can only receive a loan amounting to a maximum of ₹50 lakhs from SBI.

Maintain Good Academic Performance – From a bank’s perspective, lending money to a student with poor academic performance is much riskier than lending to one who has consistently performed well throughout their career. This is the reason why if your academic performance has been average or bad, then the education loan may get rejected. Thus, maintaining good scores in your class 10 and class 12 exams is crucial when preparing to apply for an education loan for your graduation or post-graduation studies.

The Age Factor – Unlike regular personal loans, where age does not matter much, but for education loans, the age limit is set. For most of the education loans by banks, governments, and NBFCs, the required age limit is between 18 to 35 years. However, the rules for age may vary for some banks. For example, the minimum age to apply for the HDFC Bank Education Loan is just 16 years.

Select an Eligible Country & Course for Higher Studies: When applying for an education loan, it is crucial to ensure that both your chosen country of study and your selected course are eligible for funding. Financial institutions and lenders have predefined lists of approved countries and courses, and failing to meet these criteria can result in loan rejection. For instance, you are more likely to secure a loan for a BTech in CSE, a technical degree that enhances job prospects, than a BA in English.

This practice helps financial institutions mitigate the risk of students facing employment challenges after graduation. Similarly, banks and NBFCs have a preferred list of countries where education is highly regarded and degrees are globally recognized, ensuring that graduates can easily find employment. Therefore, it is essential to research the list of approved countries and courses before applying for an education loan.

Factors to Avoid to Ensure Education Loan Acceptance

Students often make common mistakes when applying for education loans, largely due to a lack of necessary knowledge. It’s crucial for students seeking education loans to familiarize themselves with the following points to avoid these errors.

Applying For Higher Loan Amount Than Required – The most common reason student loans for higher education get rejected by financial institutions is that the requested loan amount exceeds what is necessary. If you review the education loan details of any bank, you will find a list of expenses that the loan amount can cover. Typically, education loans are provided to support costs such as course fees, hostel fees, mess fees, transportation fees, books, and study equipment. Some student loans only cover course fees.

Suppose an education loan covers only the course fees, and you include living expenses and other miscellaneous costs in your application. In that case, the lender will reject your loan upon verifying the course fee details you provided. Therefore, you should only request the amount that banks offer and what you actually need. If you require a loan to cover all expenses during a course, choose a bank that includes all these costs. Hence, reading and understanding the loan terms and conditions is very important.

Incomplete Documents During Loan Application Submission – When filling out the application form, you are required to submit various documents such as co-signers and your credit history, educational documents, admission letter mentioning the fees for the course, entrance exam result, collateral details, and more. However, if you fail to submit any of the required documents, the bank will reject your loan application.

Additionally, if you submit fake documents, like editing your college admission letter to inflate your fees for a bigger loan, your application will be rejected as well.

Also Read: Documents Required for an Education Loan – An Extensive List

Lack of a Co-signer – Most education loans require you to provide a co-signer whose name will be on the loan documents. Banks require a co-signer who is an earning member of society and can pick up the responsibility of paying off your student loan if you fail to do so in future. A co-signer for the education loan can be a parent, legal guardian, sibling, or any blood relative of the student. The co-signer is required to have an active Indian bank account to sign cheques, which is crucial for both the disbursement and repayment of the loan.

Insufficient Credit History – The lending institutions in India also check the credit history of the student and the co-borrower. They must have a good credit history, which can be checked by enquiring about their CIBIL score. Banks prefer loan applications where the applicant and the co-applicant have a CIBIL score of 750 or more. Those who have not taken any loan till now will have no credit score, and it is recommended that students apply for an education loan with a co-signer who has a good credit score. It is especially important for those students who want an unsecured education loan because credit history takes precedence over other criteria for loans without collateral.

