SBI education loan schemes are supporting students across the country with the impending cost of education. SBI has been offering various SBI education loan schemes for students as per their specific requirement. Whether you want to opt for a student loan, skill loan, scholar loan or a loan to study abroad, SBI education loans have got you covered on all fronts. With faster online application process, lighter and attractive interest rates, higher loan amounts, easier EMI options, early approvals, tax benefits and better repayment options, SBI education loans are the preferred choice for innumerable students in India.

The first step for you as a student is to identify the type of SBI education loan you require in order to pursue your academic journey. The bank offers a range of student loan schemes depending upon the requirement of the students such as SBI Student Loan Scheme, SBI Scholar Loan Scheme, SBI Skill Loan Scheme, SBI Global Ed-Vantage Scheme. To compare SBI education loan details as per their specific requirements and offerings, check the comparison table ‘SBI Education Loan – Eligibility, Courses, Rate of Interest, Repayment, Comparison’ given at the end of the article.

SBI Education Loan – Eligibility Criteria

SBI education loan eligibility criteria differ for each type of education loan offered by the bank. While being an Indian national and having secured admission at the university are the basic eligibility criteria, there are more conditions specific to the type of education loan you are opting for. Given below are the eligibility criteria for each type of SBI education loan:

1. SBI Student Loan Scheme Eligibility

SBI Student Loan Scheme is a term loan given to students of Indian nationality, looking to pursue higher education in India or abroad. The key eligibility criteria to apply for the loan is that the student must have secured admission before applying for the loan.

2. SBI Scholar Loan Scheme Eligibility

SBI Scholar Loan Scheme is open to students looking to pursue higher education in select premier institutions in India. You can check the list of approved institutions in the table ‘SBI Scholar Loan Scheme – List of Approved Institutions’ given at the end of the article.

3. SBI Skill Loan Scheme Eligibility

As the name suggests SBI Skill Loan Scheme is a term loan given to students with Indian nationality for pursuing skill development courses in India. Schools recognized by the Central or State education boards or colleges affiliated to recognised universities leading to a certificate/diploma/degree issued by such organization as per the National Skill Qualification Framework (NSQF) are eligible for this loan.

4. SBI Global Ed-Vantage Scheme Eligibility

An overseas education loan, SBI Global Ed-Vantage is open for Indian students looking to pursue full-time regular courses at foreign colleges and universities.

SBI Education Loan – Courses Covered

SBI education loan schemes vary in nature when it comes to the kind of courses covered. But all-in-all, from graduation courses to post-graduation courses, from teacher training to pilot training, and from polytechnic courses to global courses, SBI education loans cover most of the courses. Given below are the courses covered for each type of SBI education loan:

1. SBI Student Loan Scheme Courses

For studies in India:

- Graduation, post-graduation courses together with regular technical and professional degree/diploma courses conducted by colleges and universities approved by UGC/ AICTE/IMC/Government, etc.

- Regular degree/diploma courses conducted by self-directed institutions like IIT, IIM, etc.

- Teacher training/nursing courses approved by the Central or the State Government

- Regular degree/diploma courses such as pilot training, aeronautical, etc. approved by the concerned regulatory authority

For studies abroad:

- Professional/technical graduation degree courses/PG degree and diploma courses aligned towards a job offered by reputed universities

- Courses conducted by CIMA (Chartered Institute of Management Accountants) – London, CPA (Certified Public Accountant) in the US, etc.

2. SBI Scholar Loan Scheme Courses

Eligible courses for SBI Scholar Loan Scheme:

- Full-time degree/diploma courses (regular) through selection process/entrance test

- Full-time executive management courses like PGPX

Note: Students looking to pursue a certificate or part-time courses are eligible to apply.

3. SBI Skill Loan Scheme Courses

Eligible courses for SBI Skill Loan Scheme:

- Courses run by ITIs, polytechnics, training partners affiliated to National Skill Development Corporation (NSDC)/Sector Skill Councils, State Skill Mission, State Skill Corporation

Note: There is no minimum course duration.

