Dreaming of studying at a top-tier foreign university abroad? While the idea of gaining international exposure, world-class education, and a globally recognised degree is exciting but the cost related to it can feel overwhelming. This is where HDFC Bank education loan for study abroad can provide you significant help to turn your dream into reality with its tailored student loan solutions.

HDFC Bank’s education loan abroad offers more than just financial assistance, it’s a support system enabling the student to focus on their education. From covering tuition fees, travel expenses, and living costs to offering flexible repayment plans and competitive interest rates, this HDFC education loan to study abroad is designed to ease the financial burden on students and their families. What makes this student loan stand out is the user-friendly application process, faster approvals, and options to apply for loans without collateral.

Beyond the financial benefits, HDFC’s expertise and global reach simplify managing international transactions and currency exchanges. So whether you’re planning to pursue MBBS in the United States, Engineering in the UK, or an Professional degree like MBA in Europe, HDFC ensures that your financial limitations doesn’t hold you back.

Features of HDFC Bank Education Loan for Study Abroad

| Feature | Details |

| Loan Amount |

|

| Interest Rates | Floating rate of interest linked to HDFC Credila’s Benchmark Lending Rate (CBLR) + Spread

*Spread varies based on risk factors. |

| Tenure | Up to 14 years including moratorium period |

| Costs Covered | Tuition fees, living expenses, travel expenses, examination fees, books/equipment, passage money, and more. |

| Collateral Options |

|

| Eligible Courses | MS, MBA, MBBS/MD (India only), Executive Management Courses, Other Courses (case-to-case basis) |

| Eligible Universities | Over 2100 universities, 950 courses across 35+ countries |

HDFC Bank Education Loan for Study Abroad – Eligibility Criteria

Students who are willing to apply for the HDFC Bank education loan for abroad must fulfill the below eligibility criteria:

- The borrower must be an Indian citizen.

- Co-applicants must also be Indian citizens.

- The ability to offer collateral is required for certain cases.

- Co-borrower(s) must maintain a bank account in any bank in India with cheque writing facilities.

- The borrower must have confirmed admission to the college before the loan disbursement.

- Both the borrower and co-applicant(s) must meet HDFC Credila’s credit and underwriting norms, which are subject to change over time.

*Conditions apply. All education loans are provided by HDFC Credila and are subject to the sole discretion of HDFC Credila.

HDFC Bank Education Loan for Study Abroad – Expense Covered

The following expenses will be covered under the HDFC Bank education loan for study abroad:

- All tuition fees as determined by the college/university

- Up to 100% of living and hostel expenses

Travel Expenses:

- Travel expenses within the country of study.

- One economy class return ticket between India and the country of study.

- Examination Fees

- Library/Laboratory Fees

- Books,instruments, and uniform

- Passage money for studies into India

- Purchase of computers/laptops considered necessary for course completion as decided by HDFC Credila

HDFC Bank Education Loan for Study Abroad – Fees & Charges

| Description of Services | Charges in Rupees |

| Pre-payment charges | NIL |

| No Objection Certificate (NOC) | NIL |

| Delayed Payment Charges* | @ 2% per month of installment (MI/PMII) + applicable taxes thereon |

| Statutory CERSAI charges | As per charges levied by CERSAI |

| Cheque or ACH mandate or Direct Debit swapping charges* | Up to ₹500 per swap instance plus applicable taxes thereon |

| Cheque/ACH/Direct Debit Bouncing Charges* | ₹400 per dishonor of cheque or ACH or Direct Debit return per presentation plus applicable any taxes thereon |

| Legal/incidental charges | At actual rates |

| Stamp Duty and other statutory charges | As per applicable laws of the state |

| Manual Collection Charges* | ₹200 per visit plus applicable any taxes thereon |

| Charges for Updating & Handling Loan Account As Per Customer Request* | ₹1,500 plus applicable any taxes thereon |

| Origination Fees | 1.5% + Taxes of the Sanction Amount & is non-refundable |

*Important Note:

- Terms & conditions apply and may change conditionally. Credit at the sole discretion of HDFC Credila Financial Services Limited (formerly known as HDFC Credila Financial Services Private Limited).

- Charges that are in the nature of fees are exclusive of GST. GST and other government levies, as applicable, would be charged additionally.

