HDFC Education Loan: The HDFC Bank is a renowned name in the field of home loans and personal loans. HDFC Bank education loan programs, in a similar way, have been helping Indian parents and students achieve their academic targets. HDFC Bank provides education loans for both Indian and Foreign Education along with other vivid features to help students.

The HDFC Bank Education Loan Interest Rates are very competitive compared to other private bank education loans available in India. The features of ‘HDFC Doorstep Servicing’ and ‘HDFC Life Education Loan Insurance’ make it easier for students to disburse and repay their loans. HDFC Banks also provide the unique feature of loan amount withdrawal from ‘local HDFC asset centers’ which makes getting an education loan like taking out cash from any ATM.

Benefits and Features of HDFC Education Loan

- High Loan tenure: Upto 15 years and above

- Easy loan disbursal: online/offline/HDFC asset centers

- Education loan insurance cover by HDFC Life

- No hidden costs, 100% transparency

- Tax rebates and loan subsidies

- High education loan amount: ₹150 lakhs and up to ₹50 lakh without collateral for selected institutes

- Wide range of accepted collaterals including Residential Property, HDFC Bank Fixed Deposit, selective Debt Mutual Funds, Insurance Policies and National Savings Certificate (NSC) and Kisan Vikas Patra (KVP)

HDFC Bank Education Loan: Eligibility, Tenure, Margin, and others

Being aware of the complete information such as eligibility, loan duration, repayment guidelines, collateral options etc for the HDFC education loan will help students make an informed decision before applying.

HDFC Bank maintains a transparent model of information to help the applicants (students) and co-applicants (parents) in the best possible manner. Even the education loan norms for HDFC education loan abroad and HDFC Bank education loan (domestic) are the same, making it easier for students to have a complete understanding of the education loan they will be choosing.

The below table details the information for various HDFC Bank Education Loan schemes:

HDFC Bank Education Loan Scheme Details

| HDFC Bank Education Loan Norm | Particulars |

| Loan Amount | Indian Education

Foreign Education

|

| Loan Tenure |

|

| Collateral Options |

|

| Eligibility |

|

| Margin payment | Domestic Education Loans:

|

HDFC Bank Education Loan Interest Rates

Information on interest rates is important in planning for education loans. Students who are well informed about the education loan interest rates are able to know in time if they might need to refinance an education loan or for that matter foreclose it. HDFC education loan interest rate for each loan scheme is based on the MCLR rates as declared by the RBI every month for all Indian Banks providing Education Loans. The details of HDFC Bank Education Loan Interest Rate (MCLR Rates) are:

| HDFC Bank Education Loan Tenure | Respective MCLR Rate |

| Overnight | 9.20% |

| 1 Month | 9.20% |

| 3 Month | 9.30% |

| 6 Month | 9.45% |

| 1 Year | 9.45% |

| 2 years | 9.45% |

| 3 years | 9.50% |

Note: The above rates are effective as of December 7, 2024.

Based on the MCLR rates students can themselves draw up the calculation of HDFC Bank study loan Interest Rates. The general interest rates are dependent on the level of education, academic background of the applicant (student), and credit score of the co-applicant/guarantor (parents). The one benefit of HDFC student loan schemes is that the rates of interests are relatively uniform for both domestic and international education.

The details of HDFC Bank education loan interest rates are:

| Education Loan Type and Limits | Interest Rate Ranges |

| Domestic/International Loan up to ₹4,00,000 (4 Lakhs) | Min: 10.25% to Max: 12.25% |

| Domestic/International Loan above ₹4,00,000 (4 Lakhs) | Min: 10.25% to Max: 15.00% |

| Min. Education Loan Interest Rate Trend | 9.50% |

| Max. Education Loan Interest Rate Trend | 13.25% |

HDFC Education Loan for Abroad

HDFC Bank has financial ties with many foreign universities and offers an extensive list of educational institutions for international education loans. HDFC Bank education loans for abroad help students cover their education expenses, exam expenses, commute and accommodation expenses, and project and research expenses.

Features of HDFC Education Loan for Abroad

- Education Loan networks across 36 nations

- No partial loan, 100% finance available

- Expenses for library fees, equipment expenses and student insurance included

- Education loan security with Credit Secure insurance from HDFC

- Education loan available for exchange programs or cross-border programs

- Service of loan sanction before admission as well

Education Loan for Abroad Eligibility

HDFC education loan for abroad is in collaboration with 21,000 international institutions with combinations of over 950 different courses across 35+ countries. Having such diversity in the eligibility criteria, allows students to pursue a degree in their dream institution abroad. HDFC Bank offers the flexibility of adjusting margin payments with international financial assistance. Another flexibility offered by the HDFC student loan includes reducing the margin payment. With all these benefits the eligibility criteria for HDFC Bank education loan for abroad are as follows:

- Students must be Indian citizens.

