The State Bank of India (SBI) has been a trusted partner in empowering students by offering accessible and affordable student loan options. And one of the critical elements of these education loans is interest rates, which plays an important role in determining the overall education expenses and the ease of repayment of the education loans.

With competitive rates customized to meet diverse academic goals of students, the State Bank of India always ensures that students can easily focus on learning rather than worrying about finances. Whether it is about pursuing studies at a top-tier Indian institute or a global university, SBI education loan interest rates provide the balance between affordability and opportunity that aids to turn dreams into realities.

State Bank of India as a renowned for its customer-centric approach, offers competitive interest rates, making quality education accessible without undue financial strain. SBI education loans stand out for their competitive offerings, flexible repayment options, and tailored schemes for both domestic and international student loan schemes such as SBI Global Ed-Vantage Scheme, SBI Scholar Loan Scheme, etc. These loans cater to the diverse needs of students who aim to study in India or abroad.

Students can easily make the EMI calculation and overall repayment cost by understanding the rate of interest on various education loan schemes offered by the State Bank of India. By effective planning, you can enjoy a hassle-free educational journey and focus on learning while educational expenses take a backseat.

SBI Education Loan Interest Rates

We have compiled the details of SBI education loan interest rates for all five education loans offered by the bank – SBI Student Loan Scheme, SBI Scholar Loan Scheme, SBI Skill Loan Scheme, SBI Global Ed-Vantage Scheme and Shaurya Education Loan.

SBI Student Loan Scheme Interest Rates

Under the SBI Student Loan Scheme, the interest rate for loans without collateral up to ₹7.50 lakh is 11.15%, while interest rates for student loans above ₹7.50 lakh with collateral is 10.15%. Additionally, loans exceeding ₹10 lakh for takeovers (with collateral) offer education loan at 10.15% interest rate. Female students will receive a further 0.50% concession on these rates, making higher education more accessible and affordable for all.

SBI Scholar Loan Scheme Interest Rates

Under the SBI Scholar Loan Scheme, the student loans are offered at interest rates between 8.15% and 8.90% for selected institutions.

SBI Skill Loan Scheme Interest Rate

Under the SBI Skill Loan Scheme, 10.65% interest rate is offered for loan amounts up to ₹1,50,000.

SBI Global Ed-Vantage Scheme Interest Rates

Under the SBI Global Ed-Vantage Scheme, educational loans exceeding ₹7.50 lakh are offered at an interest rate of 10.15%. It applies to loans with collateral up to ₹3.00 crore and takeover loans above ₹10.00 lakh. However, for selected institutions loans with collateral exceeding ₹7.50 lakh,interest rate is 9.65% and loans without collateral exceeding ₹7.50 lakh and up to ₹50.00 lakh are offered at an interest rate of 10.15%.

Shaurya Education Loan (For spouse/wards of Defence, Indian Coast Guard & Central Armed Police Personnel including takeover Loan above ₹ 10 lakh)

Under Shaurya Education Loan scheme, student loans without collateral up to ₹40.00 lakh are offered at an interest rate ranging from 10.65% to 11.15%. On the other hand, loans with collateral exceeding ₹7.50 lakh and up to ₹1.50 crore are offered at 10.15%. Additionally, female students are eligible for a 0.50% interest rate concession on these loans.