4. SBI Global Ed-Vantage Scheme Courses

Eligible courses for SBI Global Ed-Vantage Scheme:

- Regular graduate/post graduate/doctorate courses in any discipline offered by foreign institutes/universities in the US, UK, Canada, Australia, Europe, Singapore, Japan, Hong Kong and New Zealand

SBI Education Loan – Expenses Covered

SBI education loans cover the expenses of your course and other related expenditure depending upon the type of loan you have opted for. Given below are the expenses covered for each type of SBI education loan:

1. SBI Student Loan Scheme Expenses Covered

Find below the list of the type of expenses covered under SBI Student Loan Scheme:

- Fees for college/school/hostel

- Fees for examination/library/laboratory

- Books/equipment/instruments/uniforms

- Computer necessary for completion of the course (maximum 20% of the total tuition fees payable for completion of the course)

- Building fund or caution/refundable deposit (at most 10% of tuition fees for the entire course)

- Travel expenses/passage money for studies abroad

- Cost of a two-wheeler up to ₹50,000

- Any other expenses compulsory to conclude the course

2. SBI Scholar Loan Scheme Expenses Covered

Find below the list of the type of expenses covered under SBI Scholar Loan Scheme:

- Fees for college/school/hostel

- Fees for examination/library/laboratory

- Books/equipment/instruments

- Caution deposit/building fund/refundable deposit supported by institution’s bills/receipts (maximum 10% of tuition fees for the entire course)

- Travel expenses/expenses on exchange programme (No voucher/receipt necessary; purpose (end use) need to be self-certified)

- Purchase of computer/laptop (maximum 20% of the total tuition fees payable for completion of the course – up to a lump sum amount of maximum ₹ 1 lacs)

- Any other expenses related to education (Expenditure beyond 25% cap allowed provided the student presents the voucher/receipt.)

3. SBI Skill Loan Scheme Expenses Considered

Find below the list of the type of expenses covered under SBI Skill Loan Scheme:

- Fees for tuition/course

- Fees for examination/library/laboratory

- Caution deposit

- Books, equipment and instruments

- Any other expenses compulsory to conclude the course

4. SBI Global Ed-Vantage Scheme Expenses Covered

Find below the list of the type of expenses covered under SBI Global Ed-Vantage Scheme:

- Fees for college/school/hostel

- Fees for examination/library/laboratory

- Travel expenses/passage money for studies abroad

- Books/equipment/instruments/uniforms/computer at a reasonable cost (if required for course completion) and any other expense necessary to complete the course (maximum 20% of the total tuition fees payable for completion of the course)

- Caution deposit/building fund/refundable deposit supported by institution’s bills/receipts (maximum 10% of tuition fees for the entire course)

- The premium of ‘RiNn Rakhsha’

SBI Education Loan – Loan Amount and Security

SBI education loans offer a handsome amount of loan even at the minimum level depending upon the eligibility and requirement. The kind of security, whether collateral security, third-party guarantee or co-borrower, also varies in different kinds of loans. Given below are the loan amounts and security required for each type of SBI education loan:

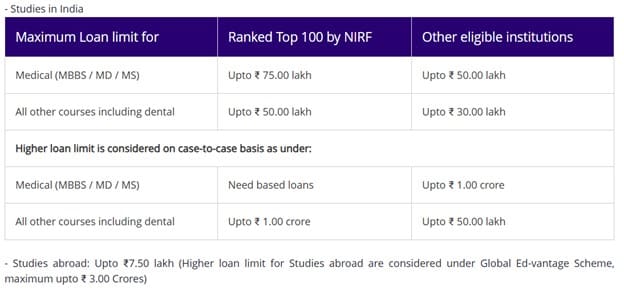

1. SBI Student Loan Scheme Amount and Security

Note: Higher loan limits for students opting to study in India are considered on a case-to-case basis, while higher loan limits for students opting to study abroad are considered under the SBI Global Ed-Vantage Scheme.

