Bank of Baroda education loan is here to bridge the gap between dreams and reality, offering customised financial solutions to support your academic journey. With competitive interest rates, hassle-free processing, and flexible repayment plans, this study loan caters to a variety of courses in India and abroad. Whether you’re aiming for a top-tier university or pursuing a specialised professional program in India or abroad, Bank of Baroda ensures you can focus on achieving excellence without financial worries.

Bank of Baroda Education Loan – Features and Benefits

Bank of Baroda offers a range of education loans with attractive features and benefits to help students finance their higher education. Some of the key features include:

- High Loan Amount: You can avail of a maximum loan of ₹125 lakh for studying in India and ₹150 lakh for studying abroad.

- Flexible Repayment Tenure: It provides flexibility to choose a repayment tenure between 10 and 15 years to meet your financial needs.

- Minimal Documentation: The Bank of Baroda loan application process is simple and easy with minimal documentation requirements.

- No Collateral Security: For loans up to ₹40 lakh for identified premier institutes, no collateral security is required.

- Competitive Interest Rates: Bank of Baroda offers competitive interest rates on education loans.

- Moratorium Period: Study loan under Bank of Baroda provides a grace period of up to 12 months after course completion, during which you don’t have to make any repayments of your education loan.

- Tax Benefits: You can also avail income tax benefits under Section 80E of the Income Tax Act on the interest paid on your Bank of Baroda education loan.

Bank of Baroda Education Loan Eligibility Criteria

To apply for an Bank of Baroda education loan. the students must be Indian citizens residing in India. Other Bank of Baroda education loan eligibilit criteria depends on the particular scheme the student is apply for. Below table enlists the eligibility criteria for the Bank of Baroda study loan:

| Bank of Baroda Education Loan Scheme | Eligibility Criteria |

| Baroda Vidya (for school education from Nursery to Class 12) |

|

| Baroda Gyan (for higher study in India) |

|

| Baroda Scholar (for study abroad) |

|

| Baroda Education Loan to students of premier Institutions |

|

| Skill Loan Scheme |

|

| Baroda Education Loan for EDP (Executive Development Programs) being offered by Premier Institutions in India |

|

| Baroda Education Loans for EDP being offered by Premier Institutions abroad |

|

Bank of Baroda Education Loan – Expenses Covered

One of the most important factors of a student loan is what expenses will be covered under it. It is very crucial for students to have information about the expenses covered under an education loan so that they can easily do their financial planning. The following expenses will be covered under the various student loan schemes offered by the Bank of Baroda:

- Academic expenses inlcuding

- Tuition fees and admission fees

- Hostel and accommodation fees

- Book Bank and other study equipment (laptop, gauges, scopes, etc.)

- Coaching and other training fees

- Laboratory fees and library fees

- Examination fees

- Insurance and health cover

- Study tour and project outings

- Non-academic expenses inlcuing

- Building fees and caution money deposits

- Educational travel expenses

- Institutional deposits

Bank of Baroda Education Loan – Interest Rates

Bank of Baroda’s Marginal Cost of Funds-Based Lending Rate (MCLR)

The Marginal Cost of Funds-Based Lending Rate (MCLR) refers to the interest rate used by Bank of Baroda to determine the interest rates on various loans and advances. It is calculated based on the bank’s marginal cost of funds, which includes the cost of deposits, borrowings, and other sources of funds. The MCLR is revised periodically by the bank to reflect changes in its cost of funds. Below table enlists the MCLR with effects from the year 2024:

| BoB Education Loan Tenure | MCLR Rate (Latest 2024) |

| Overnight Loan | 8.15% |

| 1 month | 8.35% |

| 3 months | 8.50% |

| 6 months | 8.75% |

| 1 year and above | 8.95% |

- The Base Rate applicable effective from 12 October 2024 is 9.40% per annum.

- The Benchmark Prime Lending Rate (BPLR) effective from 12 October 2024, is 13.70% per annum.

