Education is an important asset for any student aspiring to achieve success in life. However, financial constraints at home often make it challenging for them to pursue their dreams. To eliminate this gap, the Vidyalakshmi portal serves as a one-stop solution by providing them the required financial assistance.

If you are planning to study in India or in a university abroad, registering on Vidyalakshmi portal is a smart move. It is not only time savvy but also provides education loans in a transparent way without any hassle.

Background and Genesis of Vidyalakshmi Portal

The Vidyalakshmi portal was developed and launched by the Department of Financial Services (DFS), Ministry of Finance, in collaboration with Department of Higher Education (DHE), Ministry of Education, Indian Banks’ Association (IBA) and NSDL e-Governance Infrastructure Limited (which manages and operates the platform). Before the Vidyalakshmi portal was launched the students, especially from rural areas who were looking for an education loan, had to visit the bank multiple times, fill lengthy application forms, and deal with long approval times. They also used to face additional challenges due to a lack of awareness and accessibility.

Officially launched on August 15, 2025, the primary goal of Vidyalakshmi portal is to serve as a single-window system, where students can easily apply for multiple education loans from different banks without physically visiting them, have access to information about different education loan schemes available in India and tack the status of their online student loan applications. Additionally, the students can also apply for government scholarships, as the portal is linked with the National Scholarship Portal (NSP).

Objective of Vidyalakshmi Portal

The primary objectives of the Vidyalakshmi portal include:

- Simplifying education loan applications through a single-window system.

- Reducing processing delays by enabling digital document submission.

- Ensuring equal access to financial assistance for students from all backgrounds.

- Providing transparent access to various student loan schemes from multiple banks.

- Integrating scholarships with education loan applications to reduce financial burden.

Features of Vidyalakshmi Portal

Vidyalakshmi Portal provides various services like common application form, data security, CSIS: Central Loan Interest Subsidy Scheme compliance and remote service. With VidyaLakshmi education loan students can secure an education loan available at competitive interest rates with flexible repayment period.

The prominent features of Vidyalakshmi portal are:

| Vidyalakshmi Portal | |

| Centralized Application – One app for all banks | Remote Service – No branch visits |

| CSIS Compliant – Interest subsidy available | Max Loan Amount – Potential for highest loan |

| Online Support – Troubleshooting & complaints | Direct Transfer – No agents required |

| Fast Processing – Quick & no hidden fees | |

How to Apply for an Education Loan on Vidyalakshmi Portal?

Vidyalakshmi portal is very easy to use. Students can easily navigate through the website to apply for an education loan. Here is the step by step guide though for a better understanding of the Vidyalakshmi portal application process:

Step 1: Visit the official Vidyalakshmi portal (vidyalakshmi.co.in/Students/index)

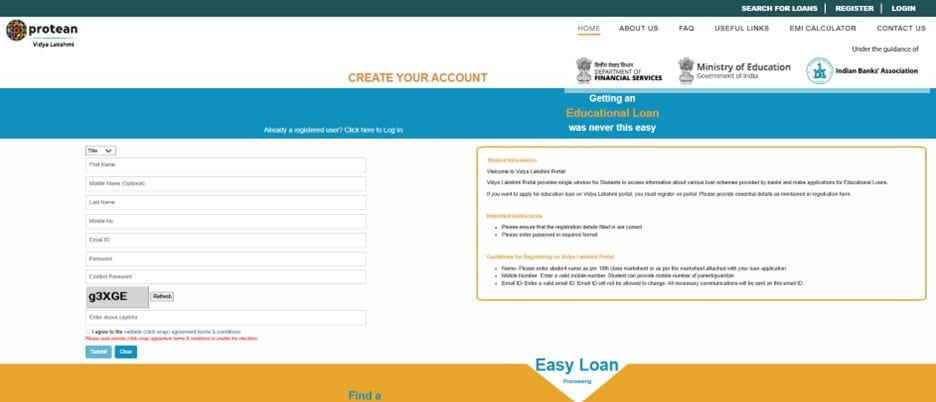

Step 2: Navigate to the ‘Register’ button on the top right-hand corner of the dashboard to create an account on the Vidyalakshmi portal.

Step 3: Fill in all the required details, enter the captcha, tick the checkbox for terms and conditions and click on the ’Submit’ button.

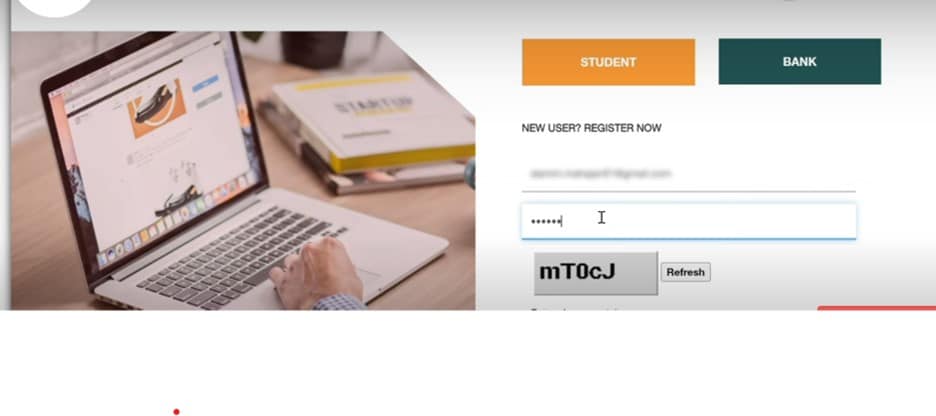

Step 4: Once the account is created, an activation link will be sent to the student’s registered ID to activate the account.

