Planning to pursue higher education abroad? The SBI Global Ed-Vantage Scheme, popularly known as the SBI Education Loan for Abroad, is a comprehensive financial solution designed to support Indian students who are willing to pursue higher education overseas. Known for its faster processing time – approval within 14 working days and lower interest rates compared to competitors, this loan is a preferred choice for many aspiring students. Additionally, the fixed processing fee of ₹10,000 makes it a cost-effective option compared to other lenders in the market.

However, only selected SBI branches (Scale 2 and Scale 3) are authorised to process loans under this scheme, ensuring streamlined services for eligible applicants.

SBI Education Loan for Abroad – Eligibility, Courses and Countries

Whether you’re considering universities in the USA, Australia, or Europe, the SBI Study Loan for Abroad is your reliable financial partner, allowing you to concentrate on your education without worrying about expenses. Here are the key eligibility criteria for the SBI education loan:

- The applicants must be Indian citizens and at least 18 years old at the time of application.

- Students must have taken admission to a recognised university or institution for a degree, diploma, or certification program.

- Candidates must have maintained consistent academic records along with fulfilment of any prerequisite tests such as GRE, IELTS, or TOEFL.

- Applicants must have a co-applicant (parent or legal guardian) with a steady income and a good credit history.

Countries of Study: Financial assistance is available for education in the USA, UK, Canada, Australia, Singapore, Japan, Hong Kong, New Zealand, and European countries such as Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Poland, Portugal, Russia, Spain, Sweden, Switzerland, and the United Kingdom.

SBI Education Loan for Abroad – Expenses Covered

SBI Education Loan for Abroad covers regular graduate, postgraduate, diploma, certificate, and doctorate courses in any discipline offered by foreign institutes or universities. Pathway courses leading to the main program may also be included. For pilot training programs, approval from the respective country’s aviation regulatory authority is mandatory. Below types of expenses will be covered under the SBI Global Ed-Vantage Scheme:

- Fees for college/school/hostel

- Fees for examination/library/laboratory

- Travel expenses/passage money for studies abroad

- Books/equipment/instruments/uniforms/computer at a reasonable cost (if required for course completion) and any other expense necessary to complete the course (maximum 20% of the total tuition fees payable for completion of the course)

- Caution deposit/building fund/refundable deposit supported by institution’s bills/receipts (maximum 10% of tuition fees for the entire course)

- The premium of Rinn Rakhsha

SBI Education Loan for Abroad – Loan Amount and Security

SBI Global Ed-Vantage Scheme offers a minimum loan amount of ₹20 Lacs and a maximum loan amount of ₹1.5 Crores. Tangible collateral security is required. Collateral security offered by third parties (other than parents) is also acceptable.

SBI Education Loan for Abroad – Interest Rate

| Loan Limit | EBR | CRP | Effective Interest Rate | Rate Type |

| Above ₹7.50 lakhs & Upto ₹1.5 Crores | 9.15% | 2.00% | 11.15% | Floating |

| Concession | A 0.50% concession is available for students who opt for SBI Rinn Raksha or any other existing life insurance policy assigned in favour of our bank. | |||

| Further Concession | 0.50% concession for female students | |||

SBI Education Loan for Abroad – Repayment Rules

The repayment period for SBI Global Ed-Vantage Scheme begins 6 months after the course completion and the loan is to be repaid in 15 years.

SBI Education Loan for Abroad – Documents Required

Find below the checklist of documents for the SBI Global Ed-vantage Scheme:

For student-applicant

- Duly-filled loan form

- Identity proof such as PAN/Passport/Driver’s License/Voter ID card

- Residence proof such as telephone bill/electricity bill/water bill/piped gas bill or copy of a Passport/Driving License/Aadhaar Card

- Passport (mandatorily in case of studies abroad)

- Academic records including Class 10 and 12 marksheet & certificates, graduation results, and entrance exam results through which admission is being taken

- Admission proof such as an offer letter/admission letter from the institution

- Statement of cost of study or schedule of expenses

- Loan account statement for the last 1 year in case of any previous loan from other banks/lenders

- 2 passport-size photographs

For co-applicant

- Identity proof such as PAN/Passport/Driver’s License/Voter ID card

- Residence proof such as telephone bill/electricity bill/water bill/piped gas bill or copy of a Passport/Driving License/Aadhaar Card

- 2 passport-size photographs

- Loan account statement for the last 1 year in case of any previous loan from other banks/lenders

Note:

- Income proof for salaried co-applicants/guarantors includes:

- Salary slips for the last 3 months

- A copy of Form 16 for the last 2 years or a copy of IT Returns for the last 2 financial years acknowledged by the IT department

- Bank account statements for the last 6 months

- Income proof for self-employed co-applicants/guarantors includes:

- Business address proof (if applicable)

- IT Returns for the last 2 years (if IT payee)

- TDS Certificate (Form 16A, if applicable)

- Certificate of qualification (for Chartered Accountants, Doctors, and other professions)

- Bank account statements for the last 6 months

- All documents should be self-attested.