For loan amount up to ₹7.5 lacs does not require any collateral security or third-party guarantee. Only parent/guardian as co-borrower are considered. Tangible collateral security and parent(s)/guardian(s) as co-borrower are required for loan amount above ₹7.5 lacs.

Note: In case of a married person, a co-obligator can be either spouse or the parent(s)/parents-in-law.

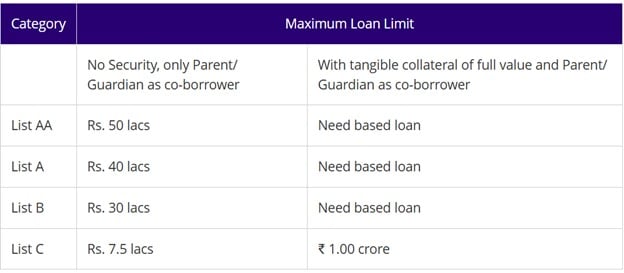

2. SBI Scholar Loan Scheme Amount and Security

3. SBI Skill Loan Scheme Amount and Security

SBI Skill Loan Scheme offers education loans between ₹5,000 and ₹1,50,000 without collateral or third-party guarantees, requiring parent/guardian and spouse (where applicable) to co-sign the loan agreement.

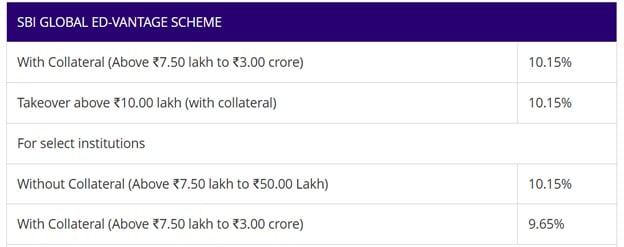

4. SBI Global Ed-Vantage Scheme Amount and Security

SBI Skill Loan Scheme offers education loans up to ₹3 crores, with select institutions offering collateral-free loans up to ₹50 lakhs, enabling convenient EMIs over 15 years, early loan disbursement, and tax benefits under section 80(E) for eligible expenses.

SBI Education Loan – Interest Rate

SBI education loan interest rates are known to be one of the most viable in the market with interest rates as low as 8.65% and special concession for girl students. Given below are the loan amounts and security required for each type of SBI education loan:

1. SBI Student Loan Scheme Interest Rates

2. SBI Scholar Loan Scheme Interest Rates

3. SBI Skill Loan Scheme Interest Rates

4. SBI Global Ed-Vantage Scheme Interest Rates

SBI Education Loan – Repayment Rules

SBI education loan repayment rules include repayment commencement a year after course completion and a repayment period as long as 15 years. Given below are the loan repayment terms for each type of SBI education loan:

1. SBI Student Loan Scheme Repayment terms

The repayment period begins 1 year after completion of the course and the loan is to be repaid in 15 years after the beginning of the repayment period.

Note: In case a second loan is availed for higher studies in the future, the combined loan amount is to be repaid in 15 years after completion of the second course.

2. SBI Scholar Loan Scheme Repayment Terms

The repayment period begins after the course completion + 12 months and the loan is to be repaid in 15 years.

Note: In case a second loan is availed for higher studies in the future, the combined loan amount is to be repaid in 15 years after completion of the second course.

3. SBI Skill Loan Scheme Repayment Terms

Loans up to ₹50,000 can be repaid in up to 3 years, loans between ₹50,000 to ₹1 lacs can be repaid in up to 5 years, and loans above ₹1 lacs can be repaid in up to 7 years.

4. SBI Global Ed-Vantage Scheme Repayment Terms

The repayment period begins 6 months after the course completion and the loan is to be repaid in 15 years.