- Applicants for the HDFC foreign education loan should be between 16 and 35 years of age.

- Candidates must have cleared the qualifying examination for their proposed course/degree.

- Applicants must have a parent, immediate guardian, or in-law as a co-applicant for the education loan.

- Students must be enrolled in one of the following courses:

- MS

- MBA

- MBBS/MD – Only India Colleges

- Executive Management Courses (Working Executives)

- All Other Courses – Cases to Case Basis

HDFC Education Loan Interest Rate Subsidy

HDFC education loans also provide financial assistance with a government-backed interest subsidy scheme named the Central Sector Interest Subsidy Scheme (CSIS). This scheme provides direct interest benefits to education loan applicants, including interest exemption or compensation. These benefits are applicable to both Indian and overseas education loans.

The details of this subsidy scheme as provided by HDFC for their education loans are:

Central Sector Interest Subsidy Scheme (CSIS) provides financial aid to students belonging to economically weaker sections who are willing to pursue technical and professional courses in India. In order to apply for this scheme, students must have availed an education loan from a Scheduled Bank after Class 12 and have a gross annual family income of up to ₹4.50 lakhs. This scheme applies to loans sanctioned from April 1, 2009, and provides interest subsidies for the moratorium period.

Important Note: Only loan disbursements made after April 1, 2009, are eligible for the subsidy, even if the loan was sanctioned earlier. The current schedule is open for loan claims for the moratorium period of April 1, 2023, to March 31, 2024. Additionally, the interest subsidy is only applicable to loan amounts disbursed after April 1, 2009. This means that if your loan was sanctioned before this date, you can still claim the subsidy for the portion of the loan disbursed after April 1, 2009.

HDFC Education Loan Payments and Charges

HDFC Bank offers transparent education loan services that aim to provide detailed information about both pre-processing and post-processing charges related to the education loan. This enables students to create a budget for their education loans and EMIs. HDFC Bank ensures a hassle-free experience for its education loan applicants by avoiding hidden fees. Below are the details of HDFC education loan charges:

| Charges Post Loan Disbursement | |

| Charge | Amount |

| Delayed Instalment Payment Charge | 18% per annum + applicable taxes |

| Cheque/ACH Swapping Charges | NIL |

| Duplicate Repayment Schedule Charges | NIL |

| Loan Re-Booking/Re-Scheduling Charges | NIL |

| EMI Return Charges | ₹450 |

| Pre-Payment / Cancellation Charges | |

| Pre-payment charges* | NIL |

| Loan Cancellation Charges | No cancellation charges will apply. However, interest for the interim period (from the date of disbursement to the date of cancellation), applicable CBC/LPP charges, and stamp duty will be retained. |

*Terms & conditions apply:

- Certain fees are exclusive of GST and other government levies. These additional charges will be applied as per applicable laws.

- The loan application for up to ₹2 lakhs, can be processed and disbursed within 15 days. Students must provide all necessary documents on time and meet the bank’s specified criteria to avail the loan.

Documents Required for HDFC Education Loan

The below documents are required to apply for the HDFC education loan:

| Stage | Document Category | Document Description |

| Pre-Sanction | Academic Documents | Academic institute admission letter with fee break-up |

| SSC, HSC, Graduation marksheets | ||

| KYC Documents | Age proof | |

| Signature proof | ||

| Identity proof | ||

| Residence proof | ||

| Income Documents (Salaried) | Latest 2 salary slips carrying the date of joining details | |

| Latest 6 months’ bank statement of the salary account | ||

| Income Documents (Self-Employed) | Last 2-years ITR with Computation of Income | |

| Last 2 years’ audited balance sheet | ||

| Last 6 months’ bank statement | ||

| Proof of Turnover (Latest Sales/Service Tax Return) [If applicable] | ||

| Last 2-year ITR with Computation of Income | ||

| Last 2 years audited balance sheet/P&L | ||

| Last 6 months’ bank statement | ||

| Qualification proof | ||

| General Documents | Complete application form | |

| Latest photograph (signed across) | ||

| Post-Sanction | Loan Agreement | Completed loan agreement to be signed by applicant and co-applicant |