HDFC Bank Education Loan for Study Abroad – Interest Rates

Following are the HDFC Bank education loan interest rates that being charged on the student loans:

| Loan Amount (₹) | ROI | Interest Amount (₹) | Yearly Tax Savings (₹) | Effective Rate of Interest |

| 200,000 | 12.50% | 25,000 | 7,725 | 8.64% |

| 400,000 | 12.50% | 50,000 | 15,450 | 8.64% |

| 600,000 | 12.50% | 75,000 | 23,175 | 8.64% |

| 1,000,000 | 12.50% | 1,25,000 | 38,625 | 8.64% |

| 1,500,000 | 12.50% | 187,500 | 57,938 | 8.64% |

| 2,000,000 | 12.50% | 250,000 | 77,250 | 8.64% |

HDFC Education Loan for Abroad: Documents required

Students are often required to comply with the documentation requirements of the bank for education loans. Below is the list of documents required for the HDFC Credila education loan:

- HDFC Bank education loan application form

- Two passport size photos of applicant and co-applicant; One set is required to be pasted on the application form and second set to be affixed (stapled) to the application form

Academic documents:

- Marksheet/Certificate of Class 12 exam

- Marksheet/Certificate of subsequent years of education

- Marksheet of any entrance exam taken e.g. CAT, CET, etc. (If applicable)

- GRE/GMAT/TOEFL/IELTS, etc. scorecards (If applicable)

- Scholarship documents (if applicable)

KYC (Identity) documents

- Identity proof/Age proof

- Residence proof

- Signature proof (as authenticated by HDFC bank)

Financial documents

1. Past 8 months bank statements for all bank accounts of the co-applicant which include statements from the account(s) where salary, business income, or professional earnings are regularly deposited

2. In case of Salaried Employee (all the following are required)

- Latest 3 Salary Slips or Salary Certificate on Employer’s Letterhead

- Last 2 year’s Form 16 from Employer or Last 2 Year’s Income Tax Returns

- Any Other Income Proof That is Not Reflected in the Above Documents

3. In case of Self Employed or Professional (all the following are required)

- Last 2 year’s income tax returns

- Last 2 year’s certified financial statements or provisional financial statements duly certified by CA

- Proof of Office (Provide any one of the following documents):

- Lease deed

- Utility bill (e.g., Electricity, Water, Gas)

- Title deed

- Property tax receipt

4. Any other income proof that is not reflected in the above documents

5. If Collateral – Immovable Property (Flat, House, Non-Agriculture Land) provide all relevant documents from the following list:

- Property title deed

- 7/12 Extracts (if applicable, for land)

- Registered sale agreement along with society share certificate

- Original Registration Receipt for the above agreement

- Allotment Letter from Municipal Corporation/Authorised Government Authority (e.g., MHADA, CIDCO, HUDA, DDA, JDA, GIDC, etc.)

- Previous chain of sale deeds establishing title

- Latest Maintenance Bill along with Receipts issued by builder/society

- Latest Property Tax Bill along with Receipts

- No Objection Certificate (NOC) for Mortgage from society/builder

- Approved Building Plan

- Encumbrance certificate as on date

Important Note:

1. Students are not required to submit any original supporting documents to HDFC Credila at the time of applying for a loan.

2. All copies of the above-mentioned documents must be self-attested by the applicants and co-applicants.

HDFC Bank Education Loan Application Process

Students can apply for HDFC Bank’s study abroad education loan both online and offline. The process for applying online and offline are given below.

Online process:

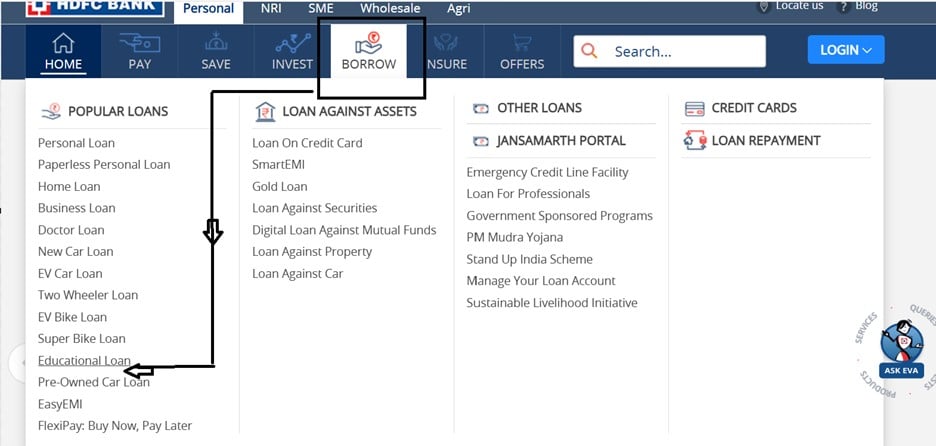

Step 1: Visit the HDFC Bank official website (hdfcbank.com)

Step 2: Navigate to the ‘Borrow’ option at the top of the dashboard, click on the ‘Educational Loan’ option and click on it.