How to Apply for SBI Education Loan for Abroad

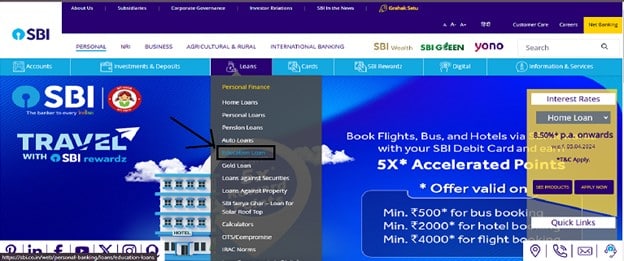

Step 1: Visit the official website of the State Bank of India (sbi.co.in/web/personal-banking/home)

Step 2: Navigate to the ‘Loans’ section of the dashboard, look for the ‘Education Loan’ and click on it.

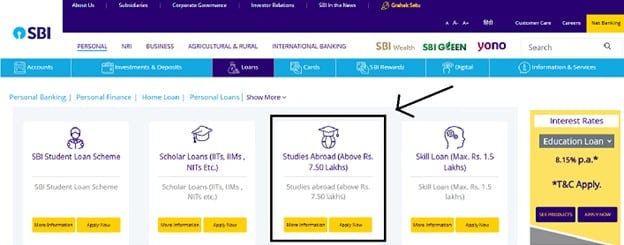

Step 3: Now, click on the ‘Apply Now’ under the ‘Studies Abroad (Above Rs. 7.50 lakhs)’.

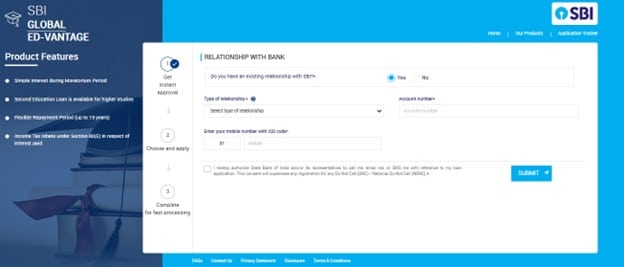

Step 4: Fill in the required details, upload the necessary documents and submit the application form.

Also Read: SBI Education Loan EMI Calculator – Benefits, Usage & Features

SBI Education Loan for Abroad – FAQs

What are the types of education loans offered by SBI for studying abroad?

SBI Bank offers various education loans customised for studying abroad. A few include:

- SBI Global Ed-Vantage Scheme: This is specifically for students pursuing full-time courses abroad.

- SBI Student Loan Scheme: It covers education both in India and abroad.

- SBI Skill Loan Scheme: This loan is for skill development courses and covers tuition fees, accommodation, travel, and other expenses.

What courses are eligible for an SBI Education Loan for studying abroad?

The below courses are eligible for an SBI education loan for studying abroad:

- Graduate and postgraduate degree programs.

- Professional courses like MBA, MS, or medical courses.

- Doctoral and technical courses from recognized institutions. Short-term diploma or certificate courses may not qualify unless covered under specific loan schemes.

What is the loan amount offered under the SBI Global Ed-Vantage Scheme? Is there any margin money requirement?

Under the SBI Global Ed-Vantage Scheme, loans range from ₹7.5 lakhs to ₹1.5 crore, with no margin money required for loans up to ₹4 lakhs, while loans above ₹4 lakhs require a 15% margin for studies abroad.

What is the repayment process, and when does repayment start?

Repayment of the student loan begins after a moratorium period of the course duration plus 6-12 months, with a repayment tenure extending up to 15 years under the SBI Education Loan for Abroad, while interest accrues during the moratorium period and can be paid separately or added to the principal.

What are the interest rate and security requirements for SBI Education Loans?

Interest rates depend on the scheme and loan amount but are typically linked to the repo rate. For loans up to ₹7.5 lakh, no collateral is required, but a co-applicant (parent/guardian) is necessary. Loans exceeding ₹7.5 lakh mandate tangible collateral security such as property, fixed deposits, or insurance.

1 thought on “SBI Education Loan for Abroad – Expenses Covered, Interest Rate & Application Process”

Comments are closed.