Education Loan – Everything You Need to Know

SBI Education Loan – Documents Required

The documents required for SBI education loan schemes also vary depending upon the type of loan you opt for. While most of the documents are the same, you must still make a checklist of the documents required for your education loan. To make your work easier, given below is the documents checklist for each type of SBI education loan:

Documents checklist for SBI Student Loan Scheme, SBI Scholar Loan Scheme and SBI Global Ed-vantage Scheme

For student-applicant:

- Duly-filled loan form

- Any one proof of identity: PAN/Passport/Driver’s License/Voter ID card

- Any one proof of residence: Recent copy of Telephone Bill/Electricity Bill/Water Bill/Piped Gas Bill or copy of Passport/Driving License/Aadhaar Card

- Passport (mandatorily in case of studies abroad)

- Academic Records: 10th result, 12th result, graduation result, entrance exam result through which admission is being taken

- Proof of admission: Offer letter/admission letter from the institution

- Statement of cost of study or schedule of expenses

- 2 passport-size photographs

- Loan A/C statement for last 1 year in case of any previous loan from other banks/lenders

For co-applicant:

- Any one proof of identity: PAN/Passport/Driver’s License/Voter ID card

- Any one proof of residence: Recent copy of Telephone Bill/Electricity Bill/Water Bill/Piped Gas Bill or copy of Passport/Driving License/Aadhaar Card

- 2 passport-size photographs

- Loan A/C statement for last 1 year in case of any previous loan from other banks/lenders

Note:

- Income proof for salaried co-applicant/guarantor include salary slips of last 3 months, copy of Form 16 for last 2 years/copy of IT Returns for last 2 financial years acknowledged by IT department, and bank account statement for last 6 months

- Income proof for self-employed co-applicant/guarantor include business address proof (if applicable), IT returns for last 2 years (if IT payee), TDS Certificate (Form 16A, if applicable), certificate of qualification (Chartered Accountants/Doctors and other professions), and bank account statement for last 6 months

- All documents should be self-attested

SBI Skill Loan Scheme documents

- Duly-filled loan form

- Marksheets of last qualifying examination

- Proof of admission scholarship, studentship, etc.

- Schedule of expenses for the specified course

- 2 passport size photographs

- Student’s and the parent/guardian/spouse’s PAN Card

- Student’s and the parent/guardian/spouse’s AADHAAR card

- Borrower’s bank account statement for last six months

- Co-borrower’s ITR/IT assessment order for last 2 years (if applicable)

- Co-borrower’s brief statement of assets and liabilities

- Proof of Income (salary slips/Form 16), if applicable

SBI Education Loan – Eligibility, Courses, Rate of Interest, Repayment, Comparison

SBI education loans come in four different categories and the table below will help you compare your choices and choose the best one.

| Feature | SBI Student Loan Scheme | SBI Scholar Loan Scheme | SBI Skill Loan Scheme | SBI Global Ed-Vantage Scheme |

| Eligibility | Indian nationals who have secured admission to higher education courses in India or abroad. | Students admitted to select premier institutions in India through entrance tests or selection processes. | Indian nationals pursuing skill development courses in India. | Indian nationals who have secured admission to regular full-time courses at foreign universities in specified countries. |

| Courses Covered | Graduation, post-graduation, and professional courses approved by UGC/AICTE/Government bodies in India. | Job-oriented professional/technical courses abroad. Full-time degree/diploma courses through entrance tests/selection processes. Full-time executive management courses like PGPX. | Courses run by ITIs, polytechnics, and training partners affiliated with NSDC/Sector Skill Councils, leading to certificates/diplomas/degrees as per the National Skill Qualification Framework (NSQF). | Regular graduate, post-graduate, and doctorate courses in any discipline offered by reputed universities in the USA, UK, Canada, Australia, Europe, Singapore, Japan, Hong Kong, and New Zealand. |