Bank of Baroda Education Loan – Interest Rate

| Conditions | Current Interest Rate (October, 2024) | |

| Baroda Vidya (for school education from Nursery to Class 12) | ||

| Study in school in India | 12.50% | |

| Baroda Gyan (Study in India) | ||

| Up to ₹7.50 lakhs | 11.15% | |

| Above ₹7.50 lakhs | 11.05% | |

| (Special rate of Interest for Children of defence personnel under Baroda Yodha Education Loan Scheme) | 10.25% | |

| Baroda Executive Development Premier Institutions (For Studies Abroad) | ||

| Up to ₹7.5 lakhs | 11.15% | |

| Above ₹7.5 lakhs | 11.50% | |

| Baroda Education Loan to Students of Premier Institutions (For Studies in India) | ||

| Categories | Floating Rates | Fixed Rates |

| AA | 8.15% | 10.15% |

| A | 8.45% | 10.45% |

| B | 9.75% | 11.40% (For up to ₹7.50 lakhs) |

| 11.75% (For above ₹7.50 lakhs) | ||

| C | 9.95% | 11.40% (For up to ₹7.50 lakhs) |

| 11.95% (For above ₹7.50 lakhs) | ||

| Bank of Baroda Skill Loan Scheme | ||

| N/A | 10.65% | |

| Conditions | Effective Rate of Interest |

| Baroda Scholar | |

| Premier Institution | 9.70% |

| (Canada, Premier Institution | 9.70% |

| Non-Premier Institutions, Up to ₹ 7.50 lakhs | 11.15% |

| Non-Premier Institution, Above ₹ 7.50 lakhs | 10.20% |

| Canada, Non-Premier Institution, Up to ₹ 7.50 lakhs | 11.15% |

| Canada, Non-Premier Institution, Above ₹7.50 lakhs | 11.70% |

| Baroda Yodha | |

| Premier Institution | 10.20% |

| Canada, Premier Institution | 10.20% |

| Non-Premier Institutions, Up to ₹7.50 lakhs | 11.15% |

| Non-Premier Institution, Above ₹7.50 lakhs | 12.20% |

| Canada, Non-Premier Institution, Up to ₹7.50 lakhs | 11.15% |

| Canada, Non-Premier Institution, Above ₹7.50 lakhs | 13.70% |

Fixed Rates to Study Abroad:

| Conditions | Effective Rate of Interest |

| Baroda Scholar | |

| Premier Institution, Up to ₹7.50 lakhs | 11.40% |

| Canada, Premier Institution, Up to ₹7.50 lakhs | 11.40% |

| Non-Premier Institutions, Up to ₹7.50 lakhs | 11.40% |

| Baroda Yodha | |

| Premier Institution, Up to ₹7.50 lakhs | 11.40% |

| Canada, Premier Institution, Up to ₹7.50 lakhs | 11.40% |

| Non-Premier Institutions, Up to ₹7.50 lakhs | 11.40% |

Important Note:

- 0.20% concession in ROI will be provided for female children studying in non-premier institutes. However, no concession for premier institutes for female children.

- Simple interest to be charged at monthly rests during the repayment holiday/moratorium period.

- Penal interest of 2% p.a. on overdue amount, if the loan amount exceeds ₹4 lakh.

- The accrued interest during the repayment holiday period will be added to the principal, and repayment will be in fixed Equated Monthly Installments (EMIs).

Bank of Baroda Education Loan Documents Required

A set of documents are required to apply for the Bank of Baroda study loans. Each scheme will have a different set of documents, but the common documents that are required for the study loans are:

- KYC of applicant and co-applicants

- Academic records which includes marksheet and certificates

- Admission proof

- Entrance Exam Result(if applicable)

- Statement of cost of study/Schedule of expenses

- Income proof for salaried co-applicant/ Guarantor (if applicable)

- Bank account statement for last 6 months etc

- Property documents (if applicable)

Bank of Baroda Education Loan Application Process

The process to apply for an education loan from Bank of Baroda is a very easy and streamlined process. Students can follow the below steps to apply for the loan opportunity hassle-free:

Step 1: Visit the official website of Bank of Baroda (www.bankofbaroda.in) and select your preferred language.

