Education is one of the most valuable investments a person can make. However, with the rising costs of higher education, especially abroad, many students and families turn to education loans to eliminate that financial gap. HDFC Bank, one of India’s leading private sector banks, offers education loans tailored to meet the needs of aspiring students who wish to pursue a higher degree in India or abroad.

This article explores the HDFC education loan interest rate and other essential aspects to help you make an informed decision before you apply for an education loan from the HDFC Bank.

What is the HDFC Education Loan Interest Rate?

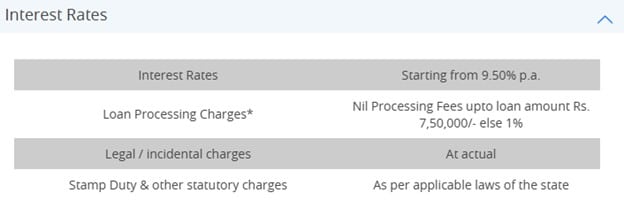

The interest rate for HDFC education loans varies based on factors such as the loan amount, type of course, and the institution where the student is enrolled. Generally, HDFC Bank offers competitive rates starting as low as 9.50% per annum.

HDFC Bank offers education loans with nil processing fees for loans up to ₹7,50,000 and 1% processing fees thereafter. Legal and incidental charges are applicable as per actuals. Stamp Duty and other statutory charges are levied as per applicable state laws.

Key Factors Influencing HDFC Education Loan Interest Rates:

- Type of Institution: Loans for students admitted to premier institutions may have lower rates.

- Loan Amount: Higher loan amounts might attract slightly higher rates.

- Collateral Requirement: Student loans with collateral often have better interest rates compared to unsecured loans.

- Co-applicant’s Profile: The financial stability and creditworthiness of the co-applicant can significantly influence the interest rate.

The below table enlists the education loan interest rates to study in India offered by HDFC Bank:

- Interest will be charged at rates linked to the External Benchmark Lending Rate (EBLR) as decided by individual banks. Banks may charge differential interest rates for collateralised and non-collateralised loans. They may also offer differential interest rates based on the rating of courses/institutions or even students.

- Simple interest will be charged during the study period and up to the commencement of repayment. Simple interest may be charged even during any subsequent moratorium period considered.

Note: Servicing of interest during the study period and the moratorium period till commencement of repayment is optional for students. Accrued interest will be added to the principal while fixing the Equated Monthly Installment (EMI) for repayment.

HDFC Education Loans Interest Rate – Study Abroad

Planning to study abroad? HDFC Bank education loans offer substantial loan amounts to pursue your dream of studying in any of the renowned institutions abroad. Applicants who are applying for HDFC student loans to study abroad must be an Indian citizen to be eligible. In certain cases, the ability to offer collateral may be required. Additionally, all co-borrowers must possess a bank account in India equipped with cheque-writing capabilities. Moreover, securing confirmed admission to the selected educational institution is a prerequisite for loan disbursement. If applicable, co-applicants must also hold Indian citizenship.

HDFC Bank education loans offer comprehensive coverage of educational expenses with no upper limit when collateral is provided.

For collateral-free student loans, the bank provides financing up to ₹45 lakhs at competitive interest rates. These loans can be utilised for pursuing studies at over 2,100 universities and 950 courses across 35+ countries, encompassing programs such as MS, MBA, MBBS/MD (for Indian colleges only), Executive Management Courses (for working professionals), and other courses on a case-by-case basis.

Eligible expenses covered for the study abroad education loan include up to 100% of living and hostel costs, travel expenses (limited to one economy class return ticket between India and the country of study), examination fees, library/laboratory fees, costs of books, equipment, instruments, and uniforms. The loan may also cover the purchase of computers/laptops deemed necessary for course completion by HDFC Credila. The transportation cost for studies in India will also be considered.

The following table outlines the rates & fees for HDFC education loans to study abroad:

| Description of Services | Charges in Rupees |

| Pre-payment charges | NIL |

| No Objection Certificate (NOC) | NIL |

| Delayed Payment Charges * | @ 2% per month of instalment (MI/PMII) + applicable taxes thereon |

| Statutory CERSAI charges | As per charges levied by CERSAI |

| Cheque or ACH mandate or Direct Debit swapping charges* | Up to ₹500 per swap instance plus applicable taxes thereon |

| Cheque/ACH/Direct Debit Bouncing Charges* | ₹400/- per dishonour of cheque or ACH or Direct Debit return per presentation plus applicable any taxes thereon |

| Legal/Incidental charges | At actual |

| Stamp Duty and other statutory charges | As per applicable laws of the state |

| Manual Collection Charges* | ₹200 per visit plus applicable any taxes thereon |

| Charges for Updating & Handling Loan Account As Per Customer Request* | ₹1,500 plus applicable any taxes thereon |

| Origination Fees | 1.5% + Taxes of the Sanction Amount & is Non-Refundable |

*Important Note:

- Terms and conditions apply and may change without prior notice. Credit is subject to the sole discretion of HDFC Credila Financial Services Limited (formerly known as HDFC Credila Financial Services Private Limited).

- Fees are subject to the addition of applicable Goods and Services Tax (GST) and other government levies.