| Loan Amount | Up to ₹10 lakh for studies in India. Up to ₹20 lakh for studies abroad. Higher amounts considered on a case-to-case basis. | Up to ₹50 lakh for List AA institutions. Up to ₹40 lakh for List A institutions. Up to ₹30 lakh for List B institutions. Up to ₹7.5 lakh for List C institutions (up to ₹1 crore with collateral). | Minimum: ₹5,000. Maximum: ₹1.5 lakh. | Minimum: ₹20 lakh. Maximum: ₹1.5 crore. |

| Repayment Period | Up to 15 years after course completion, including a 12-month repayment holiday. | Up to 15 years after course completion, including a 12-month repayment holiday. | Loans up to ₹50,000: Up to 3 years. Loans between ₹50,000 and ₹1 lakh: Up to 5 years. Loans above ₹1 lakh: Up to 7 years. | Up to 15 years after course completion, including a 6-month repayment holiday. |

| Processing Fees | Loans up to ₹20 lakh: Nil. Loans above ₹20 lakh: ₹10,000 plus taxes. | No processing fees. | No processing fees. | ₹10,000 plus taxes. |

| Security Requirements | Up to ₹7.5 lakh: Parent/guardian as co-borrower; no collateral. Above ₹7.5 lakh: Parent/guardian as co-borrower and tangible collateral security. | Varies by institution category: List AA and A: No security; parent/guardian as co-borrower. List B and C: Parent/guardian as co-borrower; tangible collateral security required for higher loan amounts. | Parent/guardian as co-borrower; no collateral or third-party guarantee required. | Parent/guardian as co-borrower; tangible collateral security required. |

| Margin | Up to ₹4 lakh: NIL. Above ₹4 lakh: 5% for studies in India; 15% for studies abroad. | Nil for all loan amounts. | Nil for all loan amounts. | 10% for all loan amounts. |

SBI Scholar Loan Scheme – List of Approved Institutions

SBI Scholar Loan Scheme can only be opted by students who are looking to pursue higher education in select premier institutions in India. Given below are the list of premier institutions covered under this scheme.