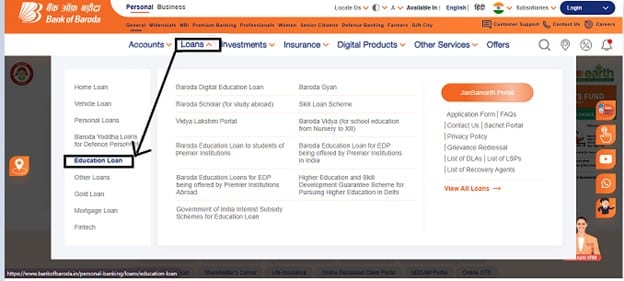

Step 2: Navigate to the ‘Loans’ section on the dashboard and click on the ‘Education Loans’ option in the dropdown menu. A list of various scheme offered by the Bank of Baroda will appear on the screen.

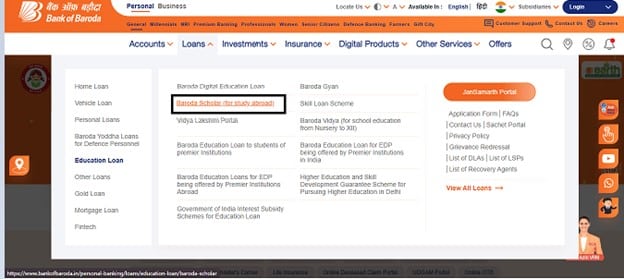

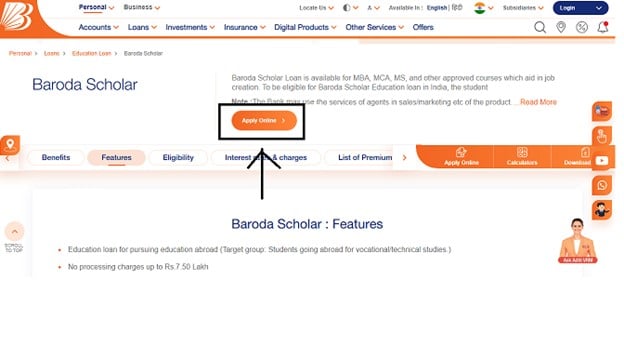

Step 3: Now. click on the scheme you want to apply for. For instance you choosed for ‘Baroda Scholar (for study abroad)’ scheme. Click on it to proceed with the process.

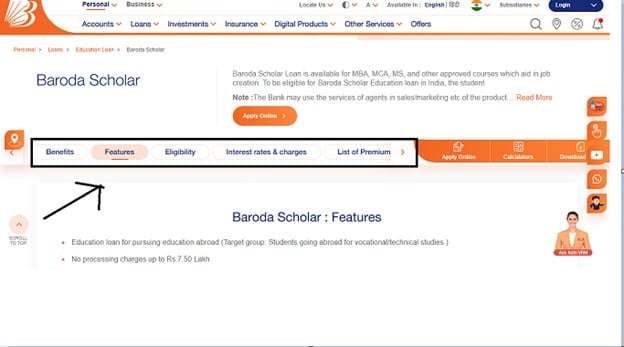

Step 4: After clicking on it, the scheme detail page will appear where you be able to navigate to details such as eligibility, features, benefits, interest rates & charges, list of premier institutions (if any), documents required, and most important terms and conditions (MITC).

Step 5: Above these details scrolling, you will be able to navigate the ‘Apply Online’ button to apply for the scheme.

