Imagine Rohit, a professional who recently completed his MBA and was placed in one of the top MNCs. He has an education loan of ₹20 lakhs, and his CTC is ₹12 lakhs per annum. If he wants, he could pay off his entire education loan in a couple of years. However, from the view of any financial expert, that would be a very big mistake because he would lose the opportunity to claim the education loan tax benefit, which would help him save taxes on the interest of the study loan.

This tax benefit is provided to all borrowers who take an education loan for higher studies under Section 80E of the Income Tax Act. If you also have an education loan and want to save some money when paying your due taxes, then you can learn about the education loan tax benefit by reading below. We have discussed what Section 80E of the Income Tax Act is and how you can use it to save taxes. In addition, you will learn about eligibility for this scheme, the documents required, the complete step-wise process, and more.

Who is Eligible for the Education Loan Tax Benefit

The education loan tax benefit under section 80E of the Income Tax Act can be claimed by the individual who has applied for the student loan. You can only get the tax benefit if you borrow the money from a recognised financial institution such as banks, NBFCs, etc. Therefore, personal loans for education from friends, family members, and private lenders are not recognised under this scheme.

Students who claim the education loan must have taken it for a full-time course under the higher education category. This means you need to have the admission letter for a full-time course offered after completing Class 12.

To become eligible for the education loan tax benefit under section 80E, you can take an education loan for yourself, your biological children, your legally adopted children, and your spouse. In addition, if you and your children split the EMI payments, then you can claim the tax benefits for the portion of the EMI you pay on the education loan, and your child can claim the benefit for the rest of the amount.

Fact: Even if the borrower defaults on his loan and the co-signer is paying off the loan, then the co-signer can not obtain the education loan tax benefit!

Specifics of Section 80E of the Income Tax Act For Study Loan Tax Benefits

Education loans have become more accessible for students pursuing higher education, but repaying them is another challenge. When banks explain repayment policies, many students get cold feet and shy away from taking the loan. To boost their morale and provide incentives, the Indian government introduced Section 80E of the Income Tax Act in 1994. This provision helps students manage the financial burden of higher education by allowing them to claim deductions on the interest paid on education loans.

The deduction is available for up to eight years, starting from the year repayment begins or until the interest is fully repaid, whichever comes first. The aim is to make higher education more accessible by reducing the tax liability for students and their families. This section applies to loans taken for higher studies in India or abroad, covering a wide range of courses.

Fact: There is no limit on the amount of interest that can be claimed for deduction under Section 80E.

Also Read: Education Loan Interest Rate – A Detailed Analysis for Popular Banks

Calculation of Education Loan Tax Benefit

Since you can save a lot of money in taxes using Section 80E, you need to understand how the calculation of taxable income is done if you claim this benefit. So let’s take the example of Rohit, whose income is ₹12 lakhs per annum, and he pays ₹50,000 in interest for his education loan every year. Thus, if he avails of the education loan tax benefits deduction under Section 80E during the tax form fill-up, then he is eligible for a ₹50,000 discount in his taxable income. Thus, his final taxable income will be ₹11.50 lakhs after the deduction.

If you’re planning to maximize your tax deductions using an education loan, like Rohit, it’s crucial to know the interest you’ll need to pay. To figure this out, you can use an education loan EMI calculator. This tool helps you estimate how much you can deduct from your taxable income in the future.

Documentation Required for Claiming the Tax Benefit on Education Loan

To get the tax benefit on your student loan, you need to provide the income tax department with sufficient proof that you have an eligible loan and that you are repaying it on time. For that, you need a certificate from the financial institution that provided the education loan. This certificate should detail the principal and interest amounts of the education loan for each financial year separately.

Benefits of Claiming the Education Loan Tax Deductions

Reduced Tax: One of the most significant benefits of claiming education loan tax deductions under Section 80E is the reduction of your tax liability. You lower your overall tax burden by deducting the interest paid on your education loan from your taxable income. This will result in considerable savings, especially over the years of loan repayment.

Extended Deduction Period: Section 80E allows for the deduction of interest paid on education loans for up to eight years. This extended period ensures that taxpayers can benefit from the deduction for the majority of their loan repayment duration, providing long-term financial relief.

