ICICI Education Loan: Education is a very powerful tool. Over time it has become a necessity, and everyone should have the opportunity to pursue higher studies. However, the looming cost of education can significantly impact one’s career goals and academic aspirations. In such circumstances, an education loan can provide the necessary financial support. It empowers students to pursue their desired degrees without being burdened by financial constraints.

ICICI Bank education loans offer students an opportunity to study in premier institutions in India or abroad without any financial restrictions. It’s hassle-free process to apply for an education loan and a significant loan amount makes it easier for students to continue their studies.

ICICI Education Loan: Eligibility Criteria

Students who wish to apply for the ICICI Bank Education Loan have to fulfil the following eligibility criteria to avail the ICICI Education Loan benefits:

- Students must be Indian residents aged between 16 and 35 years are eligible.

- Applicants must have completed their Class 12 or equivalent from a recognised institution.

- Candidates must have secured admission to a recognised institution for graduate, postgraduate, or postgraduate diploma programs.

- Students must have a strong academic record is required.

- The loan will be sanctioned based on pre-admission sanction, entrance exam scores (like GRE, GMAT, etc.), Class 12/HSC results, or confirmed admission.

- Applicants must have a co-borrower. It can be a father, mother, brother, sister, spouse, grandparent, or maternal/paternal uncle.

- The students must have security options including property (house or flat), fixed deposits, or cross-collateralisation with an existing ICICI Bank Home Loan to avail benefits of the education loan.

ICICI Education Loan – Courses and Expenses Covered

ICICI Bank offers education loans for domestic courses like UGC/AICTE/Government/AIBMS/ICMR-recognised graduate, postgraduate, or postgraduate diploma programs and international courses such as job-oriented undergraduate and postgraduate degree or diploma programs from reputed institutions.

The following expenses will be covered under the ICICI education loan:

- Fee payable at college/school/hostel

- Examination/library/laboratory fees

- One-way travel expenses/passage money for studies overseas

- Insurance premium for the student borrower

- Caution deposit, building fund/refundable deposit supported by institution bills/receipts

- Purchase of books, equipment, uniforms, or instruments

- Purchase of a computer at a reasonable cost if required for course completion

- Any other expenses required to complete the course, such as study tours, project work, or thesis fees

ICICI Education Loan – Interest Rates

| Feature | Details |

| Interest Rate | Starting from <Repo* + 3.75% (Spread)> onwards |

| Loan Tenure |

|

| Maximum Loan Amount |

|

| Collateral Requirement | Fixed Deposit, Fresh Property, Cross-collateralisation with existing Mortgage Loans |

| Unsecured Loan Requirement | Up to ₹1 crore for both undergraduate and postgraduate courses (only for premium institutes) |

| Moratorium Period | Course period + up to 12 months grace period |

| Margin |

|

*Interest rates are linked to the Repo Rate.

Note: A moratorium period may be offered, subject to the Bank’s policy, but does not apply to all loans.

| Type of Credit | Minimum | Maximum | Mean |

| Education Loan -iSMART interest rates | 9.50 % per annum | 14.25 % per annum | 11.26 % per annum |

Note: Mean rate = (Sum of interest rates for all loans)/(Total number of loans)

ICICI Education Loan: Documents required

ICICI Bank Student Loan has a concise list of documents required for both application and disbursal of funds. Below is the list of documents required to apply for an educational loan through ICICI Bank:

- Duly filled online iLENS application form

- 2 photographs of passport size

- Copy of Class 12 marksheet or latest education certificate

- Admission letter with cost of education if available

- Pan card of the student and parent(s)/guardian(s)

- Residence proof such as

- Passport

- Driving License issued by Regional Transport Authority

- Voter’s Identity Card issued by the Election Commission of India

- Job card issued by NREGA signed by State Government Officer

- Letter from National Population Register containing details of name and address

- Proof of possession of complete AADHAR number/AADHAR Card

- Age and Identity proof which include an Aadhaar card, Voter ID, Passport, Driving Licence, etc.