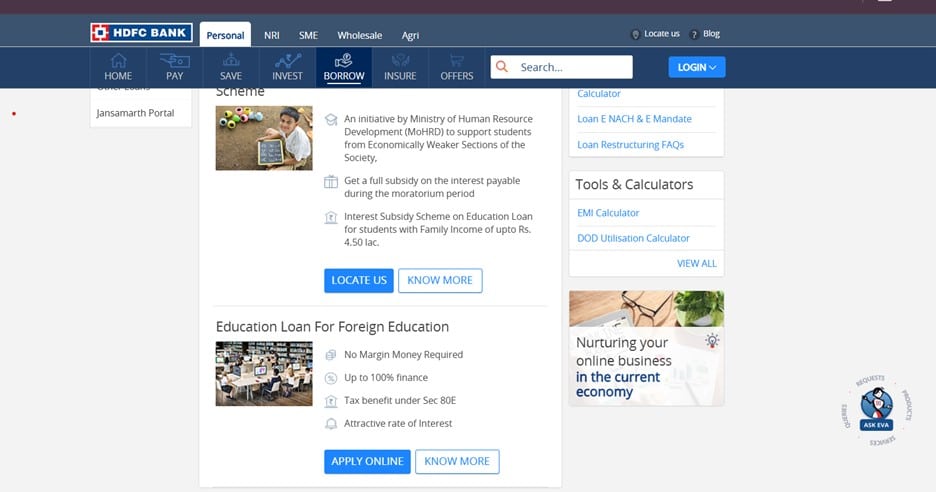

Step 3: Now, navigate to the ‘Education Loan for Foreign Education’ and click on the ‘Apply Online’ button. The student will be redirected to the Vidya Lakshmi portal.

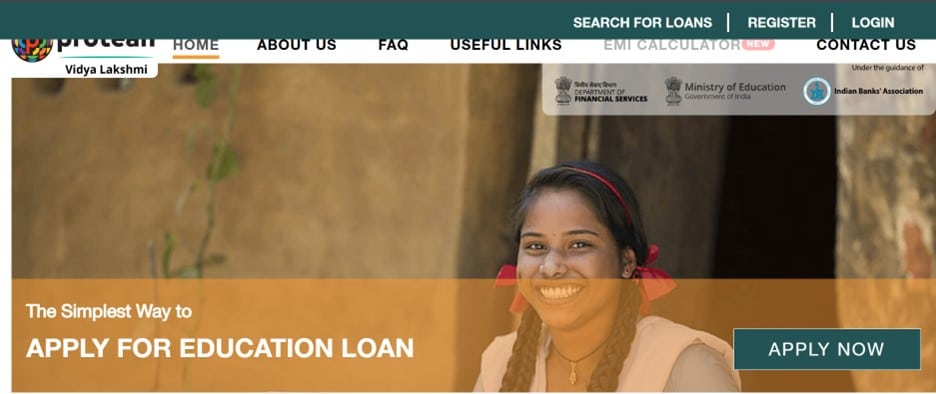

Step 4: On Vidya Lakshmi Portal, click on the ‘Register’ button at the top right corner of the dashboard.

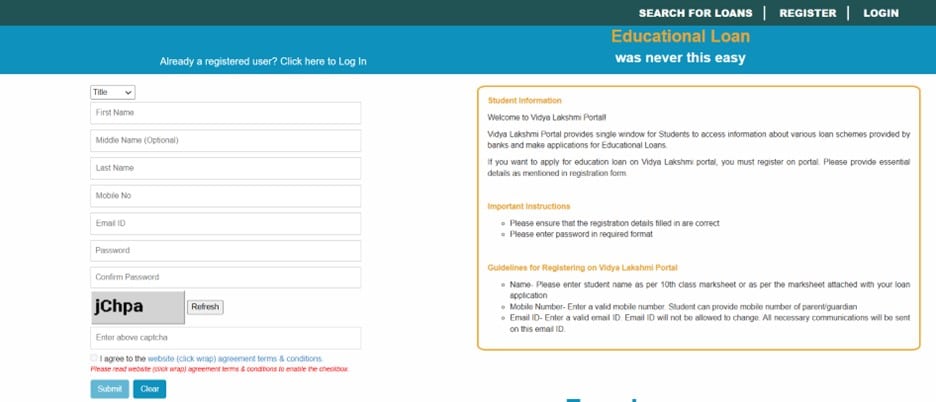

Step 5: Fill in the required details, enter the captcha, and click on the submit button to ‘Register’.

