Interest Free Education Loan in Goa – Education is getting increasingly expensive and students’ families are finding it difficult these days to finance higher education. Recognising the importance of education to shape students’ life and give direction to society, the Government of Goa has introduced the Interest Free Education Loan scheme. This scheme not only helps them to concentrate on studies better but also reduces the financial burden from them by making education accessible. This progressive initiative under the Goa Government allows students to pursue approved diploma and degree courses by providing a student loan of up to ₹16 lakh without accruing interest during the repayment period.

To illustrate the profound impact of this scheme, we turn to the case of Ram, a bright student residing in a small village in Goa. Coming from a modest background, Ram always dreamed of pursuing a degree in engineering but due to the high cost of the degree it became unattainable for him. With limited financial resources and traditional loans offering high-interest rates, his aspirations seemed out of his reach. However, when a batchmate informed him about the Interest Free Education Loan, he found a ray of hope. By addressing financial barriers and encouraging equal opportunities, the government has created a pathway for students like Ram who are willing to go for higher studies. With the help of this interest-free education loan, now Ram can easily pursue his academic dreams while ensuring he is not burdened by financial pressures. Through this education loan programme, Goa Government has not only made education affordable but has also paved the way for a future of innovation, diversity, and social mobility within the state’s academic community.

Interest Free Education Loan in Goa – Features

| Feature | Description |

| Eligibility | Domicile of Goa |

| Focus | Younger population of Goa |

| Objective | To support higher education and technical training |

| Interest | No interest charged on timely repayments |

| Study Period Coverage | Maximum 5 years for Indian courses, 2 years for foreign courses |

| Funding Source | Higher Education Promotion Fund (HEPF) |

| Fund Management | Government of Goa |

| Repayment | Repayments credited back to HEPF |

| Reservation |

|

| Last Date to Apply | February 28, 2025 |

Interest Free Education Loan in Goa – Eligibility Criteria

Any person below the age of 30 years, who has been a resident of Goa for a period of 15 years, is eligible to apply for and receive loans under the scheme, provided they fulfill the following conditions:

Qualifying Examination:

- For professional/non-professional diploma/degree courses: Candidates must have passed Class 10 and 12 from recognised schools/boards in Goa.

- For postgraduate courses: Candidates must have passed graduation from recognized institutions in Goa.

- For educational courses not available in Goa: Candidates must have passed graduation from institutions outside Goa.

- For PhD courses: Candidates must have passed postgraduation.

Minimum Marks:

- For education in India, obtaining 55% or more marks in the qualifying examination is necessary (with a relaxation of 10% for Scheduled Caste (SC)/Scheduled Tribe (ST)/Other Backward Class (OBC) candidates).

- For education abroad, obtaining 60% or more marks in the qualifying examination is necessary (with a relaxation of 10% for SC/ST/OBC candidates).

Meeting Economic/Financial Constraints:

- The applicant must meet the prescribed eligibility conditions related to economic and financial constraints.

Approved courses:

Loans provided under the scheme can be utilized for pursuing various higher and technical education courses at both undergraduate and postgraduate levels. The eligible fields of study include:

- Engineering (degree and diploma)

- Dentistry

- Medicine

- Pharmacy

- Architecture

- Finance, including Chartered Accountancy and Cost Accountancy

- Law

- Fine Arts

- Home Science

- Management

- Environment

- Computer Science

Course Related Eligibility:

- The course must be attended full-time.

- The entitled fees payable to the institution for undertaking the course should be at least ₹ 10,000 per annum.

- The course must be recognized by any of the following institutions/authorities:

- University Grants Commission (UGC)

- All India Council of Technical Education (AICTE)

- Medical Council of India (MCI)

- Dental Council of India (DCI)

- Architectural Council of India (ACI)

- Board of Technical Education, Goa

- Any other recognizing authority approved by the Government of India or the Government of Goa.

Interest Free Education Loan in Goa – Benefit

Students can avail the following maximum amount of loan in an academic year:

| Study Location | Maximum Loan Amount Per Year | Total Maximum Loan Amount |

| India | Minimum of ₹10,000 & Actual Entitled Fees, capped at ₹2 lakh | ₹10 lakh over 5 years |

| Abroad | Actual entitled fees*, capped at ₹8 lakh | ₹16 lakh over 2 years |

Terms and Conditions:

- *Entitled fees include tuition fees, lab fees, development fees, and any other associated fees.

- The maximum loan amount permissible is based on the actual entitled fees in India and abroad.

- Any scholarships or benefits received by the applicant under other schemes will be deducted from the maximum loan permissible. The applicant must provide relevant details in their application.