1. List AA Institutions

- Indian Institute of Management (IIM), Ahmedabad

- Indian Institute of Management (IIM), Bangalore

- Indian Institute of Management (IIM), Calcutta

- Indian Institute of Management (IIM), Indore

- Indian Institute of Management (IIM), Indore- Mumbai Campus

- Indian Institute of Management (IIM), Kozhikode

- Indian Institute of Management (IIM), Lucknow

- Indian Institute of Management (IIM), Lucknow- Noida Campus

- Indian School of Business (ISB), Hyderabad

- Indian School of Business (ISB), Mohali

- Xavier Labour Relations Institute (XLRI), Jamshedpur

2. List A Institutions

- Birla Institute of Technology & Sciences (BITS), Pilani

- BITS (Pilani) – Goa Campus

- BITS (Pilani) – Hyderabad Campus

- Indian Institute of Foreign Trade (IIFT), Delhi

- Indian Institute of Foreign Trade (IIFT), Kolkata

- Indian Institute of Management (IIM), Amritsar

- Indian Institute of Management (IIM), Bodhgaya

- Indian Institute of Management (IIM), Jammu

- Indian Institute of Management (IIM), Kashipur

- Indian Institute of Management (IIM), Nagpur

- Indian Institute of Management (IIM), Raipur

- Indian Institute of Management (IIM), Ranchi

- Indian Institute of Management (IIM), Rohtak

- Indian Institute of Management (IIM), Sambalpur

- Indian Institute of Management (IIM), Shillong

- Indian Institute of Management (IIM), Sirmaur

- Indian Institute of Management (IIM), Trichy

- Indian Institute of Management (IIM), Udaipur

- Indian Institute of Management (IIM), Visakhapatnam

- Indian Institute of Technology (IIT), Bhilai

- Indian Institute of Technology (IIT), Bhubaneshwar

- Indian Institute of Technology (IIT), Chennai

- Indian Institute of Technology (IIT), Delhi

- Dept of Management Studies, IIT Delhi

- Indian Institute of Technology (IIT), Dharwad

- Indian Institute of Technology (IIT), Gandhinagar

- Indian Institute of Technology (IIT), Goa

- Indian Institute of Technology (IIT), Guwahati

- Indian Institute of Technology (IIT), Hyderabad

- Indian Institute of Technology (IIT), Indore

- Indian Institute of Technology (IIT), Jammu

- Indian Institute of Technology (IIT), Jodhpur

- Indian Institute of Technology (IIT), Kanpur

- Department of Industrial & Management Engineering, IIT Kanpur

- Indian Institute of Technology (IIT), Kharagpur

- Indian Institute of Technology (IIT), Mandi

- Indian Institute of Technology (IIT), Mumbai

- Indian Institute of Technology (IIT), Palakkad

- Indian Institute of Technology (IIT), Patna

- Indian Institute of Technology (IIT), Roorkee

- Indian Institute of Technology (IIT), Rupnagar (Ropar)

- Indian Institute of Technology (IIT), Tirupati

- Indian Institute of Technology (IIT), Varanasi

- Indian School of Mining (ISM), Dhanbad

- Institute of Management Technology (IMT), Ghaziabad

- Kasturba Medical College (KMC), Mangalore

- Management Development Institute (MDI), Gurgaon

- Management Development Institute (MDI), Murshidabad

- National Institute of Industrial Engineering (NITIE), Mumbai

- Nirma Institute of Management, Ahmedabad

- S P Jain Institute of Management and Research (SPJIMR), Mumbai

- Shailesh J. Mehta School of Management (SJSOM), IIT Mumbai

- Symbiosis Centre for Management & HRD (SCMHRD), Pune

- Symbiosis Institute of Business Management (SIBM), Pune

- T. A. Pai Management Institute (TAPMI), Manipal

- Xavier Institute of Management (XIM), XUB-Bhubaneswar

- Xavier School of Human Resource Management (XSHRM), XUB-Bhubaneswar

- Xavier School of Rural Management (XSRM), XUB-Bhubaneswar

3. List B Institutions

- Army College of Dental Sciences (ACDS), Secunderabad

- Army College of Medical Sciences (ACMS), Delhi

- Army Institute of Law (AIL), Mohali

- Army Institute of Management (AIM), Kolkata

- Army Institute of Technology (AIT), Pune

- Bharathidasan Institute of Management (BIM), Tiruchirapalli

- Birla Institute of Technology (BIT), Mesra, Ranchi

- College of Engineering, Pune

- Delhi College of Engineering (DCE), Delhi

- Dhirubhai Ambani Institute of Information & Communication Technology (DAIICT), Gandhinagar

- Faculty of Engineering & Technology, Jadavpur University, Kolkata

- Faculty of Management Studies (FMS), Delhi

- Goa Institute of Management (GIM), Goa

- Indian Institute of Science (IISc), Bangalore

- Indraprastha Institute of Information Technology (IIIT), Delhi

- International Management Institute (IMI), Kolkata

- International Management Institute (IMI), New Delhi

- Jamnalal Bajaj Institute of Management Studies (JBIMS), Mumbai

- Kasturba Medical College (KMC), Manipal

- Kirloskar Institute of Advanced Management Studies (KIAMS), Bangalore

- Manipal Institute of Technology (MIT), Manipal

- Marine Engineering & Research Institute, Kolkata

- Mudra Institute of Communication (MICA), Ahmedabad

- Narsee Monjee Institute of Management Studies (NMIMS), Mumbai

- National Institute of Technology (NIT), Surathkal

- National Institute of Technology (NIT), Tiruchirapalli

- National Law School of India University (NLSIU), Bangalore

- National Law University (NLU), Jodhpur

- Prin. L. N. Welingkar Institute of Management, Development & Research (WeSchool), Mumbai