Step 6: After successful registration, apply for the HDFC student loan to study abroad.

Offline Process:

Step 1: Visit the official website of HDFC bank.

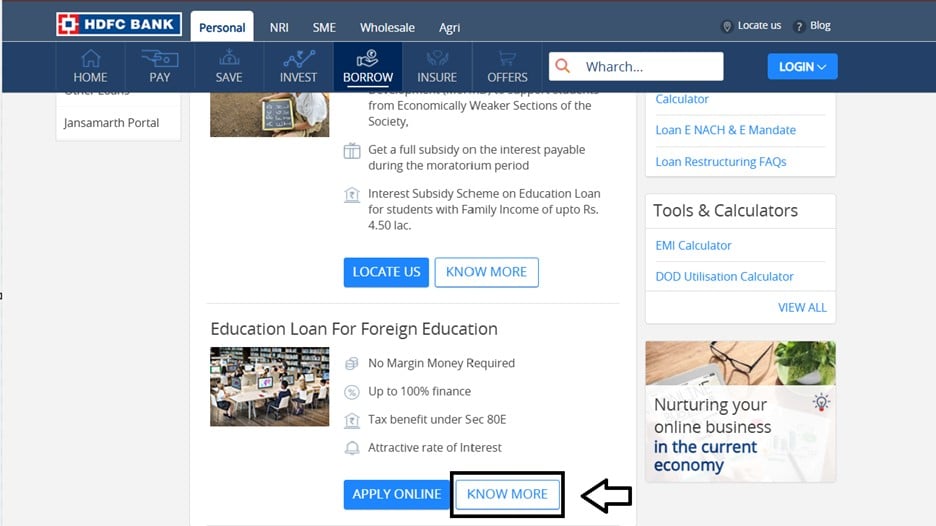

Step 2: Navigate to the ‘Education Loan for Foreign Education’ and click on the ‘Know More’ button.

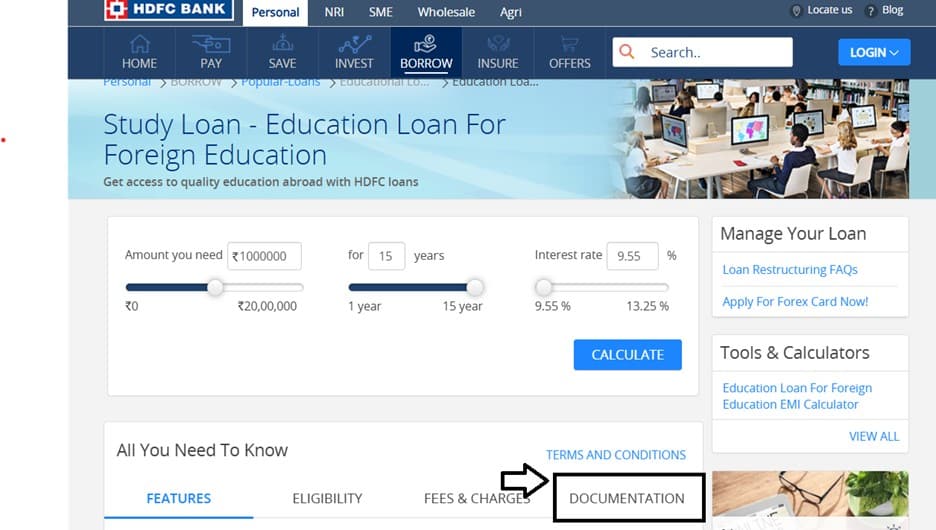

Step 3: Now, navigate to the ‘Documentation’ option at the right hand side of the dashboard.