- Income proof

List of documents for Salaried:

- Most recent salary slips and Form 16 of the parent(s)/guardian(s)/co-borrower

- Latest 3 months bank statement for non-ICICI Bank customer (Not required for ICICI Bank customer)

List of documents for Self-Employed:

- Updated ITR (Income Tax Return with income computation) of 2 years of parent(s)/co-borrower(s)/guardian(s)

Note: ICICI Bank may require additional documents to process your loan application.

ICICI Education Loan – How to Apply

Applicants can easily apply for an education loan from the ICICI Bank by following the below steps:

Step 1: Visit the official website of ICICI Bank. (www.icicibank.com/homepage)

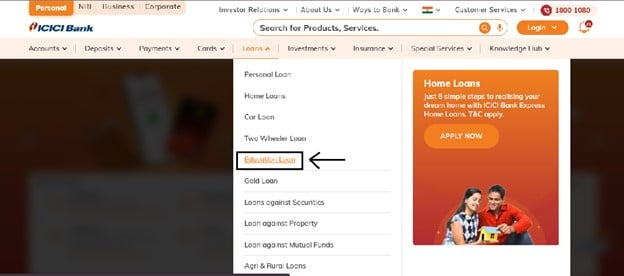

Step 2: Navigate to the ‘Loans’ option on the top bar, scroll down to the ‘Education Loan’ option and click on it.

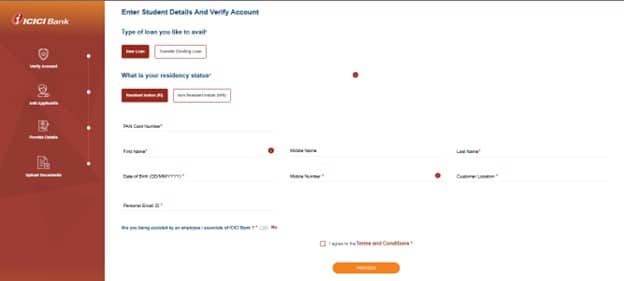

Step 3: Now, navigate to the ‘Apply Now’ button.

Step 4: Click on the ‘Apply Now’ button given on the banner.

Step 5: Fill in the required details and click on the ‘Proceed’.

Step 6: Now, add applicants, provide the necessary details, upload the documents and submit.

ICICI Bank Instant Education Loan without Collateral

Pre-approved educational loans are a hassle-free way to secure funding for your higher education. It offers instant approvals, minimal documentation and quick funds.

ICICI Bank offers student loans without collateral with the flexibility and support to pursue your academic aspirations without financial hindrance. The turnaround time for these pre-approved loans from ICICI Bank varies from days to a few minutes.

With a minimum loan amount of ₹1 lakh, you can finance your education at both international and domestic universities. ICICI Bank also offers instant online sanction letters for pre-approved education loans from the bank for students’ convenience. Moreover, they can avail the benefit of a 100% tax deduction on interest payments under Section 80E of the Income Tax Act for their instant student loan.

Applicants can easily apply for the ICICI Bank Instant Education Loan without Collateral by using the below steps:

Step 1: Log into your internet banking account.

Step 2: Locate the “Pre-approved Offers” section on your dashboard.

Step 3: Select the “Education Loan” offer and click on “Instant Sanction.”

Step 4: Provide the necessary details, such as the institution name, course details, and desired loan amount.

Step 5: Customise the loan tenure and other terms as per your requirements.

Step 6: Carefully review the terms and conditions of the loan agreement and accept the terms and conditions by checking the appropriate box.

Step 7: Submit your application by clicking on the “Submit” button.

Step 9: Enter the OTP received on your registered mobile number.

Step 10: Pay the processing fee by clicking on “Pay Now.“

Once the processing fee is paid, your pre-approved loan will be sanctioned within a few minutes.

ICICI Bank Education Loan to Study Abroad

ICICI Bank offers an extensive range of education loans for those students who wish to pursue higher education in any of the foreign universities. ICICI Bank education loan to study abroad loans come with standout features such as pre-admission sanctions, hassle-free digital processes, and generous loan limits. It offers substantial financial support of up to ₹3 crore for international studies and premium institute enrollees can benefit from collateral-free loans of up to ₹1 crore with no margin requirements, and a fully digital application process, ensuring convenience at every step.