Common Reasons for Education Loan Rejection – Real Life Examples

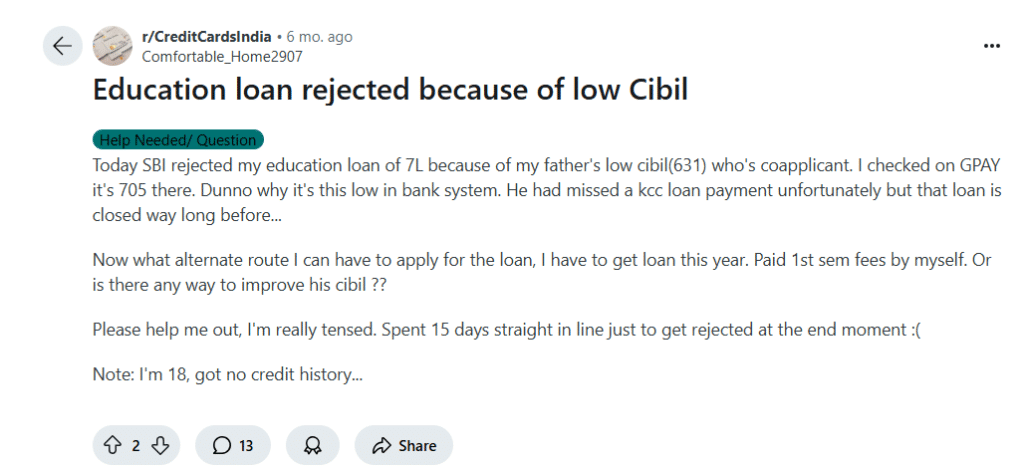

A Reddit user sought community assistance after their education loan was rejected due to their father’s low CIBIL score, who is the co-signer for the loan. Refer to the image below for more details.

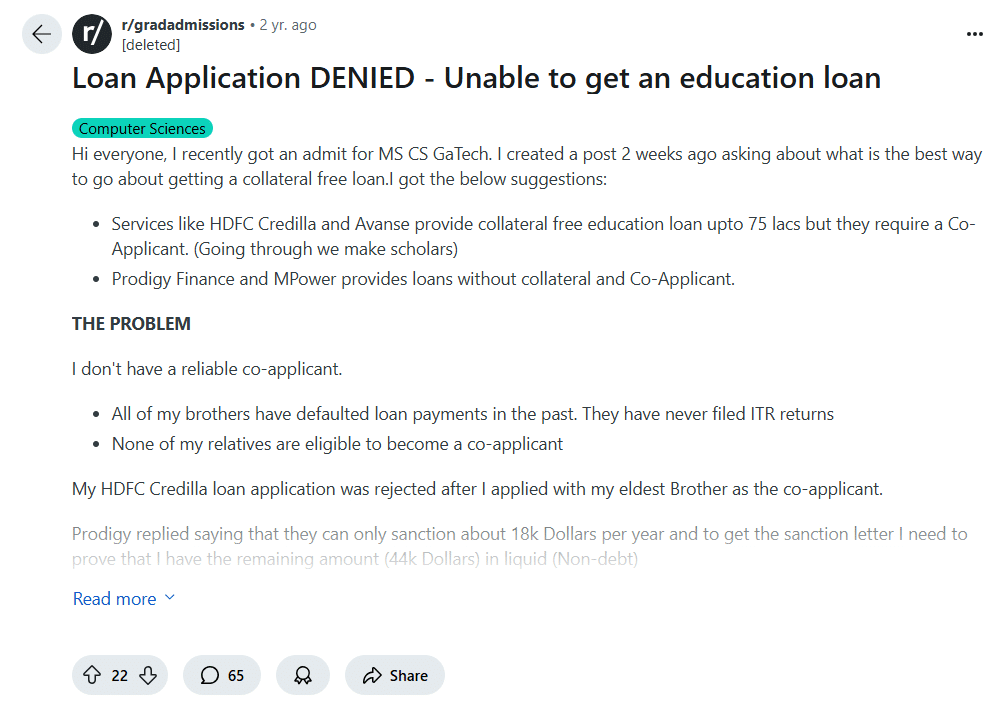

A Reddit user shared that their education loan application was rejected because they did not have a reliable co-signer. Here is what they posted:

See this example of how low academic scores can result in educational loan rejection. A Quora user posted their story and asked for suggestions from the community.

Conclusion

Understanding the dos and don’ts to avoid educational loan rejection is important for every student. In addition to maintaining a strong academic record, having a co-signer with a good credit history and providing suitable collateral can significantly improve your chances of approval. By paying attention to these key aspects and making informed decisions, you can navigate the loan application process smoothly and secure the financial support needed for your education.

FAQs

Why is my education loan application getting rejected?

There can be several reasons why your education loan application may be rejected. Some prime reasons can be the co-signer's low CIBIL score, insufficient collateral value, and incomplete application forms.

What happens to an education loan if a visa is rejected?

For any study abroad education loan, a visa is one of the most important documents. If your visa is rejected, the financial institution will hold your loan amount disbursement.

Can a bank reject an education loan after a sanction letter?

Even though it's not common, it is possible for a bank to reject an education loan after issuing the sanction letter on the grounds of document forgery, change in policy, or change in borrower's requirements.

What should I do if a bank is not giving an education loan?

If your education loan application is repeatedly rejected by a bank, consider applying to different banks or NBFCs. Additionally, there are several central and state government schemes available that provide study loans for students.

What should I do if my loan application is rejected due to incomplete information?

Review your application to ensure all required fields are completed accurately. Double-check personal, academic, and financial information before reapplying. Also, check if you have uploaded all the required documents. Contact a bank official if the problem persists.

1 thought on “Dos and Don’ts to Avoid Educational Loan Application Rejection”

Comments are closed.