| Repayment Instructions | PDCs/ACH or SI Mandate | |

| 3 Security PDCs in case of ACH and SI mode of repayment | ||

| General | Stamp duty, to be paid by the customer as per the relevant state laws | |

| Disbursement | Disbursement Documents | Disbursement Request Letter for tranche disbursement duly signed by the customer |

| University Fee Demand Letter | ||

| Applicant’s academic progress report (Previous Semester) | ||

| Fresh repayment instructions in case of full Post Dated Cheque (PDC) or swap of existing repayment instructions | ||

| Copy of the payment receipt of the previous disbursement/semester, issued by the Institute |

How to Apply for an HDFC Education Loan?

Planning for an education loan application needs careful consideration of various factors based on their specific requirements. It may include HDFC student loan eligibility, loan tenure, courses and expenses covered; all depending on the student’s education location and level of education.

Among other banks, HDFC Bank Education Loan schemes are more centralised and doesn’t differentiate based on the educational institution or any other factor, ensuring a consistent application process and uniform service level for all.

HDFC education loan application process is a relatively streamlined study loan application process compared to other banks. Students can either submit their application offline at the nearest HDFC Bank branch or online through the HDFC Bank website.

Students are required to follow the below steps to apply for the HDFC Bank education loan:

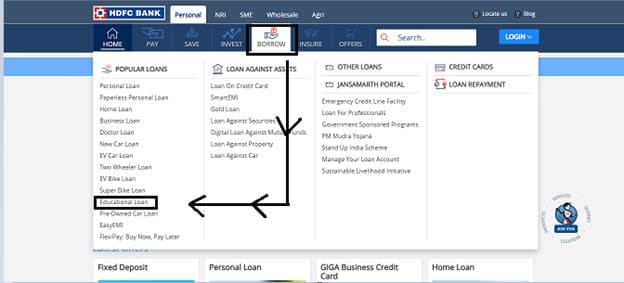

Step 1: Visit the official website of HDFC Bank (www.hdfcbank.com)

Step 2: Navigate to the ‘Borrow’ option, scroll down to the drop-down menu and click on the ‘Education Loan’ option.

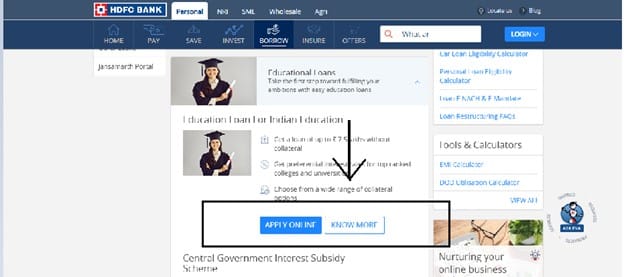

Step 3: Now, click on the ‘Apply Online’ button and the applicant will be redirected to the Vidya Lakshmi Portal.

Step 4: Register on the portal using valid credentials and apply for the education loan from HDFC Bank after filling up the ‘CELAF (Common Education Loan Application Form)’.

Step 5: Once you fill the application form, the bank officials will contact you for an education loan sanction.

Also Read: Student Loan without Collateral – Eligibility, Key Features & Interest Rates