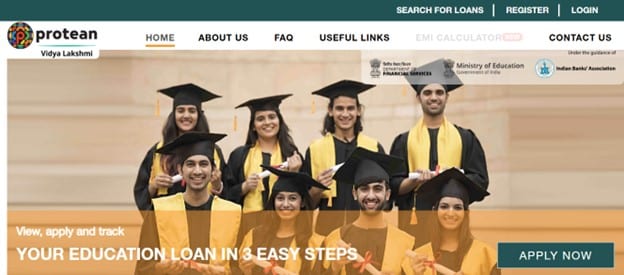

Step 6: After clicking on this button, you will be redirected to the Vidya Lakshmi portal.

Step 7: Navigate to the ‘Register’ option to the top right-hand side of the dashboard and click on it register.

Step 8: After successfully registering to the portal, navigate to the loan scheme, fill the required details, upload the necessary documents and submit your Bank of Baroda education loan application form.

Bank of Baroda Education Loan – Repayment & Moratorium Period

A moratorium period refers to a grace period where you don’t have to make repayments. This period usually lasts 6 to 12 months after course completion, giving you time to find a job and get stable in your finances. Once the moratorium ends, you’ll have to repay the study loan through Equated Monthly Installments (EMIs) over a period of 10 to 15 years. Some lenders offer flexible repayment plans to adjust EMIs based on income fluctuations. Bank of Baroda education loan offers a subtle repayment and moratorium period to repay the loan so that student can focus on their studies without any worry.

Bank of Baroda Education Loan Repayment Terms

| BoB Education Loan Scheme | Margin Payment (Down-payment) | Moratorium Period (Holiday Period) | Repayment Tenure (Duration) |

| Baroda Vidya (for school education from Nursery to XII) | NIL | None | 12 months |

| Baroda Gyan (for higher study in India) | Loan up to ₹4.0 lakhs: NIL

Loan above ₹4.0 lakhs: 5% |

Course duration + 1 year | Min: 10 years

Max: 15 years |

| Baroda Scholar (for study abroad) | Premier institutions: NIL

Other Institutions: Loan up to ₹4.0 lakhs: NIL Loan above ₹4.0 lakhs: 10% |

Course duration + 1 year | Min: 10 years

Max: 15 years |

| Baroda Education Loan to students of premier Institutions | NIL | Course duration + 1 year | Min: 10 years

Max: 15 years |

| Skill Loan Scheme | NIL | Less than 1 year courses:

Course duration + 6 months More than 1-year courses: Course duration + 1 year |

Min: 3 years

Max: 7 years |

| Baroda Education Loan for EDP (Executive Development Programs) being offered by Premier Institutions in India | Loan up to ₹4.0 lakhs: NIL

Loan above ₹4.0 lakhs: 5% |

Course duration + 3 months | Min: 10 years

Max: 15 years |

| Baroda Education Loans for EDP being offered by Premier Institutions abroad | Loan up to ₹4.0 lakhs: NIL

Loan above ₹4.0 lakhs: 5% |

Course duration + 3 months | Min: 10 years

Max: 15 years |

Bank of Baroda Education Loan Collateral Conditions

| BoB Education Loan Scheme name | Loan Limits | Education Loan Terms and Conditions: Collateral |

| Baroda Vidya (for school education from Nursery to XII) | -any- | No collateral, no security |

| Baroda Gyan (for higher study in India)

-and- Baroda Gyan (for higher study in India) |

Up to ₹4.0 lakhs | No collateral, no security |

| ₹4.0 lakhs to ₹7.5 lakhs | Third-party guarantee

Assignment of future income |

|

| Above ₹7.5 lakhs | Tangible collateral security equivalent to 100% of the loan amount

Securities, movable property, immovable property, acceptable Assignment of future income |

|

| Baroda Education Loan to students of premier Institutions | List AA: Up to ₹40 lakhs