No Upper Limit on Interest Deduction: Unlike many other tax deductions, there is no upper limit on the amount of interest you can claim under Section 80E. This means that regardless of the amount of interest paid, you can deduct the entire interest amount from your taxable income, maximizing your tax benefits.

Encourages Higher Education: By providing tax benefits for education loans, the government encourages students to pursue higher education without worrying excessively about the financial burden. This incentive helps promote a more educated and skilled workforce, contributing to the country’s overall growth and development.

Applicable for Various Courses: The deduction under Section 80E is not limited to specific courses. It applies to any full-time higher education course, which can be opted after completing Class 12. In addition, the education loan tax deduction is also applicable in courses pursued in India or abroad.

Tax Deduction on Education Loan Taken For Family Members: The education loan tax deduction is not just limited to the individual borrower. It can also be claimed for loans taken for the education of a spouse, children, or a student for whom the individual is a legal guardian.

Limitations in the Education Loan Tax Benefits

- The deduction is only applicable to the interest component of the education loan, not the principal amount.

- The benefit is available for a maximum of eight years, starting from the year repayment begins.

- The loan must be taken from a recognized financial institution or an authorized charitable trust for higher education purposes.

- The benefit can only be claimed for loans taken for the education of the individual, their spouse, children, or a student for whom the individual is a legal guardian.

- If the primary borrower cannot repay the loan, co-borrowers cannot claim the deduction.

- Proper documentation, including interest certificates and repayment proofs, is required to claim the deduction.

- If you are claiming a deduction for the interest paid on your education loan under Section 80E, you cannot claim the same interest amount under another section of the Income Tax Act.

- The taxpayer must ensure that all conditions are met and accurately reported in the income tax return. Any discrepancy between the tax deduction claim and the actual figures will hold the applicant responsible.

Steps to Avail Education Loan Tax Benefit

The process of availing the education loan tax deduction is quite easy and if you have some idea about filing your tax return, then you can do it quickly. You can follow the steps below to understand how you can avail of the education loan tax benefit.

Step 1 – Secure the Loan: Obtain an education loan from a recognized financial institution or authorized charitable trust. Ensure that you have a loan sanction letter as proof of the loan approval.

Step 2 – Repayment of Loan: Get a job and start repaying the loan EMI on time and keep detailed records of your loan repayments, including bank statements and receipts. This documentation is crucial for verifying the interest paid during the financial year.

Step 3 – Calculate the Deduction: Use an education loan EMI calculator to determine the interest portion of your loan repayments. Remember, only the interest paid on the loan qualifies for the deduction under Section 80E. You can also request an interest certificate from the bank or financial institution. This certificate should specify the interest amount paid for each financial year separately.

Step 4 – File Your Tax Return: When filing your income tax return, include the interest paid on your education loan as a deduction under Section 80E. Attach all necessary documents, such as the interest certificate and repayment proofs, to support your claim.

Tip: If you file your income tax return through any agency or CA, then you need to inform them about your education loan repayment status so that they can help you claim the deduction.

Top Education Loans For Claiming Tax Benefits

As you may have understood, education loans sanctioned by only recognised financial institutions qualify for a tax benefit. Thus, you must check the lender’s credentials when applying for a loan. To save you from this hassle, we have listed a few of the best educational loan offers from India’s recognised and reputed banks.