Step 5: After successful activation of the account, students will be able to login using the username and password through the login page.

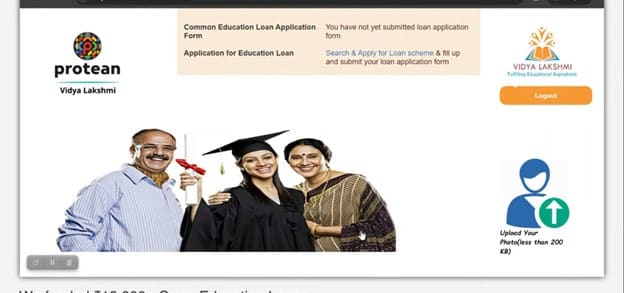

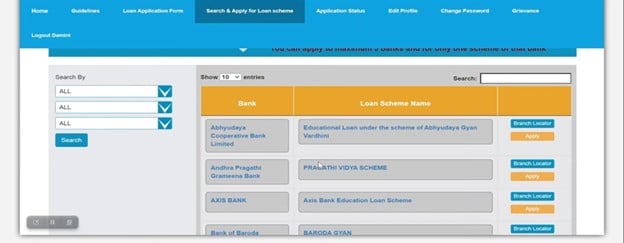

Step 6: After logging in you will be able to see this page, simply click on the ‘Search & Apply for Loan Scheme’.

Step 7: Now, at the left hand side of the page, you can apply filters to choose for an education loan that suits your financial requirements from the given list. (Note: One student can apply from a maximum of 3 banks at a time.)

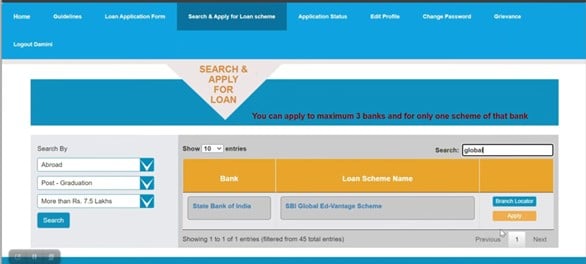

Step 8: You can also search for a scheme in the search bar on the right hand side of the screen.

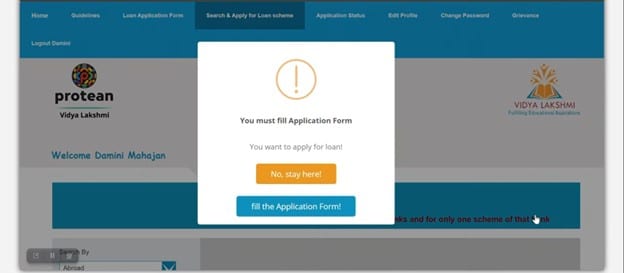

Step 9: Now, click on the ‘Apply’ button against the loan scheme and you will see a pop-up like this one on the screen. To proceed with the process, click on the ‘Fill the Application Form’ button.

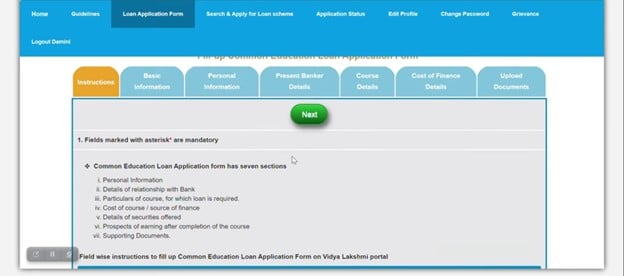

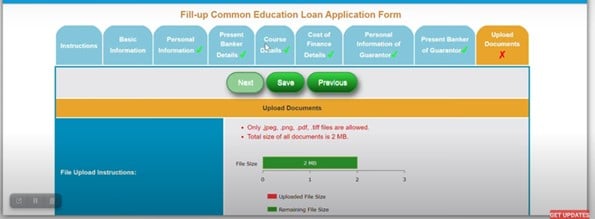

Step 10: The application form will appear like this on the screen, simply read the instructions and fill all the required fields with accurate information.

Step 11: Once you complete the application form, click on the ‘Save’ button and upload the required documents. While uploading the documents make sure that the document is in .jpeg, .png, .ttf format and up to 2MB in size.