List A: Up to ₹20 lakhs List B: Up to ₹7.50 lakhs List C: Up to ₹7.5 lakhs |

No collateral, no security |

| List AA: above ₹40 lakhs

List A: above ₹20 lakhs List B: above ₹7.50 lakhs List C: above ₹7.5 lakhs |

Tangible collateral security equivalent to 100% of loan amount

Securities, movable property, immovable property, acceptable Assignment of future income |

|

| Skill Loan Scheme | -any- | No collateral, no security |

| Baroda Education Loan for EDP (Executive Development Programs) being offered by Premier Institutions in India | Up to ₹15 lakhs | NIL |

| Above ₹15 lakhs | Tangible collateral security equivalent to 100% of loan amount

Securities, movable property, immovable property, acceptable |

|

| Baroda Education Loans for EDP being offered by Premier Institutions abroad | Up to ₹4.00 lakhs | No collateral, no security |

| ₹4.00 lakhs to ₹7.50 lakhs | Third-party guarantee

Assignment of future income |

|

| Above ₹7.5 lakhs | Tangible collateral security equivalent to 100% of the loan amount

Securities, movable property, immovable property, acceptable Assignment of future income |

Bank of Baroda Education Loan: Processing and Other Charges

Processing and other charges in an student educatiion loan refers to the fees levied by the bank for various services related to the loan processing and disbursement. These charges can vary depending on the bank, loan amount, and specific terms. Bank of Baroda charges nominal fees for the various scheme they are offering.

Baroda Vidya (for school education from Nursery to Class 12):

- Unified Processing charges: NIL

- Security: No security, In case the loan is given for purchase of computer the same is to be hypothecated to the bank.

Baroda Gyan (Study in India)

Unified Processing Charges

- Up to ₹7.50 lakh: NIL

- Above ₹7.50 lakh: 1.00% of the loan amount, maximum ₹10,000 + Applicable (GST)

Security:

- Up to ₹7.50 lakhs: No collateral or third-party guarantee will be obtained; however, a parent’s co-obligation is required.

- Above ₹7.50 lakhs up to ₹80.00 lakhs: Tangible collateral security equal to 100% of the loan amount, along with assignment of future income.

- Above ₹80.00 lakhs: Total security coverage should be 1.25 times the loan amount, along with assignment of future income.

Notes: A non-refundable lump sum amount of Rs. 8,500 per property (towards advocate and valuer charges) is to be taken upfront in case of all education loan accounts, wherever property is mortgaged. No mortgage creation charges for all types of education loans.

Baroda Executive Development Premier Institutions (For Studies Abroad)

Unified Processing Charges:

- 1.00% of the loan amount (maximum ₹10,000) to be recovered upfront, refundable on the first disbursement of the loan. This amount can be refunded to the student/borrower’s savings bank account or loan account.

- A non-refundable lump sum amount of ₹7,500 per property (towards advocate and valuer charges) will be charged upfront for all education loan accounts with property mortgage.

Security:

- Up to ₹4 lakhs: Co-obligation of a parent. No other security required.

- Above ₹4 lakhs and up to ₹7.5 lakhs: Collateral in the form of a suitable third-party guarantee, along with assignment of future income.

- The regional authority may waive the third-party guarantee at its discretion:

- If satisfied with the net worth/means of the parent who will be a joint borrower.

- To support highly meritorious/deserving students who have secured admission to a reputed institution but cannot offer a suitable third-party guarantee.

- Above ₹7.5 lakhs: Tangible collateral security equal to 100% of the loan amount, along with assignment of future income of the student for installment payments.

Baroda Executive Development Premier Institutions (For Studies in India)

- Unified Processing Charges: NIL for all cases

- Non-Refundable Charges: A lump sum amount of ₹7,500 per property (towards advocate and valuer charges) will be charged upfront for all education loan accounts with property mortgage.

- Security:

- Up to ₹15 lakhs: Student loan without collateral loan

- Above ₹15 lakhs: 100% collateral security for the full loan amount

Baroda Skill Loan Scheme

- Unified Processing Charges: NIL

- Security: No collateral or third-party guarantee will be required. However, the parent will execute loan documents along with the student borrower as a joint borrower.