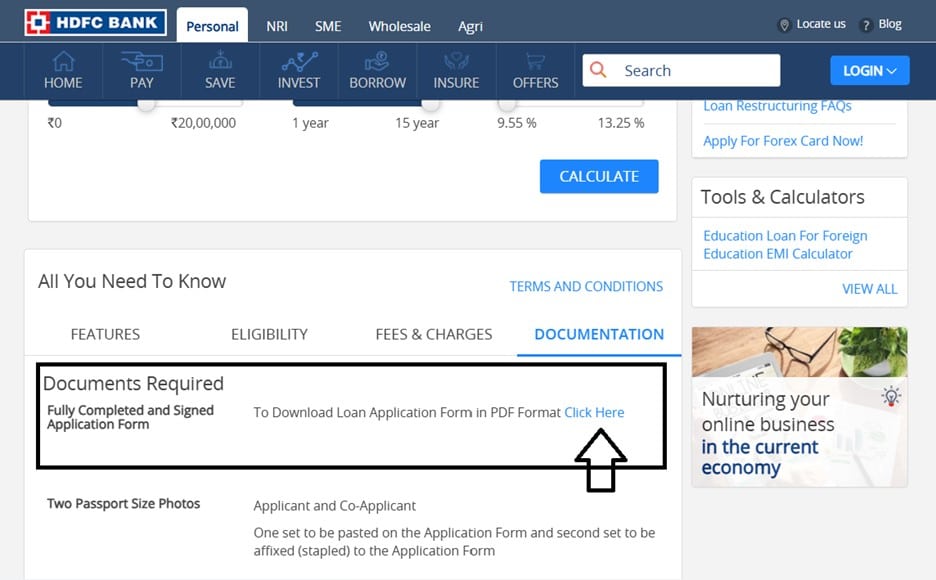

Step 4: Under the documentation section, click on the ‘Click Here’ button to download the HDFC Bank education loan for study abroad application form.

Step 5: After downloading the application form, fill in the application form, attach all the necessary documents and submit the application to the nearest HDFC Bank branch.