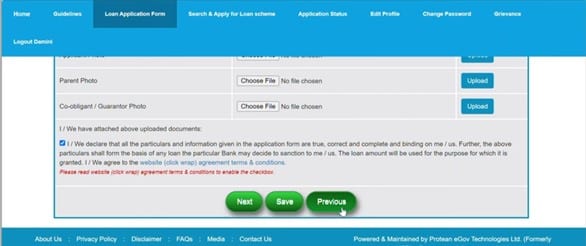

Step 12: Click on the checkbox for ‘Terms and Conditions’ and save the application for an education loan. It is advisable to preview the application details as once it is submitted, there will be no scope to make any changes to the student loan application.

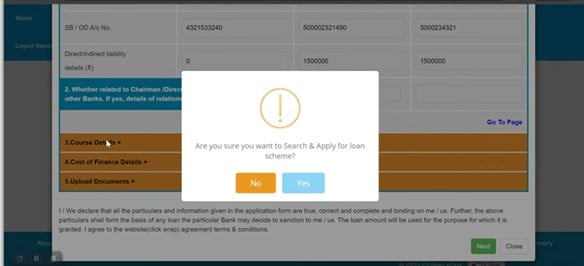

Step 13: As you submit the student loan application form, a pop up will appear to confirm if you want to apply for the loan scheme. Click on the yes button to complete the application.

Also Read: Education Loan Application Form

Vidyalakshami Portal Application Status Check

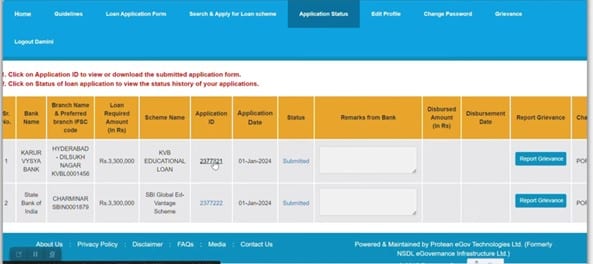

The process of checking your education loan application status is as easy as filling it. By following the below steps, students can easily check their application status:

Step 1: Login your account on the Vidyalakshmi portal.

Step 2: Click on the ‘Application Status’ option on the top of the dashboard.

Step 3: Click on the Status to view the status history of the application.

List of Banks Registered with Vidyalakshmi Portal

As of now, the Vidyalakshmi portal has 38 banks registered, offering various education loan schemes. Here’s a list of some of the participating banks:

- Abhyudaya Cooperative Bank Limited

- Andhra Pragathi Grameena Bank

- AXIS Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Chhattisgarh Rajya Gramin Bank

- City Union Bank Limited

- Dombivli Nagari Sahakari Bank Limited

- Federal Bank

- GP Parsik Bank Ltd

- HDFC Bank

- ICICI Bank

- IDBI Bank

- IDFC First Bank

- Indian Bank

- Indian Overseas Bank

- Jammu and Kashmir Bank Limited

- Karnataka Bank Limited

- Karnataka Gramin Bank

- Karnataka Vikas Grameena Bank

- Karur Vysya Bank

- Kerala Gramin Bank

- Kotak Mahindra Bank

- New Indian Cooperative Bank Limited

- Punjab and Sindh Bank

- Punjab National Bank

- Rajasthan Marudhara Gramin Bank

- RBL Bank Limited

- State Bank of India

- Tamilnad Mercantile Bank Limited

- The Kalupur Commercial Co-operative Bank Ltd

- The South Indian Bank Ltd

- UCO Bank

- Union Bank of India

- Yes Bank

Conclusion

The Vidyalakshmi portal provides a transparent, efficient, and student-friendly platform to students who want to apply for loans. While it has significantly reduced paperwork and improved accessibility, challenges like awareness gaps and processing delays still exist. But with continued efforts from the government and timely technological advancements, this portal has the potential to ensure that every deserving student in need of financial support can have access to various student loan schemes to pursue their education.

If you or someone you know is looking for a student loan, register today on the Vidyalakshmi portal and explore the best financing options available for you!

Also Read: Top Reasons to Apply for an Education Loan

FAQs

Can students register multiple times on Vidyalakshmi portal?

Students can only register once on the Vidyalakshmi portal. Multiple accounts are not allowed.

How can I apply for an education loan through the Vidyalakshmi portal?

The education loan application process on Vidyalakshmi portal is very easy and smooth. You must first register and log in to the portal. Then, complete the Common Education Loan Application Form (CELAF) with accurate information. Search for a loan scheme that suits your needs and apply for it. You can also choose to search for loans after logging in and then complete the CELAF to apply.

What is the Common Educational Loan Application Form (CELAF)?

Students can use the Common Educational Loan Application Form (CELAF) to apply for student loans from multiple banks and schemes with a single application. This education loan application form, created by the Indian Banks Association (IBA), is accepted by all banks and is available on the Vidyalakshmi portal.

How will I know once the education loan is approved?

The bank will update the education loan application status on the Vidyalakshmi portal, where students can view it on their applicant dashboard.

1 thought on “Vidyalakshmi Portal – Government Education Loan Services”

Comments are closed.