Study abroad education loans from ICICI Bank offer competitive interest rates, flexible tenures of up to 14 years, and moratorium periods that further enhance affordability, while eligibility criteria ensure accessibility for Indian nationals who have secured admission to approved universities.

ICICI Bank Study Abroad Education Loan – Eligibility Criteria

- Applicants must be Indian citizens.

- Candidates must have completed Class 12 or graduated with good academics from a recognised Indian institution/college.

- They must have secured admission to a recognised university abroad and received an offer for the same.

Documents required for a Student Loan for Study Abroad

- A duly filled online Application Form

- Passport-size photographs (2)

- Copy of the Class 12 marksheet or the latest education certificate as proof of academic qualification

- Admission letter from the overseas university or college, including the cost of education, if available

- PAN Card of the student and parent(s)/guardian(s)

- Residence proof such as a Passport, Driving License, Voter’s Identity Card, Job Card issued by NREGA, Letter from National Population Register or Aadhaar Card, etc.

- Age and identity proof such as an Aadhaar Card, Voter ID, Passport or Driving Licence, etc.

- Income Proof such as

- Most recent salary slips and Form 16 of the parent(s)/guardian(s)/co-borrower(s)

- Latest 3 months’ bank statements for non-ICICI Bank customers (not required for ICICI Bank customers)

- Updated Income Tax Returns (ITR) with income computation of the parent/co-borrower/guardian for the last 2 years

How to Use ICICI Education Loan EMI Calculator

ICICI Education Loan EMI Calculator helps to make informed decisions and helps to effectively manage your expenses. It is very simple to use the ICICI Bank’s education loan EMI and Tax Benefit Calculator by following the below steps:

Step 1: Enter details which include country, university/college, stream, course duration, tuition fees, and cost of living.

Step 2: Click on the ‘Know your EMI’ button to know the accurate EMI repayment amount.

Also Read: Credila Education Loan by HDFC: Know Details & How to Apply

ICICI Bank Education Loan: FAQs

Who is eligible for an ICICI Bank education loan?

Students who want to qualify for an ICICI Bank study loan must fulfill the following requirements:

- Applicants must be Indian nationals aged between 16 and 35 years, with a proven academic track record.

- They must have completed 10+2 years of education and pursue undergraduate/postgraduate degrees or professional courses from recognised institutes in India or abroad.

- Co-borrowers such as parents, siblings, spouses or relatives are required to apply for an education loan from ICICI Bank.

Is there a minimum salary requirement for parent(s) who are applying for an Education Loan from ICICI Bank?

No, there isn’t a specific minimum salary requirement to apply for an ICICI Bank. However, parent(s) should be able to demonstrate a stable financial background to ensure repayment capability. ICICI Bank will assess the overall financial condition of applicants and co-borrowers to determine loan eligibility.

Can I Get a 100% Education Loan for Abroad Studies from ICICI Bank?

Yes, ICICI Bank offers education loans of up to ₹3 crore for international studies which includes unsecured loans of up to ₹1 crore for students upon securing admission in premium institutions.

What is the maximum limit for ICICI Bank education loans?

Under ICICI Bank study loans, students can avail significant financial support of up to ₹3 crores for international studies and up to ₹1 crore for domestic education. Students who are pursuing degrees from top-tier institutions can benefit from collateral-free student loans of up to ₹1 crore.

What are the benefits of ICICI Bank pre-approved education loans without collateral?

Below are the benefits of a pre-approved education loan from ICICI Bank:

- Competitive interest rates

- A 100% tax deduction on the interest paid on the study loan

- Reduced waiting time

- Seamless remittance services to transfer funds to international institutions

- Additional benefits such as a Guaranteed Investment Certificate for Canada, a UK Personal Bank Account, and a Travel Card

3 thoughts on “ICICI Education Loan – Eligibility, Benefits and Documents Required”

Comments are closed.