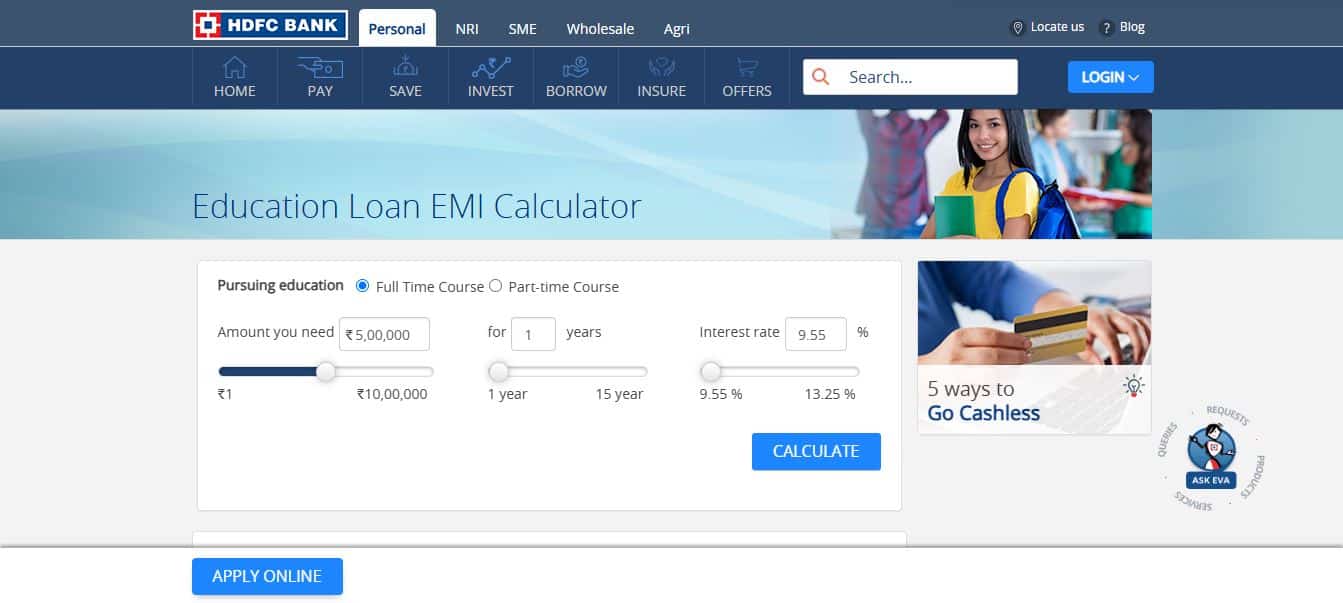

HDFC Education Loan EMI Calculator

The HDFC Bank Education Loan EMI Calculator is designed to help you to calculate your estimated monthly installments (EMI) for an education loan. You can easily calculate the amount by simply entering the loan amount, interest rate, and loan tenure and plan your finances effectively through this education loan EMI calculator.

How to Use the HDFC Education Loan EMI Calculator:

Step 1: Specify the total amount required for your education. HDFC Bank offers education loans up to ₹150 lakh, with up to ₹50 lahks available without collateral for select institutions.

Step 2: Select a repayment period between 1 and 15 years, depending on your repayment capacity and the course duration.

Step 3: Enter the interest rate applicable to your education loan. HDFC Bank’s rates vary based on factors such as the course, institution, and applicant profile and click on the ‘Calculate‘ button. The calculator will instantly generate the estimated EMI based on the provided inputs.

Note: The actual loan terms and interest rates may differ based on your profile and course details. It is advisable to contact HDFC Bank for any personalised assistance.

HDFC Education Loan – FAQs

1. What is the maximum loan amount offered by HDFC Bank for education loans?

HDFC Bank offers loans up to ₹15 lakhs for domestic education loans and the loan amount can go up to ₹20 lakhs for foreign education loans.

2. What are the loan tenures for HDFC Education Loans?

HDFC bank loan tenures range from a minimum of 3 years to a maximum of 15 years, depending on the loan amount.

3. Is collateral required for HDFC Bank Education Loans?

The collateral requirements for an HDFC study loan are as follows:

- No collateral is required for loans up to ₹4 lakhs.

- For loans between ₹4 lakhs and ₹7.5 lakhs, a third-party guarantee is needed.

- Loans above ₹7.5 lakhs require tangible collateral security.

4. What are the interest rates for HDFC Education Loans?

Interest rates for HDFC Bank education loans range from 10.25% to 15.00%, depending on the loan type and amount.

5. Are there any additional benefits for HDFC Education Loans?

Yes, there are a few benefits including:

- Doorstep loan servicing.

- Tax rebates.

- Education loan insurance cover.

- Transparent fee structure.

6. What is the margin money requirement for HDFC Education Loans?

Below are the money margin requirements for the HDFC bank domestic education loans:

- Loans up to ₹4 lakhs: No margin.

- Loans above ₹4 lakhs: 5%-10% depending on the institution.

- Foreign Education: A 15% margin is required.

7. Who is eligible for HDFC Education Loans?

Students must be Indian residents aged between 16 and 35 years to be eligible for HDFC bank education loans. They must have completed their HSC (10+2) or equivalent and have secured admission to a recognised institution for graduate or postgraduate programs to apply for a study loan from HDFC Bank.

8. What expenses are covered by the HDFC Education Loan?

The below expenses will be covered under the HDFC bank study loan:

- Tuition fees

- Examination and library fees

- Accommodation and travel expenses

- Equipment and study material costs

3 thoughts on “HDFC Education Loan – Interest Rates, Benefits and Features”

Comments are closed.