- Applicants have the choice to avail of loans at the maximum entitlement level or opt for a lesser amount based on their actual needs, which will result in a more manageable repayment schedule.

Interest Free Education Loan in Goa – Loan Amount, Duration and Equated Monthly Installment (EMI)

| Loan Amount | Repayment Period | Maximum EMI |

| Up to ₹ 50,000 | 18 months (1.5 years) | ₹ 2,777 |

| ₹ 50,001 to ₹ 1 lakh | 24 months (2 years) | ₹ 4,166 |

| ₹ 1,00,001 to ₹ 2 lakh | 36 months (3 years) | ₹ 5,555 |

| ₹ 2,00,001 to ₹ 4 lakh | 42 months (3.5 years) | ₹ 9,523 |

| ₹ 4,00,001 to ₹ 8 lakh | 48 months (4 years) | ₹ 16,666 |

| ₹ 8,00,001 to ₹ 12 lakh | 54 months (4.5 years) | ₹ 22,222 |

| ₹ 12,00,001 to ₹ 16 lakh | 60 months (5 years) | ₹ 26,666 |

The maximum loan amount a candidate can borrow in a year depends on the tuition fees charged by the institution.

Also Read: Kerala NMDFC Education Loan Scheme – A Tailor-made Loan for Minority Students

How to Apply for the Interest Free Education Loan in Goa?

Applicants who are willing to apply for the Goa interest free education loan can follow the below steps:

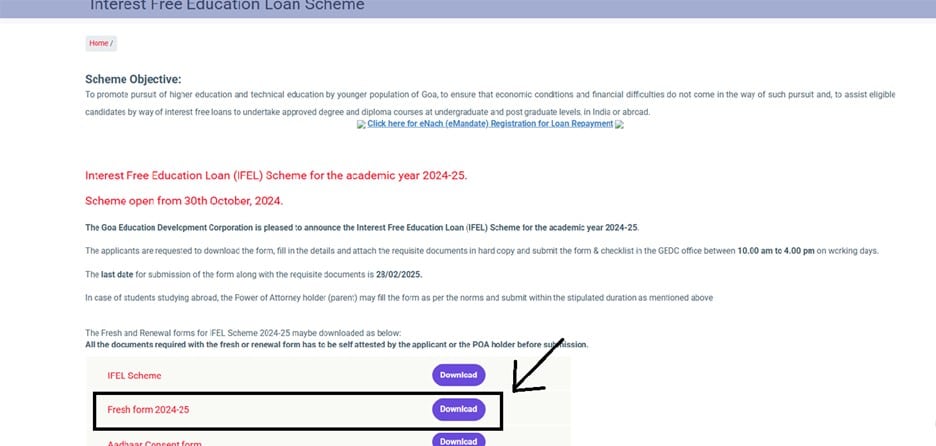

Step 1: Visit the official website of Goa Education Development Corporation (GEDC) (https://gedc-goa.org/node/33)

Step 2: Navigate to the ‘Interest Free Education Loan Scheme’ option at the bottom of the page at the left-hand side and click it.

Step 3: Navigate to the ‘Fresh Form 2024-2025’ and click on it to download the application form for the student loan.

Step 4: Fill all the relevant details in the application form, attach the self-attested copy of the required documents with the form and submit it to the following address:

Goa Education Development Corporation (GEDC)

Ground Floor SCERT Building

Alto Porvorim, Penha de França,

Goa – 403521

Email ID – office-gedc.goa@nic.in | Phone Number – (0832)-2411194

Interest Free Education Loan in Goa – Documents Required

Students applying for the Goa interest free education loan are required to submit the below mentioned documents along with the application form:

- Self-attested copy of a valid 15 year residence certificate issued by a competent authority

- Self-attested copy of birth certificate issued by a competent authority

- Copy of parents’ IT return for the financial year OR

- Attested copy of family annual income certificate for the financial year issued by a competent authority and signed by the Chief Officer or Commissioner of Municipality or Panchayat (in case of non-taxable income bracket) OR

- Pension certificate for the financial year, in case of retired parent OR

- Affidavit, in case of unemployed parents (housewife mother or unemployed father)

- Self-attested copy of marksheets of Class 10,12 and/or Diploma, Graduation, Postgraduation passing certificate

- Self-attested copy of admission proof (in case of foreign studies)

- Self-attested copy of fee receipt for the current academic year with stamp and signature from school/university/institute

- Self-attested copy of caste certificate issued by the competent authority

- Original bonafide certificate issued by the college for the current academic year along with year-wise fee structure for the entire course (tuition fee, lab fee, etc.)

