Higher education is a gateway to better opportunities, personal growth, and career advancement. However, the education cost often forces students to look for financial help in the form of education loans. While this source provides immediate relief, but these interest rates become a burden on the shoulders.

Student loan interest rates vary based on factors such as the lending institution, loan type, and repayment terms. High-interest rates can create financial stress, leading students to make difficult choices such as opting for part-time jobs, compromising on educational resources, or even reconsidering their preferred institutions. On the other hand, student loans with lower interest can ease the financial burden so that students can focus on their studies stress-free.

Understanding how education loan interest rates impact students’ decisions, financial stability, and career choices is essential for both aspiring students and their families. This article explores the significance of loan interest rates, their long-term implications, and strategies to manage education loans effectively.

Understanding ICICI Bank’s Education Loan Interest Rates

ICICI Bank’s education loan interest rates are structured to be competitive and are linked to the prevailing Repo Rate to ensure transparency and alignment with market conditions. As of January 2025, the interest rates start from [Repo Rate + 3.75% (Spread)] onwards. Given that the current Repo Rate is 6.5%, the effective starting interest rate would be approximately 10.25% per annum.

It’s important to note that these rates are subject to change based on fluctuations in the Repo Rate and the bank’s policies.

Factors Influencing ICICI Bank Education Loan Interest Rates

There are several factors that may influence the interest rates on education loan offered by ICICI Bank:

- Academic Record: A strong academic background may qualify borrowers for more favorable interest rates.

- Co-applicant’s Financial Profile: The income and creditworthiness of the co-applicant can impact the interest rate.

- Collateral: If a student provides collateral for education loans,it can often result in lower interest rates due to reduced risk for the bank.

- Institute and Course: Loans for recognised institutions and courses with high employability prospects may attract lower interest rates.

ICICI Bank Education Loan Interest Rates

The below table enlists the details pertaining to the ICICI Bank education loan interest rates:

| Feature | Details |

| Interest Rates | Starting from Repo Rate* + 3.75% (Spread) onwards |

| Loan Tenure |

|

| Maximum Loan Amount |

|

| Collateral Requirement | Fixed Deposit, Fresh Property, and Cross-collateralisation with existing Mortgage Loans |

| Unsecured Loan | Only for premium institutes: Up to ₹1 crore for both undergraduate and postgraduate courses |

| Moratorium Period | Course period + up to 12 months grace period |

| Margin | No margin for premier institutes

15% margin for institutes in other categories Margin can be FD/Scholarship/Initial fee paid to the institute |

*Interest rates are subject to the prevailing Repo Rate.

Moratorium availability depends on the Bank’s policy and may not apply to all loans.

Interest rate range for ICICI Bank student loan for the period between July 2024 and Sept 2024:

Note:

Mean rate = Sum of the rate of interest for all loans/Total number of loans

ICICI Bank Education Loan Fees and Service Charges

ICICI Bank offers education loans designed to help students achieve their academic goals with financial ease. While these loans serve as a significant support for tuition fees, living expenses, and other educational costs, they also come with specific fees and service charges. Understanding these charges such as processing fees, prepayment penalties, late payment fees, and interest rates is very important for borrowers to make informed financial decisions.

| Description of Charges | Charges Applicable |

| Service Charges | |

| Loan Processing Fee (Non-refundable) | Up to 2% of the loan amount |

| CERSAI charges (Non-refundable) | ₹100 |

| Administrative Charges (One-time, non-refundable) | ₹5000 or 0.25% of the loan amount, whichever is lower

(For appraising valuation and legal verification, independent of appraisal outcome) |

| Repayment Mode Swap Charges | ₹500 |

| Statement of Account (Printout at Branch) | ₹200 |

| Amortisation Schedule | ₹200 for printout, NIL for online |

| Prepayment/Foreclosure Statement (Printout at Branch) | ₹200 |

| Duplicate No Objection Certificate (NOC) | ₹250 |

| Revalidation of NOC | ₹250 |

| Cash Transaction Charges (EMI payment in cash at Branch) | ₹100 |

| Loan/Property Document Retrieval Charges | ₹500 |

| Loan Cancellation Charges |

|

| Conversion Charges (Floating to Fixed/Fixed to Floating) |

|

| Prepayment Charges |

|

| Penal Charges | |

| Default/Delay in Payment/Repayment | 5% per annum on overdue sum |

| Dishonour of Cheque/Default of Auto Debit/ECS/NACH | ₹500 per transaction |

| Non-Maintenance of Mode of Payment (NMMP) | ₹800 |

| Loan Related Recovery Charges (If Applicable) | |

| SARFAESI Proceedings | At Actuals |

| Sending Notices | At Actuals |

| Enforcement Charges | At Actuals |

| Paper Advertisement Charges | At Actuals |

| Repossession Charges | At Actuals |

| Security Guard Charges | At Actuals |

In addition to the fees listed above, applicants will be charged the current Goods and Services Tax (GST) and any other applicable government taxes and levies. These fees are subject to change.