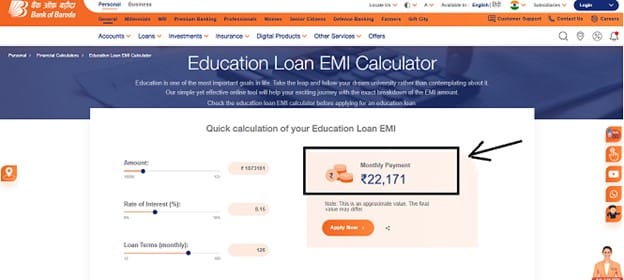

Bank of Baroda Education Loan EMI Calculator

It is very cnonvinent to use the Bank of Baroda education loan EMI calculator. It is very simple and designed in such a manner that students will have to enter a few details which include loan amount, rate of interest, monthly loan terms and it will give you the accurate amount which is required to be paid for your education loan. Following are the steps to use the educational loan EMI calculator:

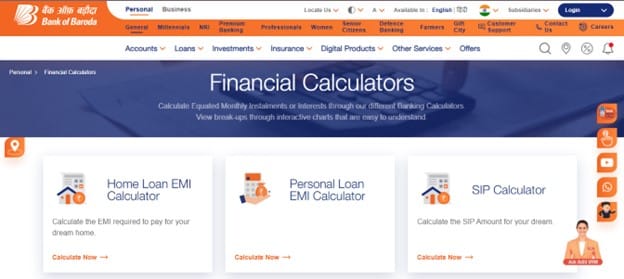

Step 1: Visit the Bank of Baroda’s official website and navigate to the ‘Financial Calculators’ option under the Personal section.

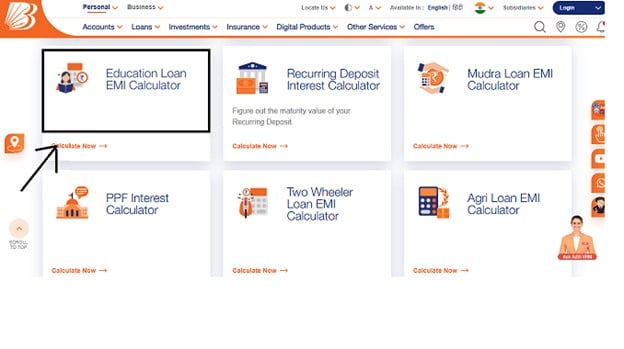

Step 2: Now, scroll down and navigate to the ‘Education Loan EMI calculator’ on the left hand side of the ‘dashboard and click on the ‘Calculate Now’ option.

Step 3: Enter the required information and your EMI amount will be reflected in the highlighted side.

Bank of Baroda Education Loan – FAQs

How much Education Loan can I get from Bank of Baroda?

You can avail of an education loan of up to ₹125 lakh for studying in India and up to ₹150 lakh for studying abroad from Bank of Baroda.

How can I repay my education loan from Bank of Baroda?

You can repay your education loan through various online channels like net banking and mobile banking. Alternatively, you can visit a nearby branch to make the payment.

Who can be co- applicant for my Bank of Broda study loan?

The co-applicant for an education loan is usually the student borrower’s parent(s) or guardian(s). For married individuals, either the spouse or the parent(s)/parent(s)-in-law can serve as the joint borrower.

What is Baroda Vidya?

It is a loan designed to finance school education of students who are enrolled in any recognised school. The maximum loan amount offered unders this loan scheme is ₹4 lakh, and repayment starts 12 months after the initial disbursement in 12 equal installments.

How much loan can a student avail via Baroda Scholar Loan?

A student can avail of a loan of up to ₹150 lakh through the Baroda Scholar Loan scheme.

Which students can apply for loan for technical courses?

Individuals who are willing to pursue skill development courses as per the skilling loan eligibility criteria of the Bank of Baroda can apply for an education loan.

2 thoughts on “Bank of Baroda Education Loan – Key Information, Features and Benefits”

Comments are closed.