- Original Power of Attorney in the name of working parent (in case of studies outside Goa) [Only for students completing 18 years of age]

- Self-attested copy of the bonafide certificate of sibling pursuing higher studies (in case where income exceeds) of the academic year

- Self-attested Xerox copy of student’s bank passbook cover page with account details (account number for electronic transfer) with IFSC code or cancelled cheque

- Letter from the institution, if the original mark sheet and other documents are submitted to the institute

- Previous year’s marksheet in case the student is studying in 2nd, 3rd, 4th or 5th year

- Self-addressed envelope with ₹5 per stamp

Important Note:

Formats for the above-mentioned documents can be downloaded from the official website.

- The application must be filled out using a ballpoint pen. Refrain from using running handwriting.

- Documents are required to be submitted in the above-mentioned sequence.

- Attach a self-addressed stamped envelope along with the application form.

- Applicants are required to scan each original document separately in colour mode and save it in JPG or PDF format. The file size must not exceed 2 MB. Submit on CD or DVD.

- Applicants have to apply for the renewal of the loan for the subsequent year. Hence, they are required to submit the necessary documents as may be required.

- The corporation reserves all the rights to cross-verify the above documents with the originals.

- Incomplete applications will be rejected summarily.

Documents for Renewal Process

The documents required for the renewal process include:

- Renewal application form

- Self-attested copy of fee receipt for the current academic year with stamp and signature from

- school/university/institute

- Original bonafide certificate issued by the college for the current academic year along with year-wise fee structure for the entire course (tuition fee, lab fee, etc.)

- Self-attested xerox copy of student’s bank passbook cover page with account details (account number for electronic transfer) with IFSC code or cancelled cheque

Distribution and Repayment Schedule – Important Details

- The Goa interest-free education loan scheme offers a repayment period of up to 5 years. 20% of the total allocated funds will be reserved for student loans to study abroad. These funds will be awarded based on merit and financial need.

- The scheme includes 7 broad categories, each corresponding to different loan amounts available to applicants. A one-year moratorium period (grace period) will be applicable, starting strictly after the completion of the minimum course duration, not from the date the loan cheque is disbursed.

- No extensions will be given for the moratorium or repayment periods, and neither the education loan amount nor any penal interest will be waived.

- Beneficiaries must apply for a clearance certificate or a no-dues certificate after settling all dues, along with copies of the repayment challan. The loan must be repaid in equal monthly installments by the 10th of each month to remain interest-free.

- Students may choose to repay the entire student loan amount after the minimum course duration or make payments exceeding the monthly installments.

Also Read: NSFDC Education Loan Scheme for Students from Scheduled Caste (SC) Communities

Interest Free Education Loan in Goa – FAQs

The IFEL is open to eligible students who are enrolled in certain undergraduate or postgraduate courses, are under the age of 30, and have been residents of Goa for 15 years.

The loan can be availed for pursuing higher and technical education courses in various fields such as Engineering, Dentistry, Medicine, Pharmacy, Architecture, Finance (including CA and Cost Accountancy), Law, Fine Arts, Home Science, Management, Environment, and Computer Science.

The loan amount varies based on the entitled fees charged by the institution. In India, the maximum loan per year is the actual entitled fees, subject to a maximum of ₹ 2 lakh per annum. For studies abroad, the maximum loan per year is the actual entitled fees, subject to a maximum of ₹ 8 lakh per annum.

Yes, any amount received as a scholarship or benefit under other schemes will be deducted from the maximum loan permissible under this scheme. Applicants must provide relevant details of such scholarships or benefits in their application.

Yes, the loan repayment is divided into seven different slabs based on the total amount disbursed. Each slab specifies the repayment period in months and the maximum Equated Monthly Installment (EMI) amount. The borrower must strictly adhere to the repayment schedule according to their respective slab.

No, it is not mandatory to avail the maximum loan amount. Applicants have the flexibility to choose a lesser loan amount that fulfills their actual needs, resulting in an easier repayment schedule. They can decide the loan amount based on their specific requirements. Who is eligible to apply for the Interest Free Education Loan (IFEL) in Goa?

What are the eligible fields of study for the IFEL in Goa?

What is the maximum loan amount that can be availed under Interest Free Education Loan in Goa?

Can scholarships or benefits received under other schemes affect the loan amount under the IFEL?

Are there any conditions for repayment of the Interest Free Education Loan in Goa?

Is it mandatory to avail the maximum loan amount entitled under the IFEL?

1 thought on “Interest Free Education Loan in Goa – Eligibility, Amount & More”

Comments are closed.