Benefits of HDFC Bank Education Loans

HDFC Bank’s education loans come with a host of benefits, making them a popular choice among students and parents. Some of the benefits include

- Flexible Repayment Options: Borrowers can choose repayment tenures ranging from 5 to 15 years, depending on their financial situation.

- Moratorium Period: HDFC Bank offers a moratorium or repayment holiday, covering the course duration plus 6-12 months after completion, giving students ample time to secure a job before repayments start.

- Loan Coverage: These loans cover tuition fees, examination fees, travel expenses, and even accommodation costs for students studying abroad.

- Customised Solutions: Tailored education loan options for courses like engineering, medical, and management programs.

HDFC Bank Education Loan

The applicant must be an Indian citizen with confirmed admission to a recognised university or institution in India or abroad. A parent, guardian, or spouse must act as a co-applicant. Co-applicants are typically required to demonstrate stable income and a good credit history. While not mandatory, a strong academic record can positively influence loan approval prospects.

Also Read: HDFC Education Loan – Interest Rates, Benefits and Features

Documents Required for HDFC Bank Education Loan

Applicants are required to submit the following documents to apply for an HDFC Bank education loan:

Pre-Sanction Documents:

| Description | Documents |

| Academic |

|

| KYC |

|

| Income Documents (Salaried) |

|

| Income Documents (Self-Employed) |

|

| Income Documents (Self-Employed – Professional) |

|

| Others |

|

Post-Sanction Documents:

| Description | Documents |

| Loan Agreement |

|

| Repayment Instructions |

|

| *Stamp duty to be paid by the customer as per the relevant state laws | |

Documents for Subsequent Disbursements (at your nearest Retail Assets Customer Service Center):

| Description | Documents |

| Disbursement Request | Disbursement Request Letter for tranche disbursement duly signed by the customer |

| University Fee | University Fee Demand Letter |

| Academic Progress | Applicant’s Academic Progress Report (Previous Semester) |

| Repayment Instructions | Fresh repayment instructions in case of full Post Dated Cheque (PDC) or swap of existing repayment instructions |

| Previous Disbursement | Copy of the payment receipt of the previous disbursement/semester, issued by the Institute |

How to Apply for an HDFC Bank Education Loan

Applying for an education loan with HDFC Bank is a straightforward process. Here’s a step-by-step guide:

1. Online Application: Visit the HDFC Bank website and fill out the education loan application form.

2. Submit Documents: Gather the necessary documents, including:

- Admission proof from the university.

- KYC documents of both the student and co-applicant.

- Academic records and fee structure.

- Income proof and bank statements of the co-applicant.

2. Loan Processing: After submitting the documents, the bank evaluates your application for the student loan. This process typically takes 7-10 working days.

4. Approval and Disbursement: Once approved, the education loan amount is disbursed directly to the institution or the borrower’s account.

Tax Benefits on HDFC Bank Education Loans

HDFC Bank education loan interest rates offer significant tax benefits under Section 80E of the Income Tax Act, 1961. This section allows you to claim a deduction on the entire interest paid on the education loan, with no upper limit. However, it’s important to note that this deduction applies only to the interest component and not the principal repayment. To avail this benefit, the education loan must be obtained from a recognized financial institution like HDFC Bank and utilised exclusively for higher education, encompassing undergraduate, postgraduate, or professional courses, both in India and abroad.

The deduction can be claimed by the individual responsible for repaying the loan, which may include parents if they are bearing the cost of their child’s education. The benefit is available for a maximum of eight years from the commencement of loan repayment or until the entire interest is fully repaid, whichever occurs first. You can effectively reduce your taxable income by availing of this tax benefit, thereby lowering your tax liability while simultaneously investing in your education. To ensure a smooth claim process, maintain all necessary documents, such as the interest certificate, to support your deductions when filing your income tax returns.

Also Read: HDFC Education Loan for Abroad – ROI, Interest Rates & Expenses Covered

HDFC Education Loan Interest Rate – FAQs

What are the typical interest rates for HDFC Education Loans?

HDFC Bank offers competitive interest rates for education loans, generally starting from around 9.50% per annum. However, the actual rate can vary depending on factors like the loan amount, type of course, chosen repayment tenure, and the borrower’s creditworthiness.

Are there any processing fees associated with HDFC education loans?

Yes, HDFC Bank charges processing fees. For loans up to ₹7,50,000, there are no processing fees. For loans exceeding this amount, a processing fee of 1% is applicable.

How are interest charges calculated on HDFC student loans?

Generally, simple interest is charged during the study period and any applicable moratorium periods. While interest servicing during these periods is optional, accrued interest is usually added to the principal amount when calculating the Equated Monthly Installment (EMI) for repayment.

What other charges might I encounter with an HDFC education loan?

In addition to interest and processing fees, you may incur incidental/legal charges, which are charged at actuals. Stamp duty and other statutory charges will also apply as per the applicable laws of the state.

How can I potentially secure a lower interest rate on my HDFC student loan?

It is advised to maintain a strong credit history, provide collateral (if possible), choose a shorter loan tenure, and compare offers from other lenders can all help you secure a potentially lower interest rate on your HDFC education loan.

1 thought on “HDFC Education Loan Interest Rate – Eligibility, ROI & Features”

Comments are closed.