If the loan is secured, applicants will also be responsible for paying the stamp duty on the loan and security documents, as determined by the laws of the state.

Also Read: HDFC Education Loan Interest Rate – Eligibility, ROI & Features

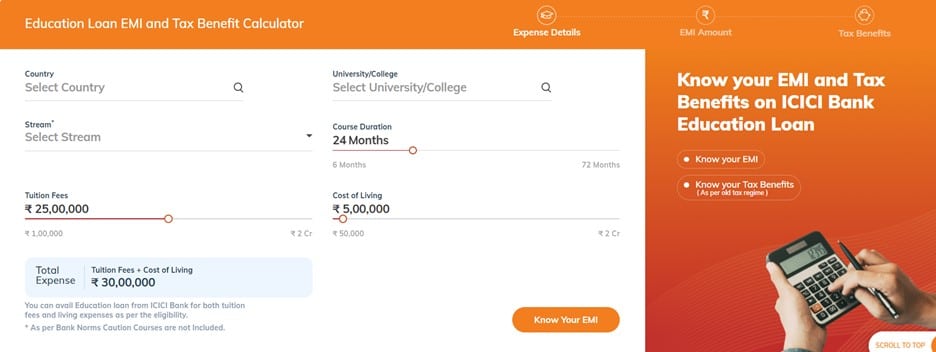

ICICI Bank Education Loan EMI and Tax Benefit Calculator

ICICI Education Loan EMI and Tax Benefit Calculator is a tool designed to help borrowers estimate their monthly loan repayments (Equated Monthly Installments – EMI) and assess the potential tax benefits they can claim under Section 80E of the Income Tax Act, 1961. Students who fulfill the eligibility criteria of an education loan can easily apply for it and avail the tax benefits.

How it works:

Enter the loan amount, loan tenure you wish to repay your loan. This period will represent the timeframe of the Equated Monthly Instalments (EMIs). If you opt for a longer tenure, it will reduce the education loan EMI amount, while a shorter tenure will increase it. And lastly, enter the preferred interest rate to accurately compute your repayment plan and click on “Know your EMI”.

Also Read: SBI Education Loan Interest Rates – Schemes, MCLR Rates and Repayment Terms

Frequently Asked Questions (FAQs)

How much tax can I save on an education loan?

Education loan tax benefits vary by country. To estimate your potential tax savings, use ICICI Bank student loan tax benefit calculator or an education loan tax benefit calculator to calculate your tax benefits on an education loan.

Is ICICI Bank education loan interest free?

No, ICICI bank education loans involve interest, but with careful planning, the cost is manageable. You can use an ICICI bank education loan interest calculator to project your repayment amount. ICICI Bank helps make this easier with competitive interest rates for both domestic and international education.

How does interest rate work for an ICICI bank education loan?

ICICI Bank makes higher education more accessible with competitive, repo-rate-linked education loan interest rates, starting at Repo + 3.75%. Flexible tenures and attractive terms offered by the ICICI bank may help you finance your education without compromising on quality.

What factors determine the EMI for an ICICI bank education loan?

The amount of the Equated Monthly Instalment (EMI) for your ICICI bank student loan is determined by several factors which includes the interest rate, loan amount and the duration of repayment.

Are there any tax benefits that can be availed on a student loan offered by ICICI Bank?

Yes, with an ICICI bank student loan, you can avail tax benefits under Section 80E of the Income Tax Act, 1961 under the old tax regime. A borrower can take benefits such as interest deduction on the loan repayment, reducing the taxable income. Such provisions or initiatives encourage investment in education, easing financial burdens for students and their families.

What is the maximum loan amount available for an ICICI Bank education loan?

CICI Bank education loans offer flexible financing options to support the academic pursuits of students who want to pursue higher studies. For courses within India, you can borrow up to ₹1 crore and for study abroad, the loan amount can go up to ₹3 crore. The repayment of student loan is structured with a grace period of up to 12 months after the course completion.

Can I get an education loan of ₹20 lakh without collateral?

Yes, ICICI Bank offers unsecured education loans up to ₹20 lakh, subject to its policies. For premium institutes, the loan amount being offered by the bank is up to ₹1 crore.

What is the ICICI Bank education loan interest rate?

The interest rate range for ICICI Bank education loans (iSMART) is between 9.50% and 14.25% per annum. The mean interest rate is 11.88% per annum. These rates are subject to change and may vary based on individual loan profiles, the course of study, and other factors. It is advised to visit the official website for the latest information.