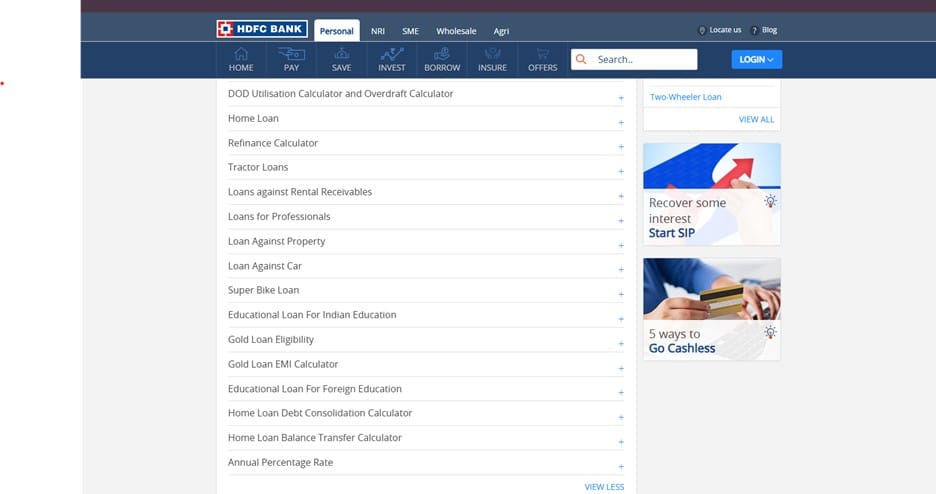

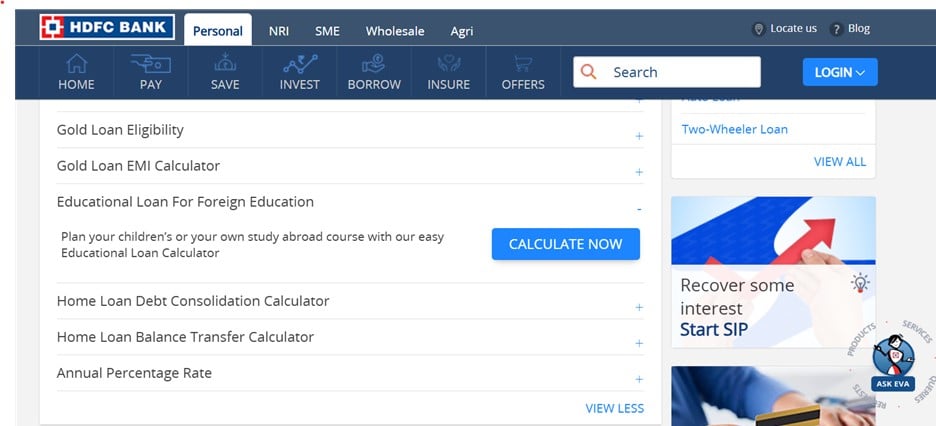

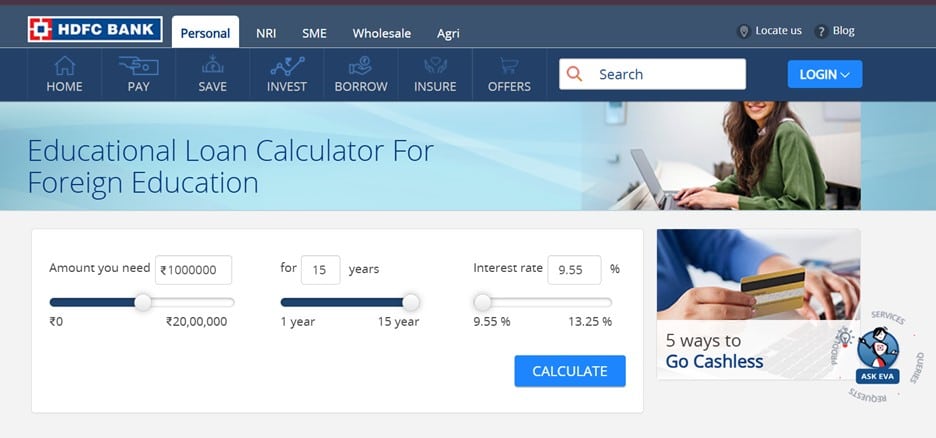

HDFC Bank Educational Loan Calculator For Foreign Education

By following the below steps students can easily take benefits of the the HDFC Bank education loan for study abroad:

Step 1: Go to the official website of the HDFC Bank (hdfcbank.com)

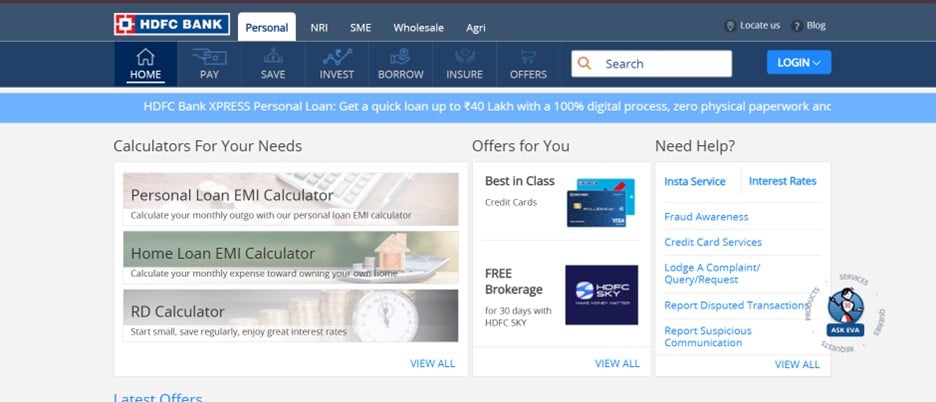

Step 2: Navigate to the ‘Calculators for you Need’ section at the left-hand side of the dashboard.

Step 3: Now, check for ‘Check for Educational Loan for Foreign Education’ and click on it.

Step 4: Click on the ‘Calculate Now’ button.

Step 5: Enter the loan amount, loan tenure, and interest rate to calculate the Study Abroad Education loan EMI amount.

Frequently Asked Questions (FAQs)

What is the maximum student loan amount I can avail for studying abroad under HDFC Bank student loan?

HDFC Bank offers education loans for studying abroad with a maximum limit that depends on the program and country. For premier institutions, higher loan amounts may be available without collateral.

What are the eligibility criteria for an HDFC Bank education loan for abroad studies?

Education loan applicants should be Indian citizens and have secured admission to a recognised course in a foreign institution. Co-applicant criteria and other requirements like income proof or collateral may also apply. Refer to above article for details.

What is the repayment period and when does the repayment start?

Repayment period starts after the moratorium period, which includes the study duration and a grace period, usually 6-12 months after course completion. The repayment tenure can go up to 15 years for a HDFC Bank education loan.

What expenses are covered under the HDFC Bank education loan for abroad?

HDFC Bank education loan covers tuition fees, travel expenses, exam fees, accommodation charges, and other related expenses like books, laptops, or living costs as specified by the institution.

Are there any tax benefits associated with HDFC Bank education loans for foreign studies?

Yes, under Section 80E of the Income Tax Act, the interest paid on an HDFC Bank student loan is eligible for tax deduction for up to 8 years. However, principal repayment is not eligible for any deduction.

2 thoughts on “HDFC Education Loan for Abroad – ROI, Interest Rates & Expenses Covered”

Comments are closed.