- Visvesvaraya National Institute of Technology (VNIT), Nagpur

4. List C Institutions

- Centre for Environmental Planning & Technology (CEPT), Ahmedabad

- Chandragupt Institute of Management, Patna

- Dr. B R Ambedkar National Institute of Technology (NIT), Jalandhar

- Indian Institute of Forest Management (IIFM), Bhopal

- Indian Institute of Petroleum and Energy (IIPE), Vishakhapatnam

- International Institute of Information Technology (IIIT), Hyderabad

- Kalinga Institute of Industrial Technology (KIIT) University School of Management (SOM)

- Kalinga Institute of Industrial Technology (KIIT) University School of Technology (SOT)

- L N Mittal Institute of Information & Technology (LNMIIT), Jaipur

- Loyola Institute of Business Administration (LIBA), Chennai

- Maharishi Markandeshwar University (MMU) Medical College, Haryana

- Malaviya National Institute of Technology (NIT), Jaipur

- Maulana Azad National Institute of Technology (NIT), Bhopal

- Motilal Nehru National Institute of Technology (NIT), Allahabad

- National Institute of Construction Management & Research (NICMAR), Pune

- National Institute of Food Technology Entrepreneurship and Management (NIFTEM), Sonepat

- National Institute of Technology (NIT), Agartala

- National Institute of Technology (NIT), Arunachal Pradesh

- National Institute of Technology (NIT), Calicut

- National Institute of Technology (NIT), Delhi

- National Institute of Technology (NIT), Durgapur

- National Institute of Technology (NIT), Goa

- National Institute of Technology (NIT), Hamirpur

- National Institute of Technology (NIT), Jamshedpur

- National Institute of Technology (NIT), Kurukshetra

- National Institute of Technology (NIT), Manipur

- National Institute of Technology (NIT), Meghalaya

- National Institute of Technology (NIT), Mizoram

- National Institute of Technology (NIT), Nagaland

- National Institute of Technology (NIT), Patna

- National Institute of Technology (NIT), Puducherry

- National Institute of Technology (NIT), Raipur

- National Institute of Technology (NIT), Rourkela

- National Institute of Technology (NIT), Sikkim

- National Institute of Technology (NIT), Silchar

- National Institute of Technology (NIT), Srinagar

- National Institute of Technology (NIT), Tadepalligudem

- National Institute of Technology (NIT), Uttarakhand

- National Institute of Technology (NIT), Warangal

- National University of Juridical Sciences (NUJS), Kolkata

- Netaji Subash Institute of Technology (NSIT), Delhi

- Sardar Vallabh Bhai National Institute of Technology (NIT), Surat

- School of Planning & Architecture, New Delhi

- Thapar University, Patiala

- University College of Engineering (UCE), Odisha

- Xavier Center For Urban Management and Governance (XUMG) [Post Graduate Programme in Urban Management and Governance (MBAUMG)]

- Xavier School of Commerce (XSC) [Master of Business Finance (MBF)]

- Xavier School of Sustainability (XSOS) [Post Graduate Programme in Sustainability Management (MBA-SM)]

SBI Education Loan – FAQs

Indian nationals who have secured admission to recognized colleges/institutions in India or abroad for various courses are eligible.

Undergraduate, postgraduate, professional, and vocational courses in India and abroad are generally eligible for SBI Education Loan Scheme.

Tuition fees, examination fees, hostel charges, cost of books, equipment, and other necessary expenses for the course are covered.

For loans up to a certain amount, no collateral may be required. However, for higher loan amounts, collateral or a third-party guarantee might be necessary.

The repayment period for SBI Education Loan typically starts after the course is completed, and it can extend up to 15 years, depending on the loan amount. Refer to the above article for detailed information.

Yes, SBI offers online application facilities for education loans through their official website. Who is eligible for an SBI Education Loan?

What courses are eligible for an SBI Education Loan?

What expenses are covered under the SBI Education Loan?

Is collateral required for the SBI Education Loan?

What is the repayment period for the loan?

Can onr apply for an SBI Education Loan online?

3 thoughts on “SBI Education Loan – All You Need to Know”

Comments are closed.