Top Student Loan Banks & Interest Rates

| Education Loans | Interest Rate Per Annum |

| Canara Bank Education Loan | 9.25% |

| IDFC First Bank Education Loan | 10% to 15% |

| Kotak Mahindra Bank Education Loan | Up to 16% |

| SBI Education Loan | 8.15% to 11.75% |

| Federal Bank Education Loan | 12.55% |

| HDFC Bank Education Loan | 9.50% |

| PNB Education Loan | 9.20% |

| Bank of Baroda Education Loan | 8.15% |

| Bank of India Education Loan | 11.05% to 11.85% |

| Axis Bank Education Loan | 13.70% to 15.20% |

| Bank of Maharashtra Education Loan | 9.45% |

| Central Bank of India Education Loan | 8.10% to 10.60% |

| ICICI Bank Education Loan | 9.85% |

| IDBI Bank Education Loan | 8.50% |

Also Read: Top Bank Loans for Education Funding in India

See What Experts Say on Education Loan Tax Benefits Under Section 80E

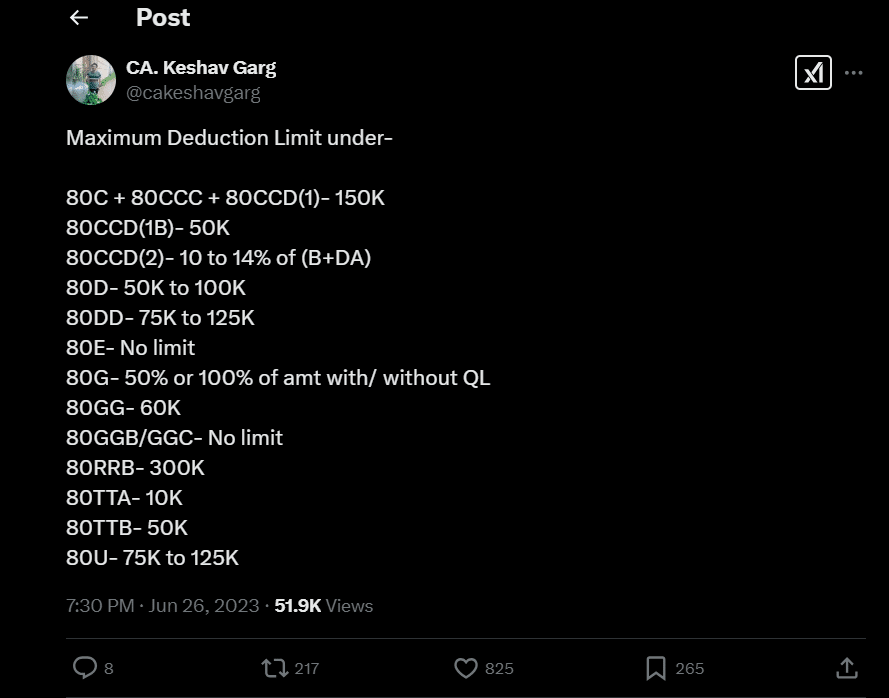

Posting on X(Twitter), CA Keshav Garg highlights the no upper limit feature of Section 80E, which is for tax benefits on education loans. Check the image for details.

The official handle of the All India CMA Association took it to Twitter to answer common queries related to education loan tax benefits.

Summary of Key Points – Education Loan Tax Benefit

- You can claim deductions on the interest paid on education loans under Section 80E.

- IT deductions are available for up to eight years from the start of repayment or till the repayment of the loan, whichever is closer.

- There is no upper limit on the interest amount eligible for deduction during ITR filing.

- The education loan must be from financial institutions that can extend loans and are registered with the RBI.

- The benefit applies to loans taken for full-time higher education after Class 12, both in India and abroad.

FAQs

Is there any tax benefit on an education loan?

Yes, there is a tax benefit on education loan interest. You can deduct the interest amount you paid in a year from your taxable income under section 80E of the Income Tax Act.

What is the maximum limit of Section 80E?

The income tax department has not set any limits for the maximum deduction possible under section 80E of the Income Tax Act. Thus, no matter how high your interest rate is, you can deduct it from your taxable income under section 80E.

Can I claim both Section 80C and 80E?

Yes, you can claim both sections 80C and 80E during the ITR filing. However, you must have supporting documents to show that you are eligible for the deductions. For 80C, the maximum deduction possible is ₹1.5 lakhs, and for 80E, there is no limit.

Is Section 80E allowed in the new tax regime?

Yes, section 80E for education loan tax benefit is available for all taxpayers with an existing education loan in the new tax regime which was proposed by the central government.

What proof is required for the education loan tax benefit under Section 80E?

To provide proof of education loan interest payment to the income tax department to claim the education loan tax benefit under Section 80E, you must provide a loan repayment certificate from your bank. The certificate should mention the principal amount, the EMI amount, and the total interest paid.

2 thoughts on “Education Loan Tax Benefits”

Comments are closed.