Also Read: SBI Education Loan – All You Need to Know

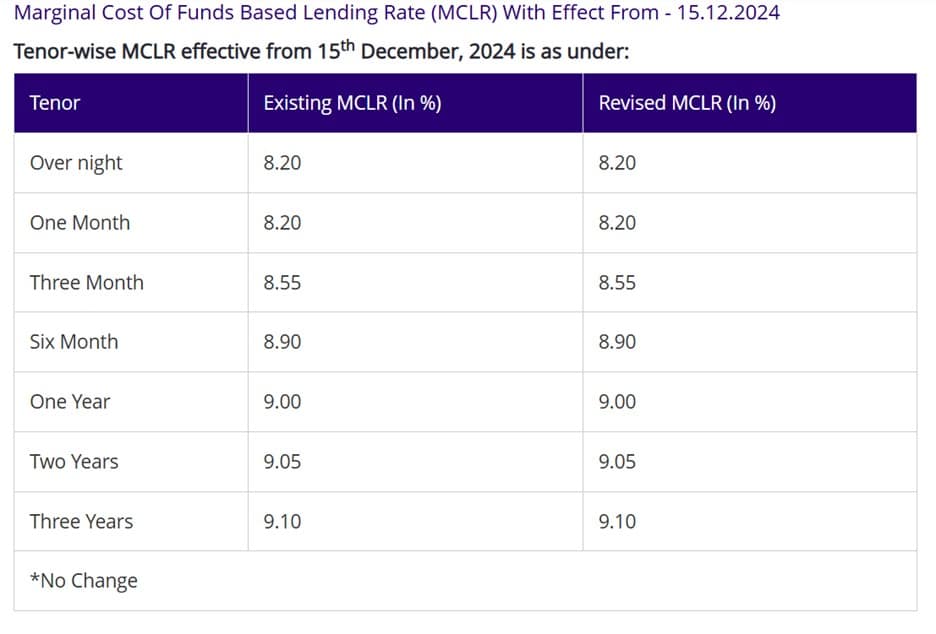

SBI Education Loan MCLR Rates

State Bank of India (SBI) offers education loans at competitive interest rates linked to its Marginal Cost of Funds-based Lending Rate (MCLR). These rates vary depending on the loan tenure and are tailored to make higher education more affordable and accessible to the students who are studying in India and abroad. Below table shows the current SBI education loan MCLR rates:

SBI Education Loan Repayment Terms

The State Bank of India (SBI) Student Loans, repayment begins after the course and moratorium periods. The repayment starts either one year after course completion or six months after securing a job, whichever comes earlier. SBI education loans are sanctioned as Term Loans. They must be repaid through Equated Monthly Installments (EMIs) over a maximum tenure of 15 years i.e. 180 EMIs.

For Student and Scholar Loan Schemes, the repayment in EMIs begins 12 months after course completion or 6 months after obtaining a job, whichever is earlier. However, for Global Ed-Vantage Loans, EMI repayment starts 6 months after course completion.

The interest accrued during the course and moratorium periods is added to the principal amount, and the repayment is structured in decent EMIs. If the full interest is paid during this period, the EMI calculated will be based on the principal amount merely.

There are no penalty charges for prepayment of the SBI student loans. Students can also prepay their education loan at any time without incurring additional fees.

SBI Education Loan Interest Rates – FAQs

What are the interest rates under the SBI Student Loan Scheme?

The interest rate for student loans without collateral up to ₹7.50 lakh is 11.15%. For education loans above ₹7.50 lakh with collateral, the interest rate is 10.15%. Female students receive a 0.50% concession on these rates.

What is the interest rate range under the SBI Scholar Loan Scheme?

The SBI Scholar Loan Scheme offers student loans at interest rates ranging from 8.15% to 8.90% for students who have secured admission to the selected institutions.

What are the interest rates under the SBI Skill Loan Scheme?

Under the SBI Skill Loan Scheme, an interest rate of 10.65% is offered for loan amounts up to ₹1.50 lakh.

What is the interest rate for the SBI Global Ed-Vantage Scheme?

For education loans exceeding ₹7.50 lakh, the interest rate is 10.15%. For selected institutions, student loans with collateral exceeding ₹7.50 lakh are offered at 9.65%. Student loans without collateral up to ₹50 lakh are offered at an interest rate of 10.15%.

What is the minimum and maximum loan amount under the SBI Global Ed-Vantage Scheme?

The minimum loan amount offered under SBI Global Ed-Vantage Scheme is ₹20 lakh, and the maximum is ₹1.5 crore. For student loans with collateral, the loan amount limit is up to ₹3 crore.

What are the interest rates under the SBI Shaurya Education Loan Scheme?

Student loans without collateral up to ₹40 lakh have an interest rate ranging from 10.65% to 11.15%. Education loans with collateral above ₹7.50 lakh and up to ₹1.50 crore are offered at interest rates at 10.15%. Female students will receive a concession of 0.50%.

Are there any benefits for female students across SBI education loan schemes?

Yes, female students will receive a concession of 0.50% on the applicable interest rates under all SBI education loan schemes.

Can loans under SBI Education Loan Schemes cover high-value amounts?

Yes, schemes like SBI Global Ed-Vantage allow loans up to ₹1.5 crore or ₹3 crore with collateral. Loans for takeover purposes exceeding ₹10 lakh are also available under various schemes offered by the State Bank of India (SBI).

Are collateral-free loans available under SBI Education Loan Schemes?

Yes, student loans without collateral are available under schemes like SBI Student Loan Scheme (up to ₹7.50 lakh), SBI Shaurya Education Loan Scheme (up to ₹40 lakh), and SBI Global Ed-Vantage Scheme (up to ₹50 lakh for selected institutions).

Are interest rate concessions applicable for specific groups?

Yes, apart from concessions for female students, Shaurya Education Loan Scheme offers benefits for the spouse/wards of Defence, Indian Coast Guard, and CAPF personnel.